FMR LLC Reduces Stake in Evelo Biosciences Inc

On October 31, 2023, FMR LLC (Trades, Portfolio), a prominent investment firm, made a significant adjustment to its portfolio by reducing its holdings in Evelo Biosciences Inc (NASDAQ:EVLO). The transaction involved the sale of 1,120,123 shares at a trade price of $0.411, leaving FMR LLC (Trades, Portfolio) with a total of 1,326,267 shares in the biotechnology company. Despite the sizeable share change, the trade had no impact on FMR LLC (Trades, Portfolio)'s portfolio due to the trade impact value being 0.

Understanding FMR LLC (Trades, Portfolio)'s Investment Approach

FMR LLC (Trades, Portfolio), known widely as Fidelity, was established in 1946 and has since become a beacon of investment innovation and risk-taking for growth potential. The firm's investment philosophy is deeply rooted in the belief that mutual funds should be managed based on individual decisions, a strategy that has been evident since Gerry Tsai's management of the Fidelity Capital Fund. Fidelity's history is marked by a series of pioneering steps, including the creation of the first money market fund with check writing capabilities and the launch of discount brokerage services. With a focus on talent investment and infrastructure development, Fidelity has grown its assets significantly, maintaining a strategy centered on constant innovation and research.

Evelo Biosciences Inc: A Biotech Innovator

Evelo Biosciences Inc, based in the United States, is at the forefront of developing orally delivered investigational medicines. These medicines are designed to interact with cells in the small intestine to produce therapeutic effects throughout the body. The company's leading product candidate, EDP1815, is aimed at treating inflammatory diseases and the hyperinflammatory response associated with COVID-19. Despite its innovative approach, Evelo Biosciences has faced challenges in the market, with a current market capitalization of $6.27 million and a stock price of $0.3314, which is a decline from the trade price.

Trade Impact Analysis on FMR LLC (Trades, Portfolio)'s Portfolio

The recent reduction in Evelo Biosciences Inc by FMR LLC (Trades, Portfolio) does not show a significant impact on the firm's portfolio, as indicated by the trade impact value of 0. This suggests that the transaction was not substantial enough to alter the firm's investment strategy or its position within the industry. FMR LLC (Trades, Portfolio)'s portfolio remains robust, with top holdings in technology and healthcare sectors, including giants like Apple Inc (NASDAQ:AAPL) and Amazon.com Inc (NASDAQ:AMZN).

Market Performance and Financial Health of Evelo Biosciences Inc

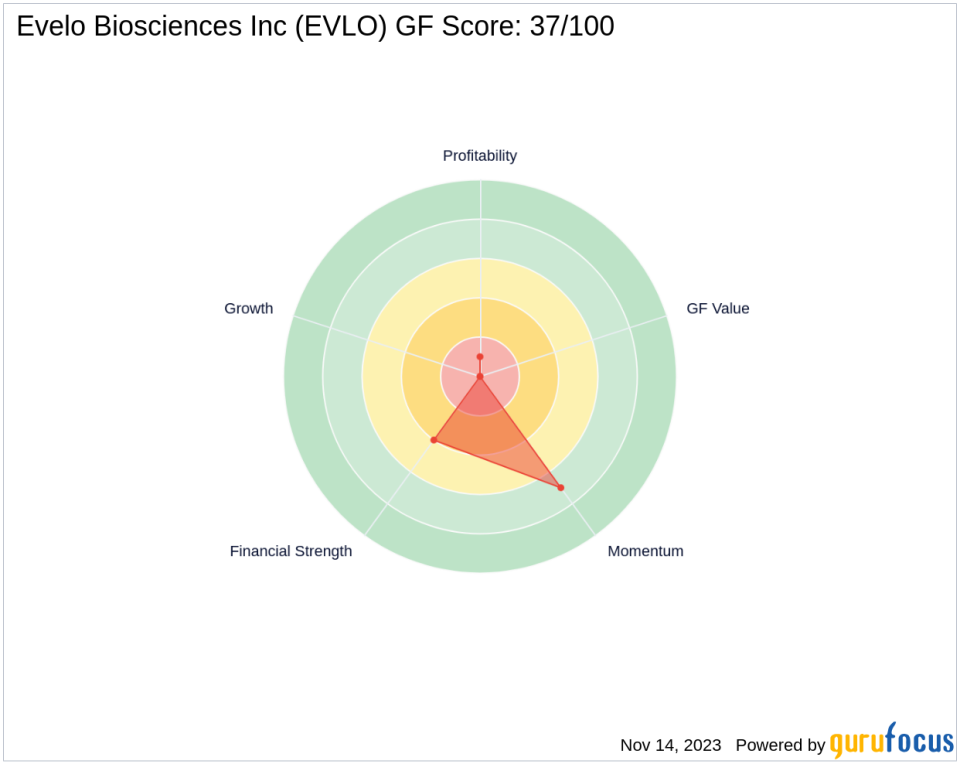

Evelo Biosciences Inc's stock performance has been underwhelming, with a GF Score of 37/100, indicating poor future performance potential. The company's financial health is also a concern, with a Financial Strength rank of 4/10 and a Profitability Rank of 1/10. The Piotroski F-Score of 3 further reflects the company's weak financial position. However, the company's Momentum Rank of 7/10 suggests some positive movement in stock price in the short term.

Comparative Analysis of Evelo Biosciences Inc and FMR LLC (Trades, Portfolio)'s Holdings

When compared to FMR LLC (Trades, Portfolio)'s other holdings, Evelo Biosciences Inc stands out as a smaller and more speculative investment. The firm's preference for technology and healthcare sectors is evident, with Evelo Biosciences fitting into the latter category. However, the company's financial indicators, such as its cash to debt ratio of 0.51, place it in a precarious position within the biotechnology industry.

Conclusion: FMR LLC (Trades, Portfolio)'s Strategic Positioning

FMR LLC (Trades, Portfolio)'s decision to reduce its stake in Evelo Biosciences Inc may be attributed to the company's underperformance and uncertain financial health. While the trade itself did not significantly impact FMR LLC (Trades, Portfolio)'s portfolio, it reflects the firm's ongoing strategy to optimize its investments and focus on companies with stronger growth potential and financial stability. Investors will be watching closely to see how FMR LLC (Trades, Portfolio) adjusts its portfolio in response to market changes and company performances.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.