Fortuna Silver Mines (TSE:FVI investor three-year losses grow to 54% as the stock sheds CA$307m this past week

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. Long term Fortuna Silver Mines Inc. (TSE:FVI) shareholders know that all too well, since the share price is down considerably over three years. Sadly for them, the share price is down 54% in that time. And over the last year the share price fell 20%, so we doubt many shareholders are delighted. Even worse, it's down 23% in about a month, which isn't fun at all.

With the stock having lost 20% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for Fortuna Silver Mines

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

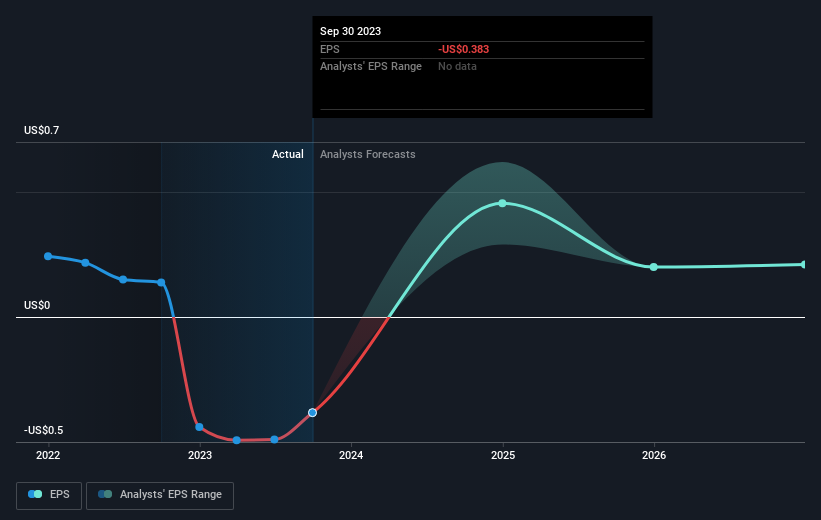

Over the three years that the share price declined, Fortuna Silver Mines' earnings per share (EPS) dropped significantly, falling to a loss. Due to the loss, it's not easy to use EPS as a reliable guide to the business. But it's safe to say we'd generally expect the share price to be lower as a result!

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. It might be well worthwhile taking a look at our free report on Fortuna Silver Mines' earnings, revenue and cash flow.

A Different Perspective

Fortuna Silver Mines shareholders are down 20% for the year, but the market itself is up 3.0%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 3% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Fortuna Silver Mines is showing 2 warning signs in our investment analysis , you should know about...

Fortuna Silver Mines is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.