Fortuna (FSM) Acquires Chesser Resources to Grow in West Africa

Fortuna Silver Mines Inc. FSM has completed the previously announced acquisition of Chesser Resources Limited, a West Africa-focused gold exploration and development company. The buyout gives FSM ownership of the Diamba Sud Gold Project located in the highly productive Senegal-Mali shear zone. Scoping Study has shown it to be a technically simple, high-value and low-risk gold development project.

The shareholders of Chesser received 0.0248 of the common share of Fortuna in exchange of each share held in Chesser. Overall, Fortuna issued 15,545,368 of its shares in exchange for the Chesser shares. This represents 5.1% of the issued and outstanding Fortuna on an undiluted basis. Chesser is now a wholly-owned subsidiary of Fortuna.

The acquisition of Chesser expands Fortuna’s presence in West Africa. Chesser holds tenements in Senegal, covering approximately 337 square miles of prospective ground. The region hosts many world-class gold mines including the Loulo, Gounkoto and Fekola mines.

Diamba Sud is comprised of four open pittable high-grade gold deposits, along with numerous anomalies, which are yet to be tested. Fortuna will prioritize exploration to expand the mineral resource at Diamba Sud before advancing the project to the development stage. The company’s strong balance sheet, technical and operational strength and attractive cost of capital will help accelerate the exploration of Diamba Sud and also drive future development.

In its latest report, Chesser’s Indicated Mineral Resource estimate for the

Diamba Sud Gold Project was 10.0 million tons (Mt), averaging 1.9 grams of gold per ton of gold, containing 625,000 ounces of gold. Inferred Mineral Resource estimate was 4.7 Mt, averaging 1.5 grams per ton, containing 235,000 ounces of gold.

The project has the potential to generate an attractive post-tax net present value of $218 million and 43% Internal Rate of Return over an estimated 7.5 year mine life.

This move reflects the company’s strategic commitment to grow in West Africa. In 2021, Fortuna had marked its foray in West Africa with the acquisition of Roxgold. This added the high-grade Yaramoko Gold Mine in Burkina Faso and the advanced development project Séguéla Gold Project in Côte d’Ivoire to FSM’s portfolio. Prior to this, Canada-based Fortuna Silver had three mines, which were San Jose in Mexico, Lindero in Argentina and Caylloma in Peru.

Séguéla poured its first gold on May 24, 2023. It has since ramped up production and the processing plant has now produced a total of 21,716 ounces of gold in doré as of the end of August.

In 2023, the Séguéla mine is expected to produce 60,000 to 75,000 ounces of gold. The Yaramoko mine is expected to produce gold in the range of 92,000 to 102,000 ounces. The company’s gold production from all of its operations is 282,000-320,000 ounces. The West African mines are collectively expected to contribute 54-55% of the current year’s expected total gold output.

The company expects gold equivalent production of 412,000 to 463,000 ounces in 2023, which includes lead and zinc by-products.

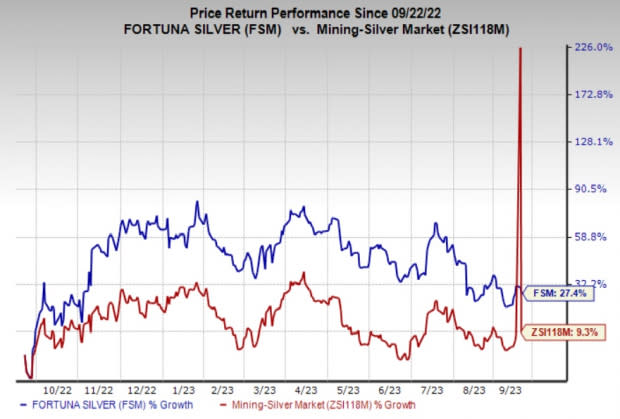

Price Performance

Shares of Fortuna Silver have gained 27.4% in a year compared with the industry’s 9.3% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Fortuna Silver currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Hawkins, Inc. HWKN, Carpenter Technology Corporation CRS and L.B. Foster Company FSTR. HWKN and CRS sport a Zacks Rank #1 (Strong Buy) at present, and FSTR carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Hawkins has an average trailing four-quarter earnings surprise of 25.5%. The Zacks Consensus Estimate for HWKN’s fiscal 2024 earnings is pegged at $3.40 per share. The consensus estimate for 2024 earnings has moved 38% north in the past 60 days. Its shares have gained 53% in the last year.

Carpenter Technology has an average trailing four-quarter earnings surprise of 10%. The Zacks Consensus Estimate for CRS’s fiscal 2024 earnings is pegged at $3.48 per share. The consensus estimate for 2023 earnings has moved 8% north in the past 60 days. Its shares have gained 96% in the last year.

L.B. Foster has an average trailing four-quarter earnings surprise of 134.5%. The Zacks Consensus Estimate for FSTR’s 2023 earnings is pegged at 53 cents per share. Earnings estimates have been unchanged in the past 60 days. FSTR’s shares have gained 87% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

L.B. Foster Company (FSTR) : Free Stock Analysis Report

Fortuna Silver Mines Inc. (FSM) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report