FMR LLC Bolsters Portfolio with Inspire Medical Systems Inc Acquisition

Overview of FMR LLC (Trades, Portfolio)'s Recent Portfolio Addition

On October 31, 2023, FMR LLC (Trades, Portfolio) made a significant addition to its investment portfolio by acquiring 3,237,401 shares of Inspire Medical Systems Inc (NYSE:INSP), a company specializing in medical technology for obstructive sleep apnea. This transaction, which saw FMR LLC (Trades, Portfolio) adding 765,937 shares, reflects a 30.99% change in their holdings and a trade impact of 0.01% at a trade price of $147.16. The position now represents 0.04% of FMR LLC (Trades, Portfolio)'s portfolio, with the firm holding an 11.04% stake in Inspire Medical Systems.

FMR LLC (Trades, Portfolio)'s Investment Profile

FMR LLC (Trades, Portfolio), known as Fidelity, was established in 1946 by Edward C. Johnson II. The firm has a rich history of taking calculated risks and seeking stocks with growth potential. Fidelity's investment philosophy has been shaped by promoting individual decision-making and innovation, as evidenced by its successful mutual funds and ETFs. With a focus on technology and healthcare sectors, Fidelity's top holdings include giants like Apple Inc (NASDAQ:AAPL) and Amazon.com Inc (NASDAQ:AMZN). As of the latest data, Fidelity manages an equity portfolio worth $1,154.67 trillion, demonstrating its significant influence in the investment world.

Inspire Medical Systems Inc at a Glance

Inspire Medical Systems Inc, trading under the symbol INSP, is a U.S.-based medical technology company that has been publicly traded since May 3, 2018. The company is dedicated to developing minimally invasive solutions for patients with obstructive sleep apnea. With a market capitalization of $3.87 billion, Inspire Medical Systems has a significant presence in the United States and Europe. Despite its innovative approach, the company's stock is currently facing challenges, with a GF Value indicating a possible value trap and a stock price that has declined by 10.96% since the transaction date.

Impact of FMR LLC (Trades, Portfolio)'s Trade on Portfolio

The recent acquisition of Inspire Medical Systems shares by FMR LLC (Trades, Portfolio) has a modest yet strategic impact on the firm's portfolio. The trade's position size and share change suggest a calculated move by FMR LLC (Trades, Portfolio) to increase its stake in a company that aligns with its investment philosophy and sector focus. This move could be indicative of FMR LLC (Trades, Portfolio)'s confidence in Inspire Medical Systems' long-term potential despite current market valuations.

Market Context and Stock Valuation

Inspire Medical Systems' current stock price of $131.03 is significantly below the GF Value of $457.34, resulting in a price to GF Value ratio of 0.29. This discrepancy suggests that the stock may be undervalued, although the designation as a possible value trap warrants caution. Since its IPO, the stock has seen an impressive increase of 435.03%, but year-to-date metrics show a decline of 48.21%, reflecting recent market volatility.

Financial Health and Performance Metrics

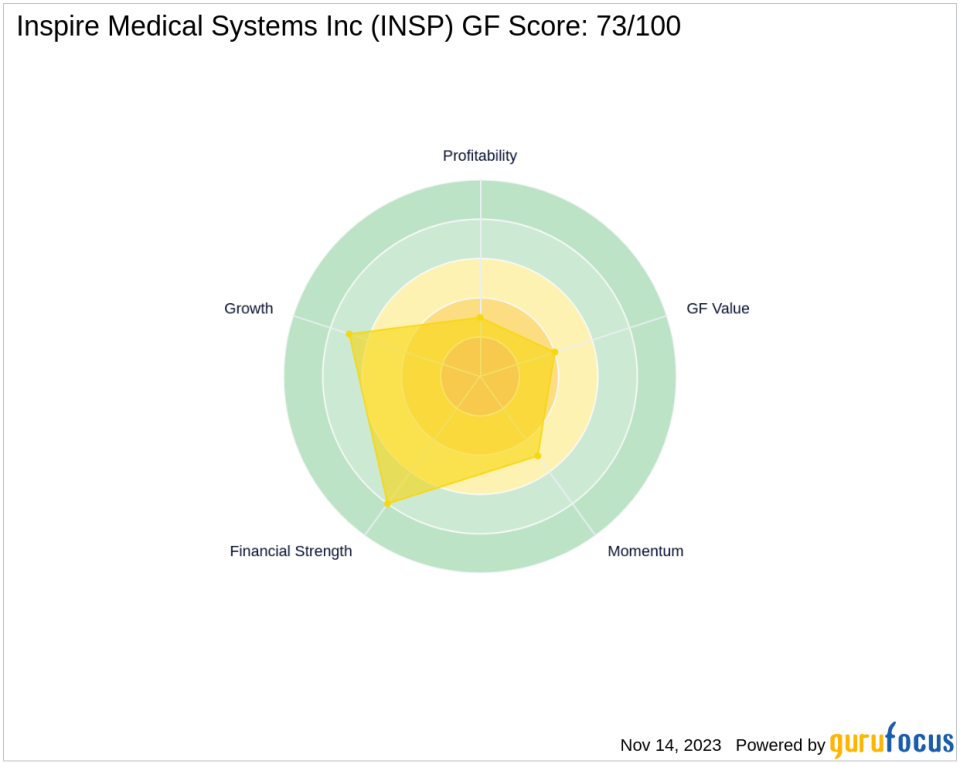

Inspire Medical Systems' financial health and performance metrics present a mixed picture. The company has a GF Score of 73/100, indicating potential for future performance. However, its financial strength and profitability ranks are low, with a Profitability Rank of 3/10 and a Financial Strength Rank of 8/10. The company's Piotroski F-Score is 3, and its Altman Z-Score is a robust 24.16, suggesting financial stability. Inspire Medical Systems also boasts a strong Cash to Debt ratio of 18.44, yet its operating margins and earnings growth have been negative over the past three years.

Sector and Industry Analysis

FMR LLC (Trades, Portfolio)'s top sectors include technology and healthcare, with Inspire Medical Systems fitting well within the latter. The Medical Devices & Instruments industry is known for its innovation and growth potential, which may align with FMR LLC (Trades, Portfolio)'s investment strategy. As the industry evolves, FMR LLC (Trades, Portfolio)'s stake in Inspire Medical Systems could benefit from advancements and increased demand for medical technology solutions.

Comparative Investor Interest

Other notable investors in Inspire Medical Systems include Joel Greenblatt (Trades, Portfolio) and Jefferies Group (Trades, Portfolio), indicating a broader interest in the company among value investors. While the largest stakeholder in Inspire Medical Systems is Baron Funds, FMR LLC (Trades, Portfolio)'s recent transaction places it among the significant investors, showcasing its commitment to the company's growth trajectory.

Conclusion

FMR LLC (Trades, Portfolio)'s recent acquisition of shares in Inspire Medical Systems Inc reflects a strategic investment decision that aligns with the firm's focus on healthcare and technology. Despite current market challenges and a cautious valuation, FMR LLC (Trades, Portfolio)'s increased stake in the company demonstrates confidence in its long-term prospects. As Inspire Medical Systems continues to innovate within the Medical Devices & Instruments industry, FMR LLC (Trades, Portfolio)'s investment could yield substantial returns, contributing to the firm's already impressive portfolio.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.