Forget the "Magnificent Seven": 2024 Will Be All About the "Fab Four". Learn About Them Here.

The so-called "Magnificent Seven" stocks have been the stars of 2023. Collectively, they account for almost two-thirds of the S&P 500's total return over the last year.

But, the real question is, will the "Magnificent Seven" -- Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms, and Tesla -- lead the market again in 2024? Or could other stocks lead the way in the new year?

I think the latter is more likely. Here are the stocks -- which I'd call the "Fab Four" -- I have my eye on:

Visa

Topping this list is Visa (NYSE: V).

Let me be clear: Visa is not the most exciting stock around. The company has been around for decades; it's not in the headlines every day. Its business model is simple, bordering on dull.

But oh boy, has that business model delivered.

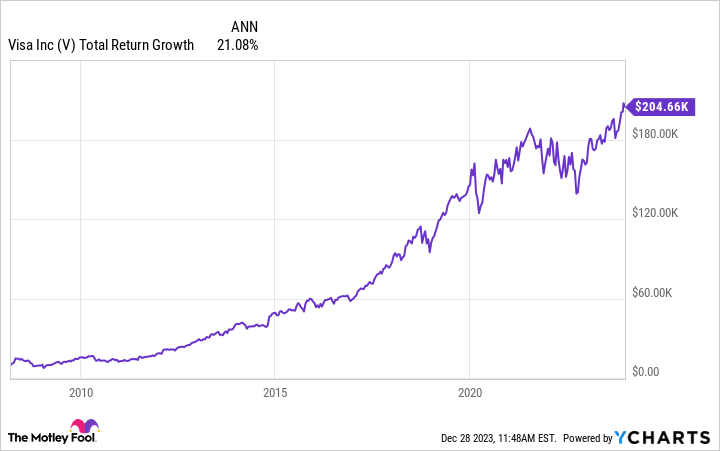

Over the 15 years since its initial public offering (IPO) in 2008, Visa shares have recorded a compound annual growth rate (CAGR) of 21%. That means $10,000 invested in Visa shares at its IPO would now be worth over $204,000.

V Total Return Level data by YCharts.

Behind that monster performance is a beautiful business model -- charging fees in exchange for facilitating payments on Visa's gigantic payments network. For fiscal year 2023 (the 12 months ending on Sept. 30), Visa processed 212 billion transactions, with a total payment volume of over $12 trillion. From that, the company generated $32.7 billion in revenue and $17.3 billion in net income.

What's more, the company then rewarded shareholders with $16.1 billion in share repurchases and dividend payments. That's a recipe every investor should love, and I think it will continue to pay off for Visa and its shareholders in 2024.

CrowdStrike Holdings

The smallest company by market cap on my list, CrowdStrike (NASDAQ: CRWD), is nevertheless a stock that every investor should know. That's because the company is one of the leading cybersecurity providers around.

CrowdStrike provides AI-enabled security modules that protect its clients' networks, data, and endpoints. This has become all the more important today as the number of cyberattacks has skyrocketed.

Indeed, in 2023 alone, organizations ranging from hospitals and schools to casinos and retailers have all been hacked. In some cases, hackers demanded ransoms to return sensitive data or to reactivate critical operations.

This enormous increase in cybercrime means that demand for CrowdStrike's products is bursting at the seams.

As of its most recent quarter (the three months ending Oct. 31), the company reported revenue growth of 35%. Moreover, CrowdStrike's subscription-based model is attractive and scalable. Over the last nine months, 94% of the company's revenue has come from subscriptions. In addition, 63% of CrowdStrike's customers use five or more of the company's security modules.

Thanks to its red-hot growth and scalable technology, I think CrowdStrike is a name to watch in 2024.

Shopify

Next up is Shopify (NYSE: SHOP). The company, which operates one of the world's fastest-growing e-commerce platforms, is poised for a big 2024.

Like many high-octane growth stocks, Shopify shares suffered a setback in 2022, as interest rates screamed higher and the stock market slumped.

However, that temporary setback lit a fire. Management has cut costs in each of the last two years, starting with staff reductions of 10% in 2022 and 20% in 2023.

As a result, Shopify's free cash flow has rebounded. It stands at $548 million as of the company's most recent third quarter.

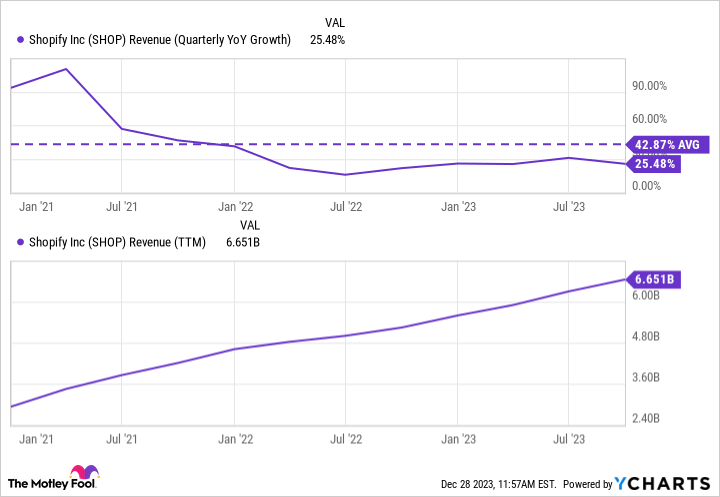

Yet despite the cost reductions, Shopify is still growing. Revenue growth has averaged 43% over the last three years, as total revenue has surged from $2.9 billion in 2020 to $6.7 billion today.

More to the point, Shopify is becoming the go-to e-commerce platform for influencers and up-and-coming brands. For example, Shopify has partnered with Crate & Barrel, Allbirds, and Blendjet to build online storefronts, increase conversion rates, and supercharge sales.

As we enter 2024, Shopify has all the hallmarks of a stock on the rise.

Nvidia

Finally, Nvidia (NASDAQ: NVDA) rounds out the Fabulous Four.

Granted, Nvidia is a well-known member of the Magnificent Seven. However, I view Nvidia as a cut above the rest. That's because Nvidia is riding an unprecedented tidal wave of demand.

Simply put, the AI revolution is changing the way business is done. Consider these examples:

Amazon now has over 750,000 robots working in its vast fulfillment warehouses.

Generative AI tools like OpenAI's ChatGPT, Adobe's Firefly, and Alphabet's AlphaCode are reshaping text, image, and source code composition.

AI learning tools, like those used by Duolingo, are reshaping how students learn.

To put it another way, AI is taking over. Not in Terminator-like fashion, more like the way the internet started reshaping the world 30 years ago. Organizations are now rushing to scale up their AI tools to stay ahead of -- or at least even with -- the competition.

As a result, demand for Nvidia's top AI chips is through the roof. Similarly, Nvidia's revenue and earnings are skyrocketing, and analysts are scrambling to raise next year's estimates. Over the last 90 days, the consensus estimate for Nvidia's 2025 earnings per share (EPS) has jumped from $16.71 to $20.50 -- an increase of 23%.

In summary, 2024 could be another stellar year for Nvidia, perhaps even more so than 2023.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now... and Nvidia wasn't one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Jake Lerch has positions in Adobe, Alphabet, Amazon, CrowdStrike, Duolingo, Nvidia, Tesla, and Visa. The Motley Fool has positions in and recommends Adobe, Alphabet, Amazon, Apple, CrowdStrike, Duolingo, Meta Platforms, Microsoft, Nvidia, Shopify, Tesla, and Visa. The Motley Fool recommends the following options: long January 2024 $420 calls on Adobe and short January 2024 $430 calls on Adobe. The Motley Fool has a disclosure policy.

Forget the "Magnificent Seven": 2024 Will Be All About the "Fab Four". Learn About Them Here. was originally published by The Motley Fool