FMR LLC Reduces Stake in Arcutis Biotherapeutics Inc

On October 31, 2023, investment firm FMR LLC (Trades, Portfolio) made a significant adjustment to its portfolio by reducing its stake in Arcutis Biotherapeutics Inc (NASDAQ:ARQT). The transaction saw FMR LLC (Trades, Portfolio) sell off 4,710,781 shares, resulting in a -57.02% change in its holdings of the company. This move left the firm with a total of 3,551,261 shares in Arcutis Biotherapeutics Inc, which, interestingly, did not alter the firm's portfolio position due to a trade impact value of 0. The shares were traded at a price of $2.25 each.

Investment Firm FMR LLC (Trades, Portfolio): A Brief History

FMR LLC (Trades, Portfolio), known for its Fidelity brand, was established in 1946 by Edward C. Johnson II. The firm has a rich history of taking calculated risks and seeking stocks with growth potential. Fidelity's investment philosophy is deeply rooted in individual decision-making and innovation, a legacy carried on by Edward C. Johnson III and later by Abigail Johnson, the current CEO. With a diverse range of products, including notable mutual funds and ETFs, FMR LLC (Trades, Portfolio) has grown to manage assets worth $1,154.67 trillion, with a strong inclination towards the technology and healthcare sectors.

Understanding Arcutis Biotherapeutics Inc

Arcutis Biotherapeutics Inc, a medical dermatology company based in the USA, focuses on developing treatments for immune-mediated dermatological diseases and conditions. Since its IPO on January 31, 2020, the company has been working on innovative therapies, including its lead product candidate ZORYVE. Despite its promising clinical trials, Arcutis has faced challenges in the market, with a current market capitalization of $205.753 million and a stock price of $2.18, reflecting a significant decline since its IPO and year-to-date.

Trade Impact on FMR LLC (Trades, Portfolio)'s Portfolio

The recent trade by FMR LLC (Trades, Portfolio) has not impacted its portfolio position, as indicated by a trade impact value of 0. This suggests that the sale of Arcutis Biotherapeutics Inc shares may have been a strategic decision to rebalance the firm's investments or to cut losses, given the stock's performance. The firm's remaining 3.77% stake in Arcutis indicates a continued, albeit reduced, interest in the company's future.

Market Position and Performance of Arcutis Biotherapeutics Inc

Arcutis Biotherapeutics Inc's market position has been under pressure, with a stock price decline of -3.11% since the transaction and a staggering -90.55% drop since its IPO. The year-to-date performance has also been disappointing, with an -85.24% decrease. These figures underscore the challenges faced by the company in a competitive biotechnology industry.

FMR LLC (Trades, Portfolio)'s Investment Focus

FMR LLC (Trades, Portfolio)'s top holdings reflect a preference for large-cap technology and healthcare companies, with significant investments in Apple Inc (NASDAQ:AAPL), Amazon.com Inc (NASDAQ:AMZN), Meta Platforms Inc (NASDAQ:META), Microsoft Corp (NASDAQ:MSFT), and NVIDIA Corp (NASDAQ:NVDA). The firm's investment in Arcutis Biotherapeutics Inc stands out as a venture into a smaller, more specialized sector, indicating a diversified approach to portfolio management.

Financial Health and Future Potential of Arcutis Biotherapeutics Inc

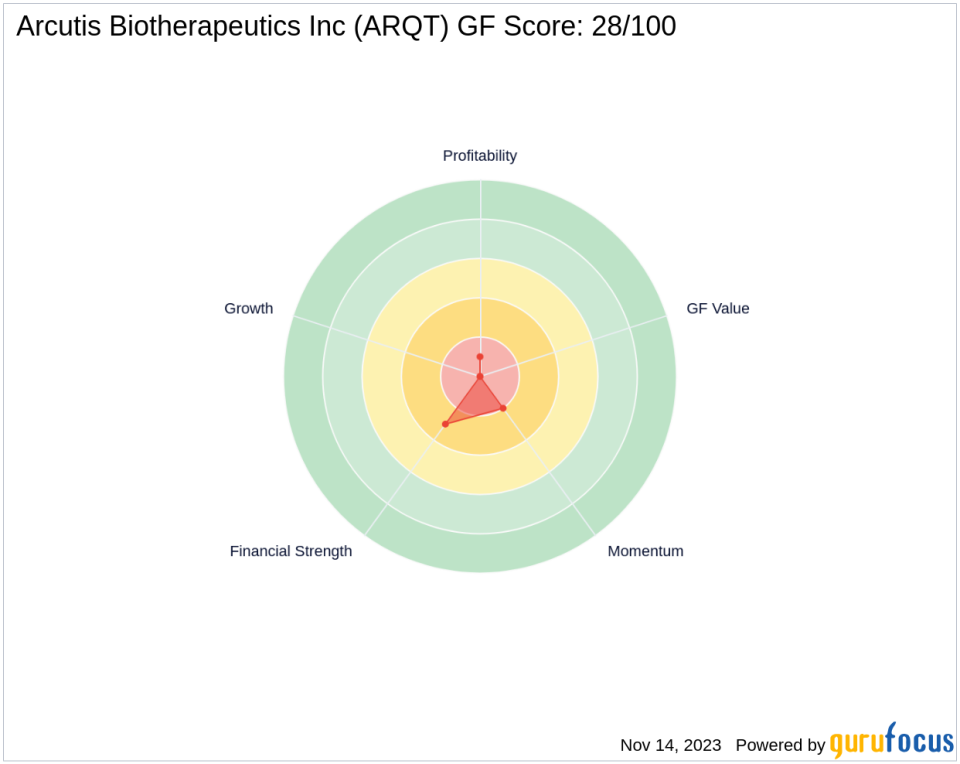

Arcutis Biotherapeutics Inc's financial health, as indicated by its GF Score of 28/100, suggests significant challenges ahead. The company's Financial Strength and Profitability Rank are low, and its Piotroski F-Score and Altman Z score indicate potential risks. However, the company's commitment to developing new treatments could offer long-term growth opportunities if successful.

Conclusion

FMR LLC (Trades, Portfolio)'s decision to reduce its position in Arcutis Biotherapeutics Inc may reflect a strategic shift or a response to the company's stock performance. While the trade has not impacted FMR LLC (Trades, Portfolio)'s portfolio significantly, it does highlight the firm's active management style and willingness to adjust its holdings in response to market conditions. Investors will be watching closely to see how this decision plays out in the context of FMR LLC (Trades, Portfolio)'s broader investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.