FMR LLC Reduces Stake in Big Lots Inc

On July 31, 2023, FMR LLC, a renowned investment firm, reduced its stake in Big Lots Inc (NYSE:BIG), a leading discount retail store in the United States. This article provides an in-depth analysis of the transaction, the profiles of the guru and the traded company, and the potential implications of the transaction.

Transaction Details

FMR LLC sold 1,568,115 shares of Big Lots Inc at a price of $10.25 per share. This transaction resulted in a 36.10% reduction in FMR LLC's holdings, leaving the firm with a total of 2,775,530 shares in Big Lots Inc. Despite this significant reduction, Big Lots Inc still represents 9.51% of FMR LLC's portfolio.

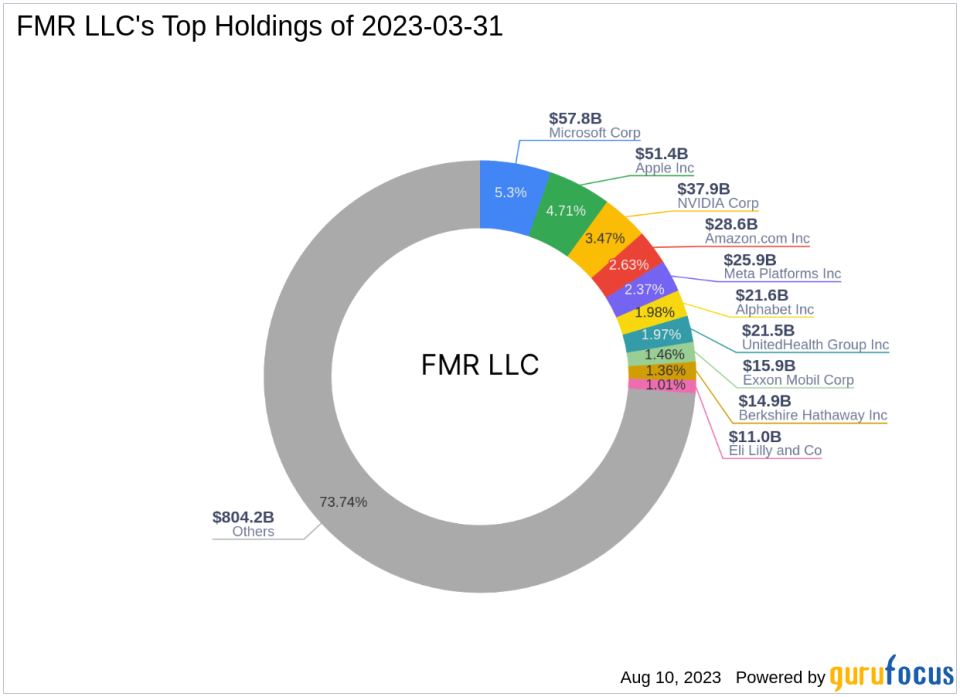

Profile of FMR LLC

FMR LLC, also known as Fidelity, was founded in 1946 by Edward C. Johnson II. The firm has a rich history of taking risks and investing in stocks with growth potential. Fidelity's top holdings include Apple Inc (NASDAQ:AAPL), Amazon.com Inc (NASDAQ:AMZN), Meta Platforms Inc (NASDAQ:META), Microsoft Corp (NASDAQ:MSFT), and NVIDIA Corp (NASDAQ:NVDA). The firm's equity stands at a staggering $1,090.64 trillion, with a strong focus on the technology and healthcare sectors.

Profile of Big Lots Inc

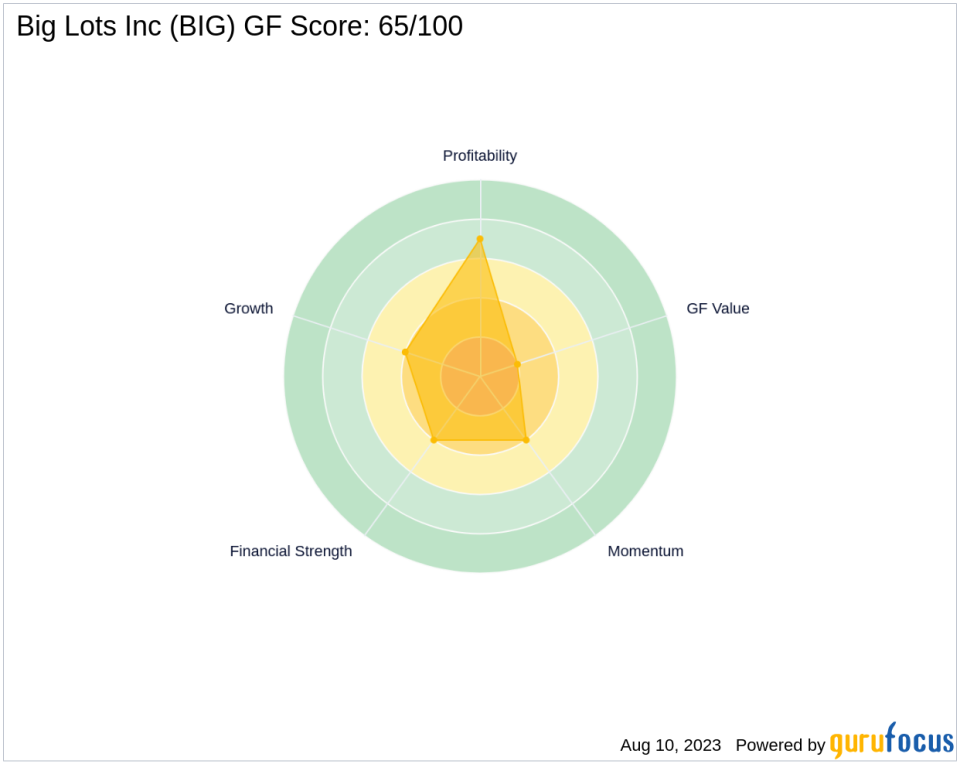

Big Lots Inc, with a market cap of $255.01 million, operates discount retail stores across the United States. The company offers a wide range of merchandise, including food, consumables, soft home products, hard home products, furniture, electronics, and accessories. Despite its current stock price of $8.74, the GF Value of Big Lots Inc stands at $44.80, indicating a potential value trap. The company's GF Score is 65/100, suggesting a moderate future performance potential.

Stock Performance and Industry Analysis

Big Lots Inc operates in the retail - defensive industry. The company's stock has seen a year-to-date decline of 41.18%, and its price has decreased by 14.73% since the transaction. Despite these declines, the stock has gained 221.32% since its IPO in 1988. Big Lots Inc's financial strength is rated 4/10, with an interest coverage of 0.00 and an Altman Z score of 2.30. The company's profitability rank is 7/10, and its Piotroski F-Score is 1, indicating a weak financial situation.

Largest Guru Holding the Traded Stock

The largest guru holding Big Lots Inc is Barrow, Hanley, Mewhinney & Strauss. The investment strategy of this guru could potentially influence the transaction and the performance of the stock.

Conclusion

In conclusion, FMR LLC's decision to reduce its stake in Big Lots Inc could have significant implications for both the guru and the traded company. The transaction could influence the stock's performance and the composition of the guru's portfolio. However, given the current financial situation of Big Lots Inc and the potential value trap, investors should exercise caution when considering this stock.

This article first appeared on GuruFocus.