Focus on New Products & Digitization Aid Armstrong World (AWI)

Armstrong World Industries, Inc. AWI has been benefiting from digitization, inorganic growth and investment in new products.

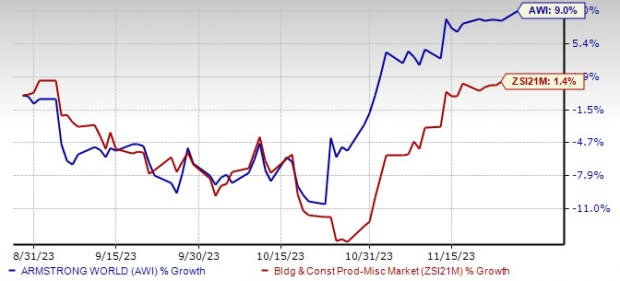

Shares of the global producer of ceiling systems have gained 9% in the past three months, outperforming the Zacks Building Products – Miscellaneous industry’s 1.4% rise. Earnings estimates for 2023 and 2024 for the company have moved 4.3% and 3% upward, respectively, over the past 60 days. This positive trend signifies bullish analysts’ sentiments, indicating robust fundamentals and the expectation of outperformance in the near term. The estimated figure indicates 8.2% and 6.6% year-over-year growth for 2023 and 2024, respectively.

Armstrong World — a Zacks Rank #2 (Buy) stock — has a favorable VGM Score of B.

Our research shows that stocks with a VGM Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or 2, offer the best investment opportunities to investors. In the next three to five years, the company is likely to generate 8.5% earnings growth.

Image Source: Zacks Investment Research

Let’s delve into the major driving factors.

Focus on Digital Investments: Armstrong World maintains its focus on digitalization and technology enhancement initiatives. The company is consistently investing in Healthy Spaces and digital projects, anticipating a positive impact on its overall growth. Since 2022, the company's digital initiative, Canopy, has shown consecutive quarter-on-quarter growth, generating new demand for its products.

In the third quarter of 2023, sales through Armstrong World's Canopy doubled year over year, accompanied by favorable EBITDA growth. The Healthy Spaces initiative has also yielded positive results. Additionally, in the second quarter, the company's strategies for growth in healthy spaces and digital platforms made a beneficial impact on Mineral Fiber sales. Robust sales growth in the Health Zone product line through the online marketplace helped offset some of the adverse effects of the overall decline in market activity. Notably, sales through Canopy have exceeded the total sales for the entire year of 2022.

Focus on New Products: Since its separation from the flooring business in 2016, Armstrong World has strategically directed investments toward new products, sales and support services, and advanced manufacturing capabilities. Recent investments in metal, wood, and Tectum product development are contributing to the company's overall performance. The Architectural Specialties segment of the company has effectively utilized the new product platforms acquired over the past several years. This strategic approach has empowered AWI to expand its scale and reach, facilitating a deeper presence in the specialty ceiling and wall category across various spaces and commercial buildings. Importantly, it enables participation in larger and more complex projects. The company remains committed to innovation, consistently introducing new products that contribute to a balanced and beneficial product mix.

The recent inclusion of BOK Modern further enhances these efforts. BOK's distinctive architectural metal solutions complement Armstrong World's existing Architectural Specialties. With innovative designs that prioritize material and installation efficiency, BOK Modern allows architects to seamlessly integrate internal and exterior building aesthetics, meeting the requirements of diverse projects.

Acquisitions: Armstrong World adheres to a systematic inorganic strategy aimed at portfolio enhancement. Over the past seven years, the company has strategically acquired nine businesses to bolster its capabilities within the Architectural Specialties segment. While the third quarter of 2023 witnessed no significant buyouts, the company remains committed to focusing on strategic acquisitions that bring unique attributes and capabilities, leveraging its core business strengths.

In July 2023, Armstrong World successfully acquired BOK Modern, LLC, as part of its ongoing efforts to augment its portfolio. The company plans to harness BOK's third-party network and explore the potential integration of certain operations into existing factories to optimize the supply chain and enhance capacity for accelerated expansion. The outcomes of this acquisition are reflected in the company's third-quarter 2023 results, presenting additional sales opportunities in new domains for Armstrong World.

Other Key Picks

Here are some other top-ranked stocks that investors may consider from the Zacks Construction sector.

Installed Building Products, Inc. IBP currently sports a Zacks Rank #1. IBP delivered a trailing four-quarter earnings surprise of 7.3%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of the company have gained 11.1% in the past six months. The Zacks Consensus Estimate for IBP’s 2023 sales and earnings per share (EPS) indicates growth of 4.6% and 8.6%, respectively, from the previous year’s reported levels.

Acuity Brands, Inc. AYI currently sports a Zacks Rank of 1. AYI delivered a trailing four-quarter earnings surprise of 12%, on average. Shares of the company have gained 10.5% in the past six months.

The Zacks Consensus Estimate for AYI’s fiscal 2024 sales and EPS indicates a decline of 3% and 4.7%, respectively, from the previous year’s reported levels.

Construction Partners, Inc. ROAD currently sports a Zacks Rank of 1. ROAD has a trailing four-quarter earnings surprise of 10.6%, on average. Shares of the company have gained 39.3% in the past six months.

The Zacks Consensus Estimate for ROAD’s fiscal 2024 sales and EPS indicates growth of 14.6% and 47.1%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Armstrong World Industries, Inc. (AWI) : Free Stock Analysis Report

Acuity Brands Inc (AYI) : Free Stock Analysis Report

Installed Building Products, Inc. (IBP) : Free Stock Analysis Report

Construction Partners, Inc. (ROAD) : Free Stock Analysis Report