Forrester Research Inc (FORR) Faces Headwinds: Contract Value and Revenue Dip in 2023

Contract Value: Decreased by 4% year-over-year to $332.1 million.

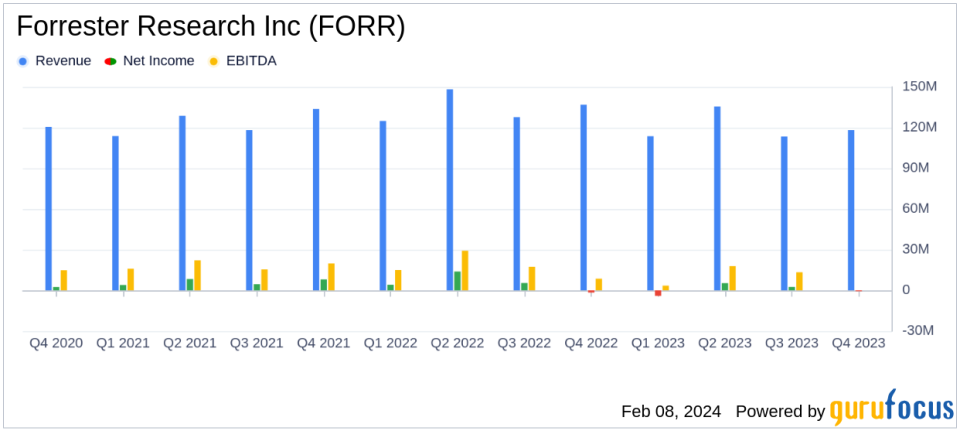

Revenue: Declined by 11% in 2023, with total revenues of $480.8 million.

Net Income: GAAP net income fell to $3.1 million, or $0.16 per diluted share, from $21.8 million in 2022.

Adjusted Net Income: Dropped to $36.6 million, or $1.90 per diluted share, compared to $47.2 million in the previous year.

2024 Guidance: Forrester anticipates continued pressure on CV, retention metrics, and revenue.

On February 8, 2024, Forrester Research Inc (NASDAQ:FORR) released its 8-K filing, detailing a year marked by financial challenges and strategic advancements. The company, a leading provider of independent research, data, and advisory services, reported a 4% decrease in contract value and an 11% decline in revenue for the year ended December 31, 2023. Despite these headwinds, Forrester made significant progress in improving its Forrester Decisions platform, upskilling its sales organization, and preparing its genAI tool, Izola, for general release.

Financial Performance and Strategic Progress

Forrester's CEO, George F. Colony, acknowledged the difficulties faced in 2023 but remained optimistic about the company's foundational improvements and the potential for growth in 2025. The company's transition to the Forrester Decisions platform is expected to be completed in 2024, which is reflected in the guidance for the year. The full-year financial results showed a decrease in total revenues to $480.8 million, down from $537.8 million in 2022. GAAP net income also saw a significant reduction to $3.1 million, or $0.16 per diluted share, compared to $21.8 million, or $1.14 per diluted share, in the previous year.

Adjusted net income, which excludes certain expenses such as stock-based compensation and restructuring costs, was $36.6 million, or $1.90 per diluted share, for 2023. This represents a decline from the adjusted net income of $47.2 million, or $2.46 per diluted share, reported in 2022. The adjusted effective tax rate for 2023 was 29%.

Key Financial Details

Forrester's balance sheet as of December 31, 2023, showed $124.5 million in cash, cash equivalents, and marketable investments, with $58.9 million in net accounts receivable and $156.8 million in deferred revenue. The company's debt stood at $35 million, down from $50 million the previous year. Operating activities provided net cash of $21.7 million, and the company made repayments of debt totaling $15 million and repurchased $4.1 million of its common stock.

Key metrics for the year included a contract value of $332.1 million, a client retention rate of 73%, and a wallet retention rate of 87%. The number of clients decreased to 2,449 from 2,778 in the previous year, and total headcount was reduced to 1,744 from 2,033.

"2023 was a challenging year, with revenue down 11% and CV down by 4%. However, we made steady progress in 2023 on multiple fronts, including improving the Forrester Decisions platform, upskilling the sales organization, and readying our genAI tool, Izola, for general release," said George F. Colony, CEO of Forrester.

Looking Ahead

Forrester's guidance for 2024 indicates that the company expects continued challenges but is poised to leverage its product, go-to-market, and organizational foundations to return to contract value growth in 2025. The company's focus on customer obsession and its strategic initiatives, including the Forrester Decisions platform and the genAI tool Izola, are key to navigating the transition year and setting the stage for future growth.

Forrester Research Inc (NASDAQ:FORR) remains committed to providing leaders with the insights necessary to thrive in a dynamic business environment. As the company navigates through its transition period, investors and stakeholders will be closely monitoring its performance and the effectiveness of its strategic initiatives.

For more detailed information, readers are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Forrester Research Inc for further details.

This article first appeared on GuruFocus.