Forward Air Corp (FWRD) Reports Mixed Results Amidst Integration Efforts and Market Challenges

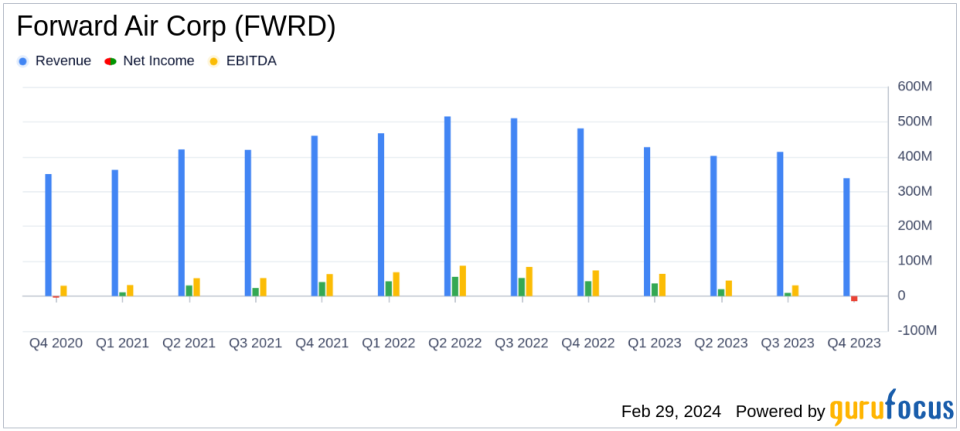

Operating Revenue: Q4 saw a 16% decline year-over-year, with full-year revenue down by 18.4%.

Net Income: A stark contrast between Q4's net loss of $14.7 million and the prior year's net income of $39 million.

Adjusted EBITDA: Decreased by 27.8% for Q4 and 30.5% for the full year compared to 2022.

Free Cash Flow: Increased by 12.5% in Q4, showing a positive cash position despite revenue declines.

Dividend Suspension: Forward Air suspends its quarterly dividend to focus on reducing leverage.

Omni Logistics Acquisition: Completed on January 25, 2024, expected to create long-term shareholder value.

On February 28, 2024, Forward Air Corp (NASDAQ:FWRD) released its 8-K filing, detailing its financial results for the fourth quarter and full year of 2023. The company, known for its asset-light freight and logistics services, including Expedited Freight and Intermodal operations, faced a challenging market environment that impacted its overall performance.

Performance and Challenges

Forward Air's Expedited Freight segment, which is the company's primary revenue generator, experienced positive volume trends with a 6% growth in pounds per day and an 11% increase in weight per shipment compared to the same period in the prior year. However, this was overshadowed by a 16% decline in consolidated revenue for Q4 and an 18.4% decrease for the full year, attributed to softer freight conditions and decreased customer demand for Intermodal and truckload brokerage services.

The company's net income took a significant hit, with a net loss of $14.7 million in Q4 compared to a net income of $39 million in the same quarter of the previous year. This drastic change was primarily due to decreased revenue and increased interest expenses. Despite these challenges, Forward Air's free cash flow saw an uptick, increasing by 12.5% in Q4, which suggests a resilient cash position amidst revenue declines.

Financial Achievements and Strategic Moves

One of the key strategic developments for Forward Air was the acquisition of Omni Logistics, which was completed in early 2024. This move is expected to position the company as a premier provider for mission-critical freight transportation and create long-term value for shareholders. The integration of Omni Logistics is already showing operational cost synergies, particularly in the consolidation of linehaul networks.

Despite the temporary discontinuation of earnings guidance due to the ongoing integration, Forward Air remains committed to transparency and plans to provide updates on key milestones. The company's decision to suspend its quarterly dividend reflects a strategic focus on reducing leverage and de-risking its capital structure.

Key Financial Metrics

Forward Air's financial performance is reflected in several key metrics:

Financial Aspect | Q4 2023 | Q4 2022 | Change |

|---|---|---|---|

Operating Revenue | $338,428K | $403,039K | (16.0)% |

Net Income | ($14,721K) | $39,009K | (137.7)% |

Adjusted EBITDA | $50,198K | $69,494K | (27.8)% |

Free Cash Flow | $48,913K | $43,476K | 12.5% |

These figures demonstrate the company's ability to generate cash flow despite a downturn in revenue and net income. The operating margin also contracted significantly from 14.0% to 0.9% in Q4, indicating pressure on profitability.

Management Commentary

"Execution of our revenue growth strategies in the fourth quarter led to positive volume trends and improved freight quality metrics," said Michael Hance, Interim Chief Executive Officer. He also highlighted the company's commitment to delivering exceptional service, with on-time service performance at 98% and a cargo claims ratio of 0.09%.

Chief Financial Officer Rebecca J. Garbrick noted the temporary discontinuation of earnings guidance, emphasizing the company's dedication to maintaining transparency and fostering open communications with shareholders.

Analysis and Outlook

While Forward Air faces headwinds from market conditions and the integration of Omni Logistics, the company's focus on Expedited Freight and cost synergies may pave the way for recovery. The suspension of the dividend and the emphasis on reducing leverage are prudent steps in strengthening the balance sheet. Investors will be watching closely for the realization of synergies from the Omni Logistics acquisition and the company's ability to navigate through the current market challenges.

For detailed insights and further analysis, investors are encouraged to visit GuruFocus.com for comprehensive financial data and expert commentary.

Explore the complete 8-K earnings release (here) from Forward Air Corp for further details.

This article first appeared on GuruFocus.