Fortuna Silver (FSM) Q3 Gold Equivalent Production Rises 26% Y/Y

Fortuna Silver Mines Inc. FSM reported a record gold production of 94,821 ounces and a silver production of 1,680,751 ounces in third-quarter 2023. Gold output marked a 43% year-over-year increase, mainly attributed to the first full quarter of production and steady operating performance at FSM’s newest flagship mine, Séguéla.

Silver production was down 8.5% year over year. Gold equivalent ounces were 128,671 in the third quarter of 2023, up 26% from the prior-year quarter.

Mine Performances in Q3

FSM currently has five operating mines in its portfolio, with the Séguéla mine located in Côte d´Ivoire, contributing 31,498 ounces in its first full quarter of production. The mine poured its first gold on May 24, 2023, and completed the processing plant performance test in August 2023. The mine's operation has already exceeded nameplate capacity and is on track to meet the mid-point of its gold production guidance for the second half of 2023.

At the Lindero mine in Argentina, third-quarter gold production was 20,933 ounces, down 30.3% year over year mainly due to the lower head grade of mineralized material placed on the leach pad that is aligned with the mineral reserves and mining sequence. The company, however, has stated that the mine is on track to meet annual production guidance.

The Yaramoko Mine in Burkina Faso produced 34,036 ounces of gold, up 25% year over year, reflecting higher grades mined and an increase in milled tons. Backed by the solid third-quarter performance, FSM has increased Yaramoko's annual gold production guidance to 110,000-120,000 ounces from 92,000-102,000 ounces stated earlier.

The San Jose mine in Mexico produced 1,372,530 ounces of silver and 8,205 ounces of gold in the third quarter. Silver production was down 11% year over year, whereas gold production declined 9.7%. The company expects the gold production to fall below the annual guidance of 34,000-37,000 ounces due to lost production days in the second quarter of 2023 owing to the union blockade. Silver production is on track to meet the annual guidance of 5.3-5.8 million ounces.

The Caylloma mine in Peru produced 308,221 ounces of silver in the third quarter, up 6% year over year. Zinc production was around 14 million pounds and lead production was 10.3 million pounds. Compared with the prior-year quarter, zinc and lead production improved 18% and 14%, respectively. This improvement was due to higher head grades. The mine is well-positioned to meet its annual guidance.

2023 Guidance Maintained

Gold equivalent production guidance is maintained between 412,000 and 463,000 ounces. The range projects a year-over-year increase of 3-15%.

The gold production guidance is pegged at 282,000-320,000 ounces for 2023, which indicates growth of 9-23% from the 2022 reported level. The silver production guidance for the year is 6.3-6.9 million ounces, which suggests a decline of up to 9% from the 2022 output.

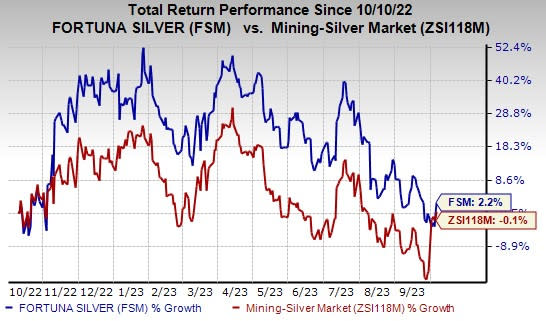

Price Performance

Shares of Fortuna Silver have gained 2.2% in the past year against the industry’s 0.1% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks from the basic materials space are Yara International ASA YARIY, Carpenter Technology Corporation CRS and L.B. Foster Company FSTR. YARIY sports a Zacks Rank #1 (Strong Buy) at present, and CRS and FSTR carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Yara International has an average trailing four-quarter earnings surprise of 56%. The Zacks Consensus Estimate for YARIY’s fiscal 2023 earnings is pegged at $1.27 per share. The consensus estimate for 2023 earnings has moved 9% north in the past 60 days. Its shares gained 5.2% in the last year.

Carpenter Technology has an average trailing four-quarter earnings surprise of 10%. The Zacks Consensus Estimate for CRS’s fiscal 2024 earnings is pegged at $3.48 per share. The consensus estimate for 2023 earnings has moved 8% north in the past 60 days. Its shares gained 109.6% in the last year.

L.B. Foster has an average trailing four-quarter earnings surprise of 134.5%. The Zacks Consensus Estimate for FSTR’s 2023 earnings is pegged at 53 cents per share. Earnings estimates have been unchanged in the past 60 days. FSTR’s shares gained 98.4% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

L.B. Foster Company (FSTR) : Free Stock Analysis Report

Yara International ASA (YARIY) : Free Stock Analysis Report

Fortuna Silver Mines Inc. (FSM) : Free Stock Analysis Report