Fortis (FTS) Unveils Capital Outlook, Ups Annual Dividend

Fortis Inc. FTS recently announced its five-year capital outlook and its board of directors also approved a 4.4% increase in the dividend rate. The new long-term capital expenditure will be directed to strengthen transmission operations in the Midwest and resource transition plans in Arizona.

Details of Capital Outlook

The new capital expenditure is projected to be $25 billion for the 2024-2028 period, which shows an increase of $2.7 billion from the previous five-year plan for the 2023-2027 period. The planned investment will support regional transmission projects and support FTS’ power generation unit Tucson Electric Power’s exit from coal.

The five-year capital plan is low-risk and highly executable, with nearly 100% regulated investments and 18% relating to major capital projects. Nearly 27% of the five-year capital plan is allocated to cleaner energy investments focused on connecting renewables to the grid, renewable and storage investments in Arizona and the Caribbean and cleaner fuel solutions in British Columbia.

A Long History of Dividend Payment

Fortis has a long history of paying dividends to its shareholders and the current 4.4% increase in quarterly dividends marks 50 consecutive years of increased dividends.

The new quarterly dividend of 59 cents will be payable on Dec 1, 2023, to the common shareholders of record at the close of business on Nov 17, 2023. The increase in the annual dividend rate is within the company’s annual dividend growth guidance of 4-6% through 2028.

The current dividend yield of the company is 5.74%, better than its industry’s yield of 3.6%.

Other Utilities Raising Dividends

Due to a domestic focus, regulated operations and stable demand, utilities have a steady performance year after year, which allows them to reward shareholders through the payment of dividends, raise dividends and announce a share buyback program to increase shareholders’ net worth.

In the past few months, National Fuel Gas Company NFG, Chesapeake Utilities Corp. CPK and Consolidated Water Co. Ltd. CWCO have raised quarterly dividend rates by 4.2%, 10.3% and 11.8%, respectively.

The Zacks Consensus Estimate for National Fuel Gas’ fiscal 2023 earnings is pegged at $5.22 per share, implying 1.8% growth in the past 60 days. Its current dividend yield is 3.69%.

The Zacks Consensus Estimate for Chesapeake Utilities’ 2023 earnings is pinned at $5.16 per share, implying a year-over-year increase of 2.4%. Its current dividend yield is 2.15%.

The Zacks Consensus Estimate for Consolidated Water’s 2023 earnings is pegged at $4.79 per share, implying a growth of nearly 49% in the past 60 days. Its current dividend yield is 1.14%.

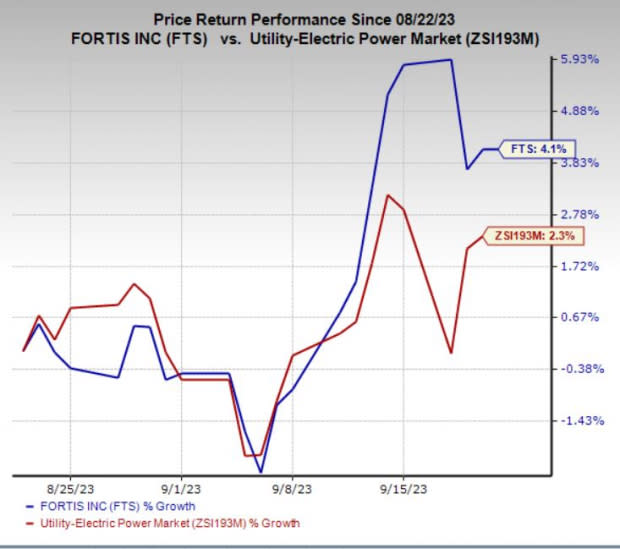

Price Performance

In the last month, Fortis’ shares have returned 4.1% compared with the industry’s growth of 2.3%.

Image Source: Zacks Investment Research

Zacks Rank

Fortis currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chesapeake Utilities Corporation (CPK) : Free Stock Analysis Report

National Fuel Gas Company (NFG) : Free Stock Analysis Report

Consolidated Water Co. Ltd. (CWCO) : Free Stock Analysis Report

Fortis (FTS) : Free Stock Analysis Report