FMR LLC Boosts Stake in Advanced Energy Industries Inc

On July 31, 2023, FMR LLC (Trades, Portfolio), a renowned investment firm, significantly increased its holdings in Advanced Energy Industries Inc (NASDAQ:AEIS), a leading provider of precision power-conversion measurement and control solutions. This article will delve into the details of the transaction, provide an overview of both FMR LLC (Trades, Portfolio) and Advanced Energy Industries Inc, and analyze the potential implications of this move for value investors.

Details of the Transaction

FMR LLC (Trades, Portfolio) added 1,099,352 shares of Advanced Energy Industries Inc to its portfolio, bringing its total holdings to 3,803,580 shares. The transaction, executed at a trade price of $125.18 per share, had a minor impact of 0.01% on FMR LLC (Trades, Portfolio)'s portfolio. Following the transaction, FMR LLC (Trades, Portfolio) now holds a 10.13% stake in Advanced Energy Industries Inc, representing 0.04% of its total portfolio.

Profile of FMR LLC (Trades, Portfolio)

FMR LLC (Trades, Portfolio), also known as Fidelity, was founded in 1946 by Edward C. Johnson II. The firm has a rich history of taking calculated risks and investing in stocks with growth potential. Fidelity's investment philosophy is centered around promoting trailblazing individuals and basing its growth on constant innovation and research. As of the date of this article, Fidelity holds 5,049 stocks in its portfolio, with a total equity of $1,090.64 trillion. The firm's top holdings include Apple Inc (NASDAQ:AAPL), Amazon.com Inc (NASDAQ:AMZN), Meta Platforms Inc (NASDAQ:META), Microsoft Corp (NASDAQ:MSFT), and NVIDIA Corp (NASDAQ:NVDA). The technology and healthcare sectors dominate Fidelity's portfolio.

Overview of Advanced Energy Industries Inc

Advanced Energy Industries Inc, based in the USA, has been a public company since November 17, 1995. The company provides precision power-conversion measurement and control solutions, primarily serving original equipment manufacturers and end customers in the semiconductor, flat panel display, solar panel, and other industrial capital equipment markets. As of the date of this article, the company has a market capitalization of $4.28 billion.

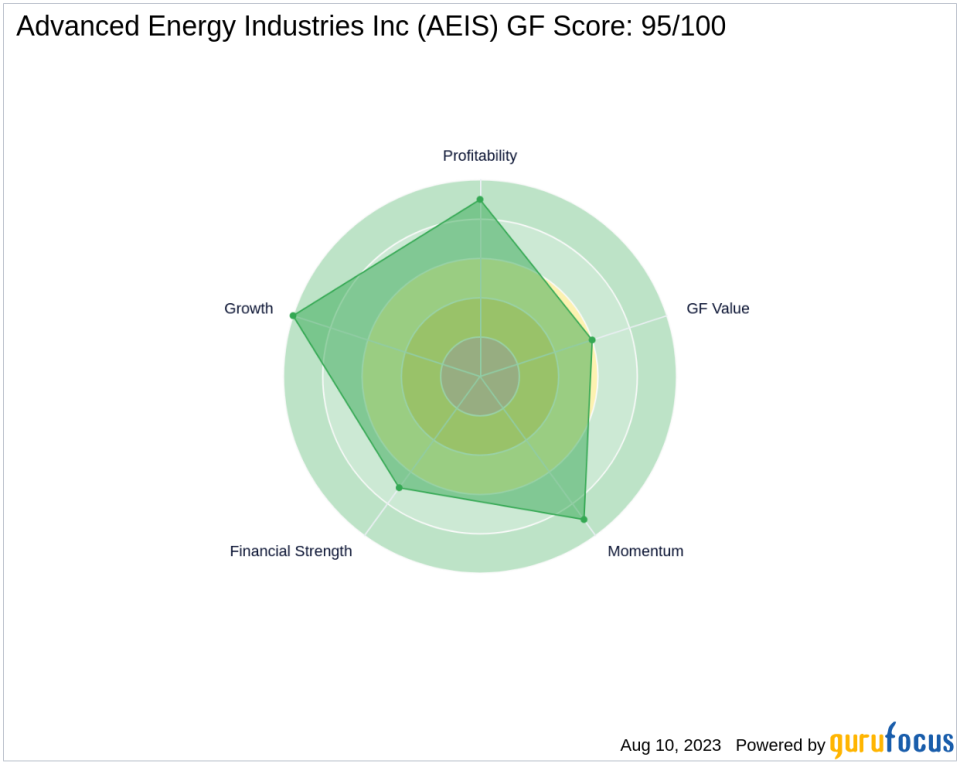

The company's financial health and performance are impressive, with a GF Score of 95/100, indicating a high outperformance potential. The company also boasts a Balance Sheet Rank of 7/10, a Profitability Rank of 9/10, and a Growth Rank of 10/10.

Comparison of the Traded Price and Current Stock Price

Since the transaction, the stock price of Advanced Energy Industries Inc has decreased by 9.16% to $113.71, compared to the traded price of $125.18. The year-to-date price change ratio stands at 32.93%.

Analysis of Advanced Energy Industries Inc's Valuation

According to GuruFocus, Advanced Energy Industries Inc is fairly valued, with a GF Value of $109.21 and a Price to GF Value ratio of 1.04. The GF Value Rank is 6/10, indicating a fair valuation.

Overview of Other Gurus' Positions in Advanced Energy Industries Inc

Other notable gurus who hold shares in Advanced Energy Industries Inc include Ken Fisher (Trades, Portfolio), First Eagle Investment (Trades, Portfolio), and Jefferies Group (Trades, Portfolio). However, FMR LLC (Trades, Portfolio)'s position in the company is significantly larger than that of these gurus.

Conclusion

In conclusion, FMR LLC (Trades, Portfolio)'s recent acquisition of additional shares in Advanced Energy Industries Inc is a noteworthy move that could potentially impact the firm's portfolio. Given Advanced Energy Industries Inc's strong financial performance and fair valuation, this transaction could offer significant value to FMR LLC (Trades, Portfolio) in the long run. As always, investors are advised to conduct their own comprehensive analysis before making investment decisions.

This article first appeared on GuruFocus.