FormFactor Inc (FORM) Navigates Industry Softness with Mixed Fiscal 2023 Results

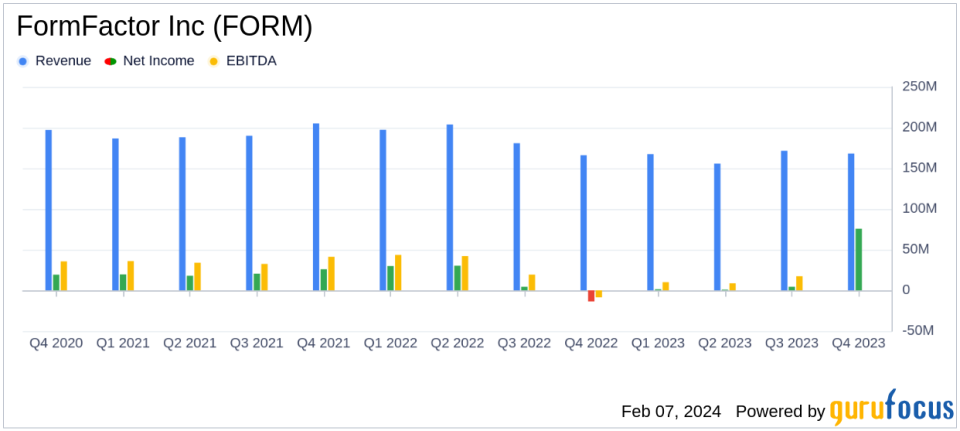

Quarterly Revenue: Q4 revenue slightly increased by 1.3% year-over-year to $168.2 million.

Annual Revenue: Fiscal 2023 revenue declined by 11.3% to $663 million from $748 million in fiscal 2022.

Net Income: GAAP net income for Q4 stood at $75.8 million, with a significant gain from the sale of FRT.

Gross Margin: Maintained at 40.4% in Q4, consistent with Q3 but a notable increase from 27.2% in Q4 of the previous year.

Free Cash Flow: Fiscal 2023 free cash flow decreased to $11.4 million from $67.1 million in fiscal 2022.

Non-GAAP Measures: Non-GAAP net income for Q4 was $15.7 million, or $0.20 per fully-diluted share.

Future Outlook: Q1 expectations set for similar performance to recent quarters, with revenue around $165 million.

On February 7, 2024, FormFactor Inc (NASDAQ:FORM) released its 8-K filing, detailing the financial outcomes for the fourth quarter and full fiscal year of 2023. The company, a leading provider of essential test and measurement technologies for the semiconductor industry, reported a slight year-over-year increase in quarterly revenue, while annual figures showed a decline, reflecting broader market challenges.

FormFactor Inc operates in two segments: Probe Cards and Systems. The former, which includes sales of probe cards and analytical probes, is the primary revenue driver, while the latter comprises probe stations and thermal sub-systems. The company's diversified product portfolio has been instrumental in navigating a period of industry softness, with a particular demand surge for DRAM probe cards attributed to the growth of high-bandwidth-memory, crucial for generative AI applications.

Fiscal Performance and Strategic Moves

Despite a dip in annual revenue, FormFactor's Q4 performance exceeded the mid-point of the company's outlook range for both revenue and gross margin. This stability is partly due to a strategic divestiture of its China operations to Grand Junction Semiconductor Pte. Ltd., which also established an exclusive distribution and partnership agreement for continued sales and support in the region. This move is indicative of FormFactor's agility in optimizing its global footprint amidst shifting market dynamics.

CEO Mike Slessor commented on the results, stating,

The strength and stability of our balanced product portfolio enables us to make investments in innovation, capacity and other strategic initiatives, while maximizing quarterly profitability and protecting our strong balance sheet during the current period of industry softness."

Financial Highlights and Outlook

FormFactor's GAAP net income for Q4 was significantly bolstered by a $73.0 million gain from the sale of FRT, excluded from non-GAAP results. This one-time gain skews the comparison with previous quarters and the same quarter of the prior year, where the company experienced a net loss. The non-GAAP figures, which exclude this gain and other adjustments, present a more modest but stable profitability scenario.

The company's gross margin remained consistent at 40.4% in Q4, matching the previous quarter and showing a significant improvement from the 27.2% in Q4 of fiscal 2022. This improvement is a testament to the company's operational efficiency and ability to manage costs effectively.

Looking ahead, FormFactor anticipates the first quarter of fiscal 2024 to mirror the performance of recent quarters, with expected revenue of approximately $165 million and a non-GAAP gross margin of around 41%. This outlook suggests a cautious but steady approach in a still uncertain market environment.

Value investors may find FormFactor's strategic positioning and financial resilience appealing, particularly given the company's ability to maintain profitability and a strong balance sheet amidst industry headwinds. The company's focus on innovation and strategic partnerships, coupled with its diversified product offerings, positions it well to capitalize on future growth opportunities in the semiconductor space.

For a more detailed analysis of FormFactor's financials and strategic outlook, investors are encouraged to review the full 8-K filing and consider the implications for their investment strategies.

Explore the complete 8-K earnings release (here) from FormFactor Inc for further details.

This article first appeared on GuruFocus.