FMR LLC Boosts Stake in BRP Group Inc

On July 31, 2023, FMR LLC (Trades, Portfolio), a renowned investment firm, significantly increased its holdings in BRP Group Inc (NASDAQ:BRP), a leading insurance distribution firm. The firm added 1,349,627 shares to its portfolio, bringing its total holdings to 6,571,567 shares. This transaction, which represents a 25.85% increase in FMR LLC (Trades, Portfolio)'s stake in BRP, has a 0.02% impact on its portfolio and accounts for 10.31% of BRP's total shares. The shares were traded at a price of $24.91 each.

About FMR LLC (Trades, Portfolio)

FMR LLC (Trades, Portfolio), also known as Fidelity, was founded in 1946 by Edward C. Johnson II. The firm's investment philosophy is centered on taking risks and investing in stocks with growth potential. Fidelity is known for its trailblazing individuals and its growth based on constant innovation and research. As of the date of this article, Fidelity holds 5,049 stocks in its portfolio, with a total equity of $1,090.64 trillion. The firm's top holdings include Apple Inc (NASDAQ:AAPL), Amazon.com Inc (NASDAQ:AMZN), Meta Platforms Inc (NASDAQ:META), Microsoft Corp (NASDAQ:MSFT), and NVIDIA Corp (NASDAQ:NVDA). The technology and healthcare sectors dominate its portfolio.

BRP Group Inc Overview

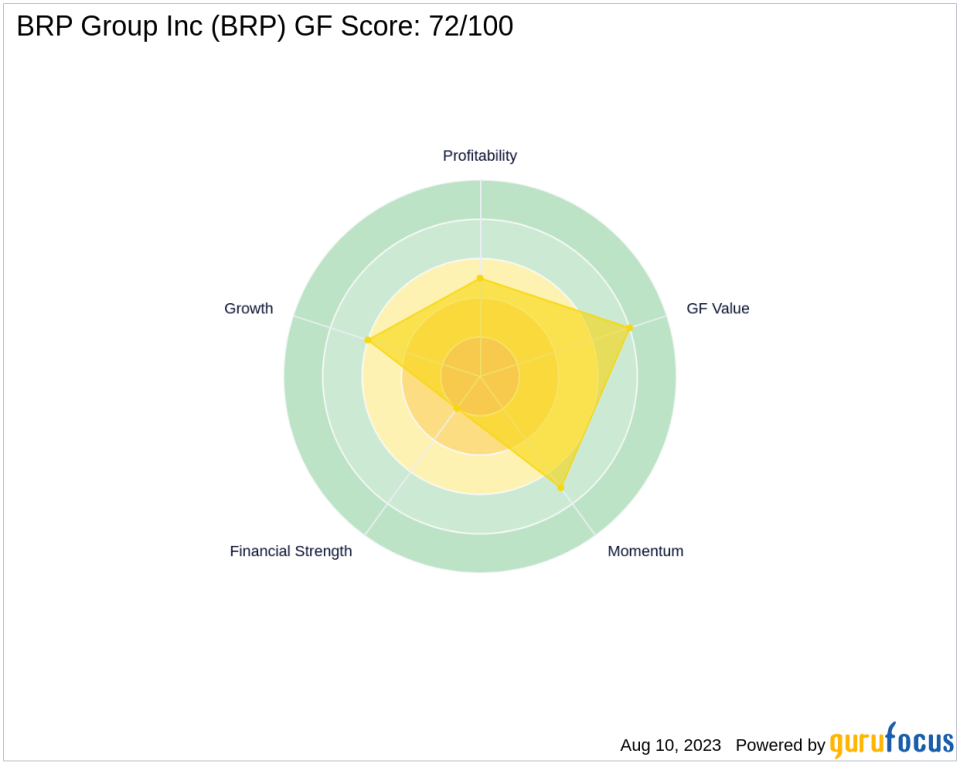

BRP Group Inc, based in the USA, is a prominent insurance distribution firm. The company operates through four segments: Middle Market, Specialty, Mainstreet, and Medicare, with the Middle Market segment generating the most revenue. BRP Group Inc went public on October 24, 2019. As of the date of this article, the company has a market cap of $1.5 billion and its shares are trading at $23.59. The company's GF Score is 72/100, indicating a good outperformance potential. However, its Financial Strength and Profitability Rank are relatively low, at 2/10 and 5/10 respectively.

BRP's Financial Performance and Market Position

BRP Group Inc's financial performance has been mixed. The company's revenue growth over the past three years stands at 30.90%, but its earnings growth during the same period is -15.50%. The company's Operating Margin growth is 0.00%, and its gross margin growth is -5.80%. BRP's Growth Rank is 6/10, its GF Value Rank is 8/10, and its Momentum Rank is 7/10. The company's Piotroski F-Score is 3, and its Altman Z score is 0.62, indicating financial stability.

Implications of the Transaction

FMR LLC (Trades, Portfolio)'s increased stake in BRP Group Inc underscores the firm's confidence in BRP's growth potential. Despite BRP's mixed financial performance, Fidelity's investment could provide a significant boost to the company. For value investors, this transaction highlights BRP as a potential investment opportunity. However, investors should also consider the company's financial strength, profitability, and market position before making investment decisions.

As of the date of this article, the largest guru investor in BRP Group Inc is Baron Funds, further emphasizing the company's potential appeal to value investors.

In conclusion, FMR LLC (Trades, Portfolio)'s increased stake in BRP Group Inc is a significant development that could have far-reaching implications for both the company and the investment firm. This transaction underscores the importance of thorough research and careful consideration in investment decision-making.

This article first appeared on GuruFocus.