Fortive (FTV) Plans to Acquire EA Holding GmbH for $1.45B

Fortive Corporation FTV announced that it has entered into an agreement to acquire a leading company of high-power electronic testing solutions for energy storage, mobility, hydrogen, and renewable energy applications — EA Elektro-Automatik Holding GmbH.

The acquisition is valued at $1.45 billion in cash, accounting for $215 million in tax benefits from Bregal Unternehmerkapital. The completion of the acquisition is contingent on customary closing requirements and regulatory approvals, with an anticipated closure in early first-quarter 2024, added Fortive.

The acquisition will likely help Fortive to bolster its position in electronic testing and measurement. Also, the acquisition will likely improve Fortive's position in high-growth markets across various industries and generate substantial value for both customers and shareholders. The acquisition will be financed using a combination of existing cash and debt financing.

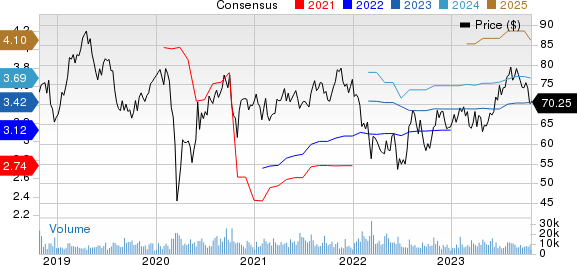

Fortive Corporation Price and Consensus

Fortive Corporation price-consensus-chart | Fortive Corporation Quote

Fortive foresees that this acquisition will have a positive impact on adjusted gross and operating margins, with a neutral to slightly positive effect on adjusted diluted net earnings per share (EPS) for fiscal 2024.

Fortive is a diversified industrial growth company that provides industrial technology and professional instrumentation solutions on a global basis. Going ahead, the company aims to tackle the overall cyclicality of its businesses by investing in multiyear megatrends, like automation, digitization and electrification.

In September, the company’s subsidiary Fluke Corp completed the acquisition of Solmetric. The acquisition aligns with the company’s effort to expand its footprint in the electrification market.

Prior to that, the company’s subsidiary, Fluke Reliability, completed the acquisition of Azima DLI. The acquisition aligns with Fluke Reliability's connected reliability approach, which involves merging hardware, software, and remote monitoring services to tackle the reliability demands of assets.

FTV plans to expand its market position in line with secular growth trends. The company has transitioned its software offering in line with the growing demand for artificial intelligence and machine learning.

Fortive currently has a Zacks Rank #3 (Hold). Shares of the company have gained 12.2% in the past year against the sub-industry’s decline of 0.1%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the broader technology space are Asure Software ASUR, Synopsys SNPS and Wix.com WIX. Asure Software and Wix.com presently sport a Zacks Rank #1 (Strong Buy), whereas Synopsys holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Asure Software’s 2023 EPS has increased 5.9% in the past 60 days to 54 cents.

Asure Software’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 676.4%. Shares of ASUR have surged 49.5% in the past year.

The Zacks Consensus Estimate for Synopsys’ 2023 EPS has gained 2.5% in the past 60 days to $11.09. SNPS’ long-term earnings growth rate is 16.4%. Shares of SNPS have surged 61.3% in the past year.

The Zacks Consensus Estimate for Wix’s 2023 EPS has remained unchanged in the past 60 days to $3.35.

Watts Water’s earnings beat estimates in all the trailing four quarters, delivering an average surprise of 319.3%. Shares of WIX have rallied 7% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Wix.com Ltd. (WIX) : Free Stock Analysis Report

Fortive Corporation (FTV) : Free Stock Analysis Report