FMR LLC Boosts Stake in Flywire Corp

On August 1, 2023, FMR LLC (Trades, Portfolio), a renowned investment firm, significantly increased its holdings in Flywire Corp (NASDAQ:FLYW), a leading global payments platform. This article provides an in-depth analysis of the transaction, the profiles of both FMR LLC (Trades, Portfolio) and Flywire Corp, and the potential implications for investors.

Details of the Transaction

FMR LLC (Trades, Portfolio) added 4,946,218 shares of Flywire Corp to its portfolio at a trade price of $35.05 per share. This transaction increased FMR LLC (Trades, Portfolio)'s total holdings in Flywire Corp to 5,500,697 shares, representing a 5.05% stake in the company and a 0.02% position in FMR LLC (Trades, Portfolio)'s portfolio. The transaction signifies FMR LLC (Trades, Portfolio)'s confidence in Flywire Corp's growth potential and strategic direction.

Profile of FMR LLC (Trades, Portfolio)

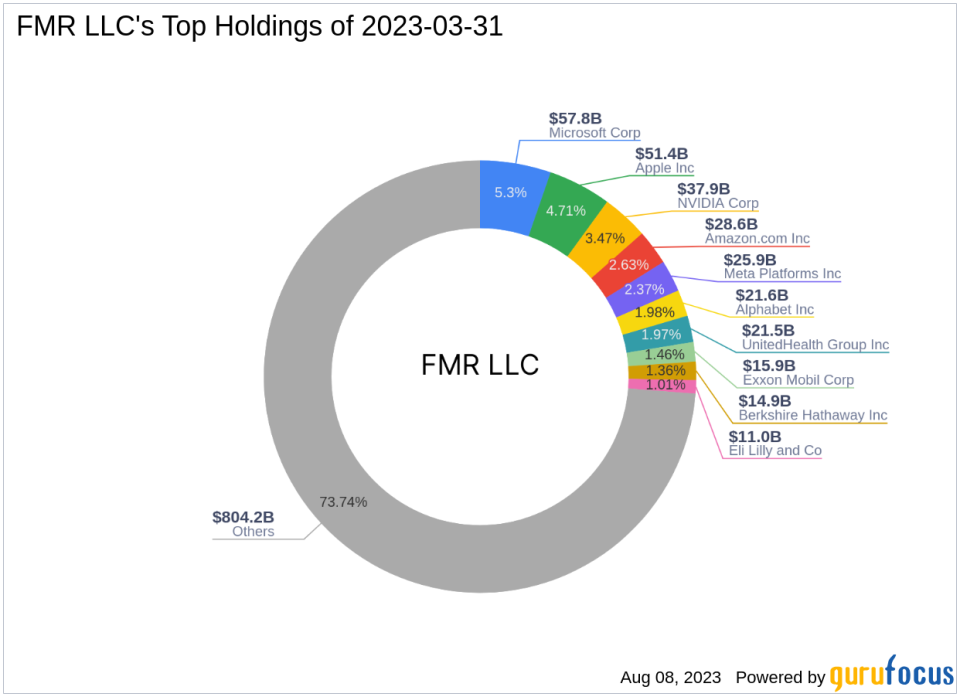

FMR LLC (Trades, Portfolio), also known as Fidelity, was founded in 1946 by Edward C. Johnson II. The firm's investment philosophy is rooted in taking calculated risks and investing in stocks with growth potential. Fidelity's top holdings include Apple Inc (NASDAQ:AAPL), Amazon.com Inc (NASDAQ:AMZN), Meta Platforms Inc (NASDAQ:META), Microsoft Corp (NASDAQ:MSFT), and NVIDIA Corp (NASDAQ:NVDA). The firm's equity stands at a staggering $1,090.64 trillion, with a strong focus on the technology and healthcare sectors.

Profile of Flywire Corp

Flywire Corp, based in the USA, is a secure global payments platform that offers innovative and streamlined processes for receiving reconciled domestic and international payments. The company's solutions are built on a payments platform, a proprietary global payment network, and vertical-specific software. Flywire Corp's market capitalization stands at $3.56 billion, with a current stock price of $32.17. The company's GF Score is 20/100, indicating poor future performance potential.

Analysis of Flywire Corp's Stock

Since its IPO on May 26, 2021, Flywire Corp's stock has experienced a -5.38% change. The year-to-date price change ratio stands at 34.43%. However, due to insufficient data, the GF Valuation, GF Value, and Price to GF Value cannot be evaluated. The stock's performance since the transaction has declined by -8.22%.

Evaluation of Flywire Corp's Financial Health

Flywire Corp's financial strength is reflected in its balance sheet rank of 8/10. However, its profitability rank and growth rank stand at 1/10 and 0/10 respectively, indicating areas of concern. The company's Piotroski F-Score is 4, and its Altman Z score is 17.26, suggesting a low risk of bankruptcy. Flywire Corp's cash to debt ratio is 181.71, ranking 443 in the software industry.

Analysis of Flywire Corp's Performance Metrics

Flywire Corp's interest coverage is 0.00, indicating that it is not generating enough earnings to cover its interest expenses. The company's return on equity (ROE) and return on assets (ROA) are -6.89 and -5.22 respectively. The company's gross margin growth and operating margin growth are both 0.00, while its 3-year revenue growth stands at 36.00%.

Examination of Flywire Corp's Stock Momentum

Flywire Corp's RSI 5 Day, RSI 9 Day, and RSI 14 Day stand at 48.20, 52.83, and 54.43 respectively. The company's Momentum Index 6 - 1 Month is 3.45, and its Momentum Index 12 - 1 Month is 17.35. These metrics suggest a neutral momentum for the stock.

Implications of the Transaction

The recent transaction by FMR LLC (Trades, Portfolio) indicates a strong belief in Flywire Corp's potential for growth. Despite the company's current financial health and performance metrics, FMR LLC (Trades, Portfolio)'s increased stake could signal a positive future outlook. However, investors should conduct thorough research and consider various factors before making investment decisions.

All data and rankings are accurate as of August 8, 2023.

This article first appeared on GuruFocus.