Fortuna Silver (FSM) Repays $40M Debt on Improved Cash Flow

Fortuna Silver Mines Inc. FSM announced that it paid down $40 million of its revolving credit facility with cash on hand at the end of the third quarter of 2023. This takes the total reduction in the total net debt to roughly $65 million in the third quarter. This move indicates enhanced cash flows from the contribution of the first full quarter of production of FSM’s newest flagship mine, Séguéla.

FSM recently reported a record gold production of 94,821 ounces and a silver production of 1,680,751 ounces in third-quarter 2023. Gold output marked a 43% year-over-year increase, which was mainly attributed to the first full quarter of production and a steady operating performance at the Séguéla mine.

Following the payment, the company's total outstanding debt balance on its credit facility (excluding letters of credit) is expected to be $206 million. It has approximately $46 million of convertible notes for an estimated total net debt after cash and cash equivalents of $133 million.

Fortuna Silver plans to refocus its capital allocation strategies on paying down debt, and advancing its high-value exploration possibilities. The company intends to evaluate other initiatives to enhance shareholder value.

At the end of second-quarter 2023, the company reported a leverage ratio of 0.9 times total net debt to adjusted EBITDA. In the June-end quarter, FSM posted adjusted earnings per share of 1 cent, which missed the Zacks Consensus Estimate of 5 cents. The bottom line was flat year over year.

Results were affected by the lower volume of metal sold at San Jose and the lower volume at Lindero. This was partially offset by the lower cost of sales per ounce of gold at Yaramoko.

Fortuna Silver’s revenues declined 6% year over year to $158 million in the quarter under review. The top line missed the Zacks Consensus Estimate of $163 million.

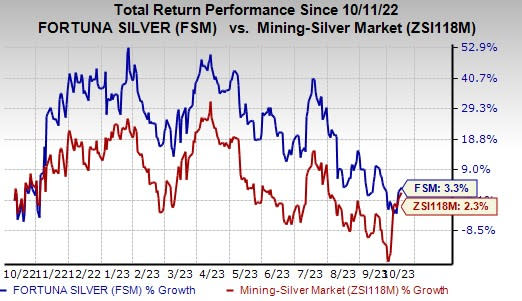

Price Performance

Shares of Fortuna Silver have gained 3.3% in the past year compared with industry’s 2.3% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Fortuna Silver currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks from the basic materials space are Yara International ASA YARIY, Carpenter Technology Corporation CRS and L.B. Foster Company FSTR. YARIY sports a Zacks Rank #1 (Strong Buy) at present, and CRS and FSTR carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Yara International has an average trailing four-quarter earnings surprise of 56%. The Zacks Consensus Estimate for YARIY’s fiscal 2023 earnings is pegged at $1.27 per share. The consensus estimate for 2023 earnings has moved 9% north in the past 60 days. Its shares gained 5.2% in the last year.

Carpenter Technology has an average trailing four-quarter earnings surprise of 10%. The Zacks Consensus Estimate for CRS’s fiscal 2024 earnings is pegged at $3.48 per share. The consensus estimate for 2023 earnings has moved 8% north in the past 60 days. Its shares gained 109.6% in the last year.

L.B. Foster has an average trailing four-quarter earnings surprise of 134.5%. The Zacks Consensus Estimate for FSTR’s 2023 earnings is pegged at 53 cents per share. Earnings estimates have been unchanged in the past 60 days. FSTR’s shares gained 98.4% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

L.B. Foster Company (FSTR) : Free Stock Analysis Report

Yara International ASA (YARIY) : Free Stock Analysis Report

Fortuna Silver Mines Inc. (FSM) : Free Stock Analysis Report