Foot Locker (FL) Stock Grapples With Multiple Headwinds

Foot Locker, Inc. FL appears to be a weak performer, due to several issues that the company has been facing for a while now. A tough operating landscape, including the inflationary pressures, foreign currency headwinds and other woes, is weighing on the company’s performance. Consequently, the company posted dull first-quarter fiscal 2023 results and issued a bleak outlook for the current fiscal year.

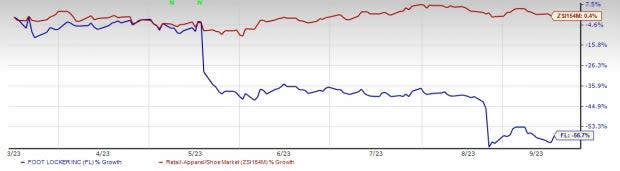

Driven by these limitations, shares of this Zacks Rank #5 (Strong Sell) company have lost 56.7% in the year-to-date period against the industry’s 0.4% rise. For fiscal 2023, the Zacks Consensus Estimate for Foot Locker’s sales and earnings per share (EPS) is currently pegged at $8 billion and $1.39, respectively. These estimates show corresponding decreases of 9% and 72.5% from the year-ago period’s figures.

Let’s Delve Deeper

In addition to the aforesaid headwinds, a slowdown in consumer spending and supply-chain woes have been weighing on the company’s performance. Markdowns to optimize inventory levels and elevated promotional environment have been weighing on the company’s margins. It has been witnessing higher SG&A expenses for a while now.

In second-quarter fiscal 2023, Foot Locker’s sales and earnings fell short of the Zacks Consensus Estimate, with both the metrics declining year over year. The company posted adjusted earnings of 4 cents per share, which missed the Zacks Consensus Estimate by a penny. FL registered total sales of $1,864 million, which came below the consensus estimate of $1,884 million. Excluding the foreign currency fluctuation impacts, total sales declined 10.2%. Comparable-store sales (comps) also inched down 9.4% due to persistent consumer softness, changing vendor mix and repositioning of Champs Sports.

Image Source: Zacks Investment Research

Consequently, management has provided a dull outlook for fiscal 2023. The company continues to operate in an extremely dynamic retail landscape and has witnessed softer-than-expected sales in the first half. The sales and promotional dynamics have continued into August, compelling management to trim the sales and margin outlook for the fiscal year.

For fiscal 2023, management expects sales to decline 8-9%, including 1% from the extra week, and the comps to fall 9-10% year over year. These are comparable with the earlier views of sales and comps declining 6.5-8% and 7.5-9%, respectively. Licensing revenues are likely to be $17 million. The gross margin is anticipated to decrease 390-410 bps in the range of 27.8-28% compared with the prior view of 28.6-28.8%. The company lowered the gross margin guidance on account of higher markdown activity, incremental occupancy deleverages and an increase in shrink. The SG&A rate is forecast to be 22.7-22.9%, up from the earlier view of 22.4-22.6%.

The company envisions fiscal 2023 adjusted earnings per share to be $1.30-$1.50, down from $2.00-$2.25 predicted earlier. The earnings guidance incudes 15 cents a share from the extra week.

Given the aforesaid negatives, we remain cautious about the stock in the near term. A Growth Score of F further adds to the weakness.

Key Picks

We have highlighted three better-ranked stocks, namely Abercrombie & Fitch ANF, American Eagle Outfitters AEO and Boot Barn BOOT.

Abercrombie & Fitch, a leading casual apparel retailer, currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current financial-year sales and EPS suggests growth of 0.5% and 526.3%, respectively, from the year-ago reported figures. ANF delivered an earnings surprise of 107.7% in the last reported quarter.

American Eagle Outfitters, a retailer of casual apparel, accessories and footwear, currently sports a Zacks Rank of 1. AEO delivered an earnings surprise of 82.6% in the last reported quarter.

The Zacks Consensus Estimate for American Eagle Outfitters’ current financial-year sales and EPS suggests growth of 3.3% and 24.2%, respectively, from the year-ago reported figures.

Boot Barn, a fashion retailer of apparel and accessories, currently carries a Zacks Rank #2 (Buy). The company has a trailing four-quarter earnings surprise of 8.7%, on average.

The Zacks Consensus Estimate for Boot Barn’s current financial-year sales and EPS suggests growth of 8.2% and 9.1%, respectively, from the year-ago reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Foot Locker, Inc. (FL) : Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report