Fortinet Inc (FTNT) Director Judith Sim Sells 20,637 Shares

Director Judith Sim of Fortinet Inc (NASDAQ:FTNT), a global leader in broad, integrated, and automated cybersecurity solutions, has sold 20,637 shares of the company on March 6, 2024, according to a recent SEC filing. The transaction was executed at an average price of $70.79 per share, resulting in a total value of approximately $1,460,923.23.

Fortinet Inc specializes in providing top-tier cybersecurity solutions to a wide range of customers, including enterprises, service providers, and government organizations. The company's broad portfolio of products and services covers network security, cloud security, secure access, and endpoint protection, among others.

Over the past year, the insider has sold a total of 20,637 shares and has not made any purchases of the company's stock. The recent sale by Judith Sim is part of a series of insider transactions at Fortinet Inc. In the past year, there have been 5 insider buys and 28 insider sells for the company.

On the day of the insider's recent sale, shares of Fortinet Inc were trading at $70.79, giving the company a market capitalization of $55.75 billion. The price-earnings ratio of the company stands at 50.39, which is above the industry median of 27.61 but below the company's historical median price-earnings ratio.

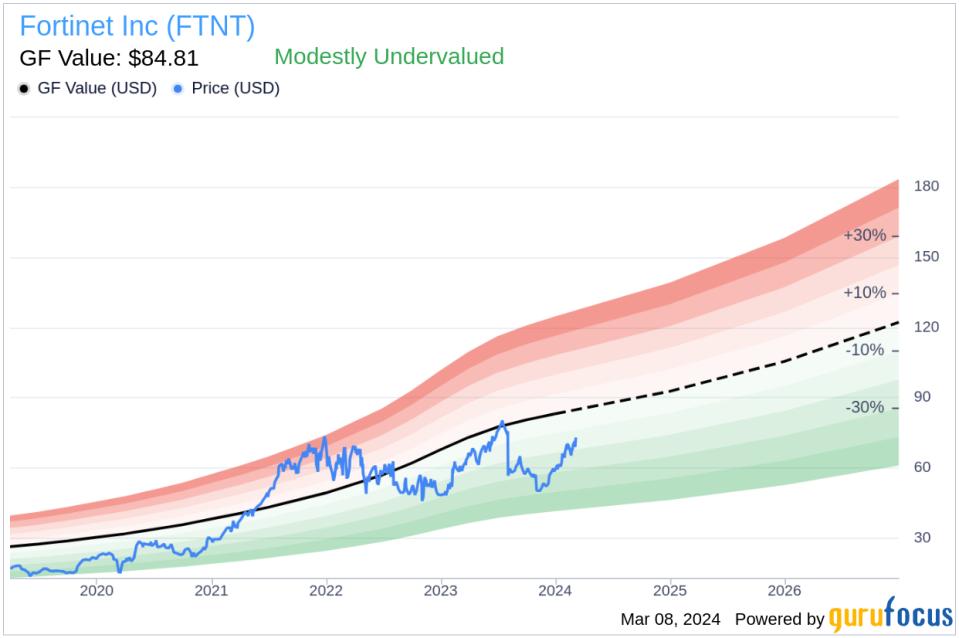

According to the GuruFocus Value assessment, with a share price of $70.79 and a GF Value of $84.81, Fortinet Inc has a price-to-GF-Value ratio of 0.83, indicating that the stock is modestly undervalued.

The GF Value is determined by considering historical trading multiples such as price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow, along with a GuruFocus adjustment factor based on the company's past returns and growth, and future business performance estimates from Morningstar analysts.

The recent insider sell by Director Judith Sim may provide investors with insight into the insider's perspective on the stock's valuation and future prospects. However, investors should also consider the broader market conditions and the company's fundamentals before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.