Forex: EUR/GBP Technical Analysis – Stop-Loss Hit on Short Position

To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

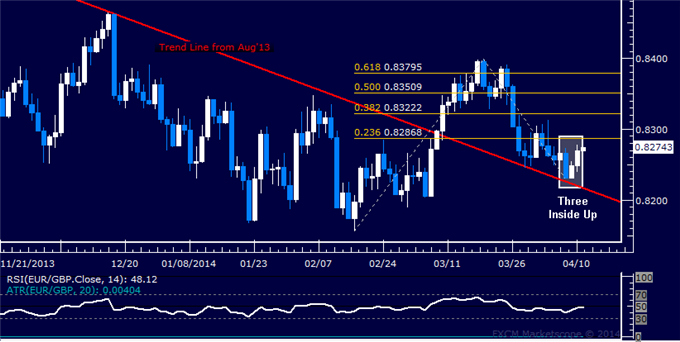

EUR/GBP Technical Strategy: Short at 0.8357

Support: 0.8463 (50% Fib ret.), 0.8535 (61.8% Fib ret.)

Resistance: 0.8390 (38.2% Fib ret.), 0.8301 (23.6% Fib ret.)

Our short Euro position against the British Pound from 0.8357 was stopped out as prices issued a close above 0.8377, the March 13 high. Prices have now edged above resistance at 0.8390, the 38.2% Fibonacci retracement, seemingly exposing the 50% level at 0.8463. Alternatively, a reversal back below 0.8390 sees the next key layer of support at 0.8301, the 23.6% Fib.

Prices broke resistance by a mere 5 pips. In the context of a 20-day ATR reading at 42, our level of conviction in upside follow-through is relatively low. With that in mind, we will opt not to chase the pair higher and pass on a long position, choosing to monitor developments from the sidelines for now.

Confirm your chart-based trade setups with the Technical Analyzer. New to FX? Start Here!

Daily Chart - Created Using FXCM Marketscope 2.0

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.