Fomento Economico Mexicano SAB de CV (FMX): A Strong Contender in the Alcoholic Beverages ...

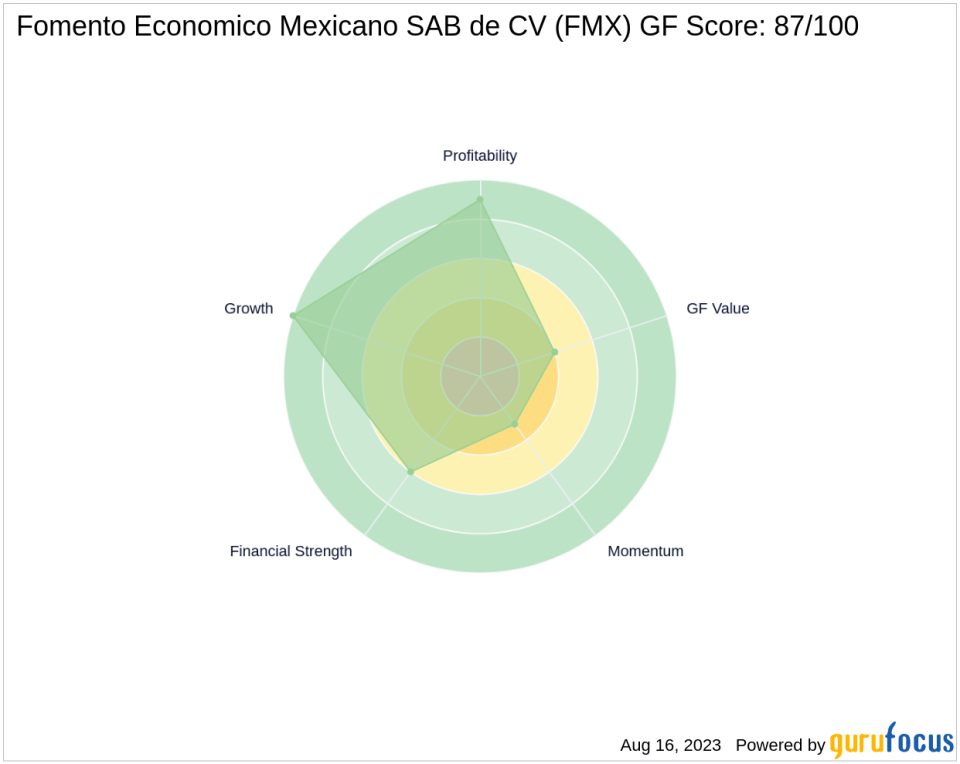

Fomento Economico Mexicano SAB de CV (NYSE:FMX), a leading player in the alcoholic beverages industry, is currently trading at $116.88 with a market capitalization of $209.11 billion. The company's stock price has seen a gain of 4.01% today and has risen by 7.38% over the past four weeks. FMX's GF Score stands at an impressive 87 out of 100, indicating good outperformance potential. The GF Score is a comprehensive stock performance ranking system developed by GuruFocus, which evaluates a company's financial strength, profitability, growth, GF value, and momentum.

Financial Strength Analysis

FMX's Financial Strength rank is 6/10. This score is derived from several factors, including its interest coverage of 5.04, indicating a manageable debt burden, and a debt to revenue ratio of 0.43, which is relatively low. The company's Altman Z score is 2.08, suggesting it is not in immediate danger of bankruptcy.

Profitability Rank Analysis

The company's Profitability Rank is 9/10, reflecting its strong profitability. FMX's Operating Margin is 8.27%, and its Piotroski F-Score is 6, indicating a healthy financial situation. The company has shown consistent profitability over the past 9 years, despite a slight downtrend in the operating margin over the past 5 years (-0.70%).

Growth Rank Analysis

FMX boasts a perfect Growth Rank of 10/10, reflecting its robust growth in terms of revenue and profitability. The company's 5-year revenue growth rate is an impressive 60.00%, and its 3-year revenue growth rate is 53.70%. Furthermore, FMX's 5-year EBITDA growth rate stands at 61.90%, indicating strong operational growth.

GF Value Rank Analysis

The company's GF Value Rank is 4/10, suggesting that the stock is currently fairly valued. This rank is determined by the price-to-GF-Value ratio, a proprietary metric calculated based on historical multiples and an adjustment factor based on a company's past returns and growth.

Momentum Rank Analysis

FMX's Momentum Rank is 3/10, indicating that the stock's price performance has been relatively weak recently. This rank is determined using the standardized momentum ratio and other momentum indicators.

Competitor Analysis

When compared to its competitors in the same industry, FMX holds a strong position. Intrepid Potash Inc (NYSE:IPI) has a GF Score of 85, American Vanguard Corp (NYSE:AVD) has a GF Score of 83, and CF Industries Holdings Inc (NYSE:CF) has a GF Score of 90. You can find more details about these competitors here.

Conclusion

In conclusion, FMX's overall GF Score of 87 suggests good outperformance potential. The company's strong financial strength, high profitability, and robust growth make it a compelling choice for potential investors. However, investors should also consider the company's fair GF Value and relatively weak momentum before making an investment decision.

This article first appeared on GuruFocus.