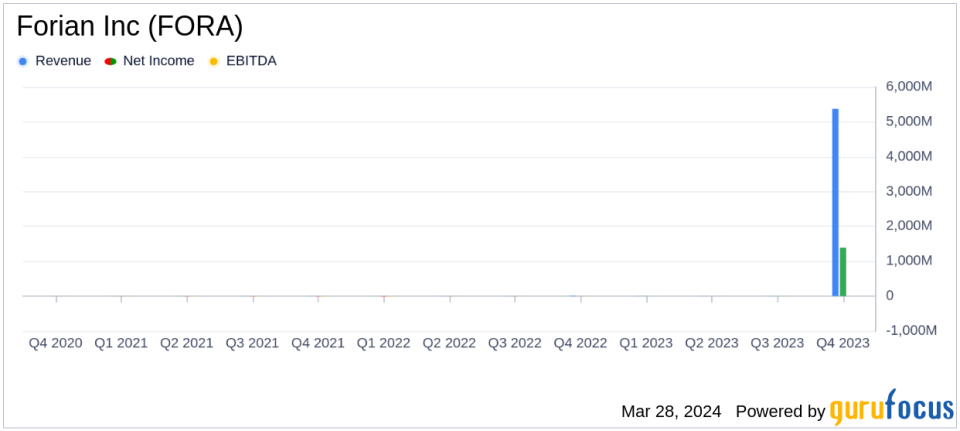

Forian Inc (FORA) Outperforms Analyst Revenue Estimates and Achieves Positive Adjusted EBITDA

Revenue: Q4 revenue of $5.368 million, surpassing analyst estimates of $5.4515 million.

Net Income: Q4 net income of $1.388 million, a significant turnaround from the previous year's net loss.

Adjusted EBITDA: Achieved $1.033 million in Q4 and $2.336 million for the full year, indicating improved operational efficiency.

Earnings Per Share (EPS): Q4 diluted EPS at $0.04, a notable improvement from the prior year's loss per share.

Balance Sheet: Strong liquidity with over $6 million in cash and cash equivalents and $42.296 million in marketable securities.

On March 28, 2024, Forian Inc (NASDAQ:FORA), a provider of data science driven information and analytics solutions to the healthcare and life sciences industries, announced its financial results for the fourth quarter and full year ended December 31, 2023. Forian Inc (NASDAQ:FORA) released its 8-K filing showcasing a year of substantial financial progress, with full-year revenue growth of 25% and a positive Adjusted EBITDA of $2.3 million.

Forian Inc provides a suite of SaaS solutions, data management capabilities, and proprietary data and analytics to optimize and measure operational, clinical, and financial performance for customers within the healthcare and life sciences sectors, as well as cannabis dispensaries, manufacturers, cultivators, and regulators.

Forian Inc (NASDAQ:FORA)'s performance in the fourth quarter demonstrated a significant improvement, with revenue increasing by 8% to $5.368 million, exceeding the estimated $5.4515 million. This growth is particularly noteworthy given the challenges faced by the healthcare and services industry, including regulatory changes and competitive pressures. The company's ability to surpass revenue estimates and achieve a positive net income of $1.388 million, compared to a net loss in the previous year, signals strong operational execution.

The company's financial achievements, including a 25% increase in full-year revenue and a positive Adjusted EBITDA, are critical for sustaining growth and investment in innovation. Forian Inc (NASDAQ:FORA)'s focus on the healthcare and life sciences sectors positions it well to capitalize on the growing demand for data analytics and precision medicine.

Key financial details from the year-end report include:

Financial Metrics | Q4 2023 | Full Year 2023 |

|---|---|---|

Revenue | $5.368 million | $20.481 million |

Net Income | $1.388 million | $11.106 million |

Adjusted EBITDA | $1.033 million | $2.336 million |

EPS (Diluted) | $0.04 | $0.34 |

Cash and Equivalents | $6.043 million | - |

Max Wygod, Chairman and CEO of Forian, commented on the results, stating,

Forian finished the year by executing against our quarterly plan and closed what was a transformational year. In 2023, we successfully completed a major divestiture and refocused our business on healthcare and life sciences, continued revenue growth and achieved Adjusted EBITDA ahead of schedule."

Forian Inc (NASDAQ:FORA) also provided an outlook for the full year 2024, indicating a continued focus on growth and operational efficiency. The company's strong balance sheet, with over $6 million in cash and cash equivalents and $42.296 million in marketable securities, offers a solid foundation for future investments and strategic initiatives.

Investors and stakeholders can find more details on the company's performance and future plans in the full 8-K filing. Forian Inc (NASDAQ:FORA) will discuss these results in a conference call and webcast later today.

Explore the complete 8-K earnings release (here) from Forian Inc for further details.

This article first appeared on GuruFocus.