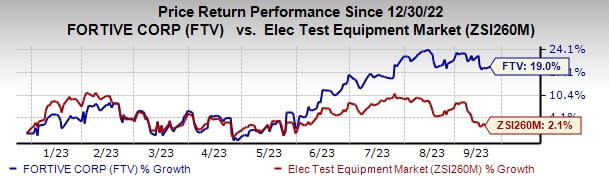

Fortive (FTV) Stock Gains 19% YTD: Will the Trend Continue?

Fortive FTV witnessed strong momentum year to date, with its shares up 19% in the same time frame compared with the sub-industry’s rise of 2.1%.

Fortive is a diversified industrial growth company that provides industrial technology and professional instrumentation solutions on a global basis. Going ahead, the company aims to tackle the overall cyclicality of its businesses by investing in multiyear megatrends, like automation, digitization and electrification.

Image Source: Zacks Investment Research

Catalysts Behind the Price Surge

Let’s delve deeper to unearth the factors working in favor of this Zacks Rank #2 (Buy) stock.

The company’s performance is being driven by momentum in software and services businesses and recovery in the healthcare segment. The company plans to grow its business using a five-way strategy. It plans to expand its market position in line with secular growth trends. FTV has transitioned its software offering in line with the growing demand for artificial intelligence and machine learning.

The company continues to engage in mergers and acquisitions to expand its market share. In August, the company’s subsidiary, Fluke Reliability, completed the acquisition of Azima DLI. The acquisition will help Fluke Reliability steer customers away from reactive and rudimentary analysis by shifting them to cutting-edge and scalable predictive maintenance.

This reiterates the company's strategic commitment to promoting connected reliability while simultaneously delivering inventive solutions that leverage the transformative capabilities of artificial intelligence and pioneering software-as-a-service technology. The company expects software and recurring revenues to grow 45-50% and 20%, respectively, from 2023 to 2028.

The company’s industrial and scientific business segment benefits from iNet expansion and cross-sell activity. Higher adoption of FAL digital solutions and robust backlog in power and digital T&M solutions bode well. Due to strong business trends, the company expects to have more than $200 billion in excess backlog by the end of 2023.

The company also raised guidance for 2023. Fortive now projects adjusted net earnings per share (EPS) in the range of $3.36-$3.42 (earlier view: $3.29-$3.40). Revenues are now anticipated in the band of $6.070-$6.1 billion (earlier view: $6-$6.1 billion).

FTV’s 2023 and 2024 revenues are anticipated to rise 8.6% and 8.4% year over year, respectively. The company has outpaced estimates in all the trailing four quarters, delivering an earnings surprise of 4.1%, on average.

Despite strong demand, the company's near-term prospects might be affected by global macroeconomic weakness and inflation. High research and development costs and leveraged balance sheets are concerns.

Other Stocks to Consider

Some other top-ranked stocks in the broader technology space are Woodward WWD, Aspen Technology AZPN and Badger Meter BMI. Woodward presently sports a Zacks Rank #1 (Strong Buy), whereas Badger Meter and Aspen Technology currently carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Woodward’s fiscal 2023 EPS has increased 15.9% in the past 60 days to $4.15.

WWD’s long-term earnings growth rate is 13.5%. Shares of WWD have gained 34.9% in the past year.

The Zacks Consensus Estimate for Aspen Technology’s fiscal 2024 EPS has increased 5.8% in the past 60 days to $6.58.

Aspen Technology’s long-term earnings growth rate is 17.1%. Shares of AZPN have declined 7.6% in the past year.

The Zacks Consensus Estimate for Badger Meter’s 2023 EPS has increased 6.3% in the past 60 days to $2.86.

Badger Meter’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 6.7%. Shares of BMI have surged 76.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Woodward, Inc. (WWD) : Free Stock Analysis Report

Aspen Technology, Inc. (AZPN) : Free Stock Analysis Report

Fortive Corporation (FTV) : Free Stock Analysis Report