Forward Air misses Q3 mark, Q4 outlook also light

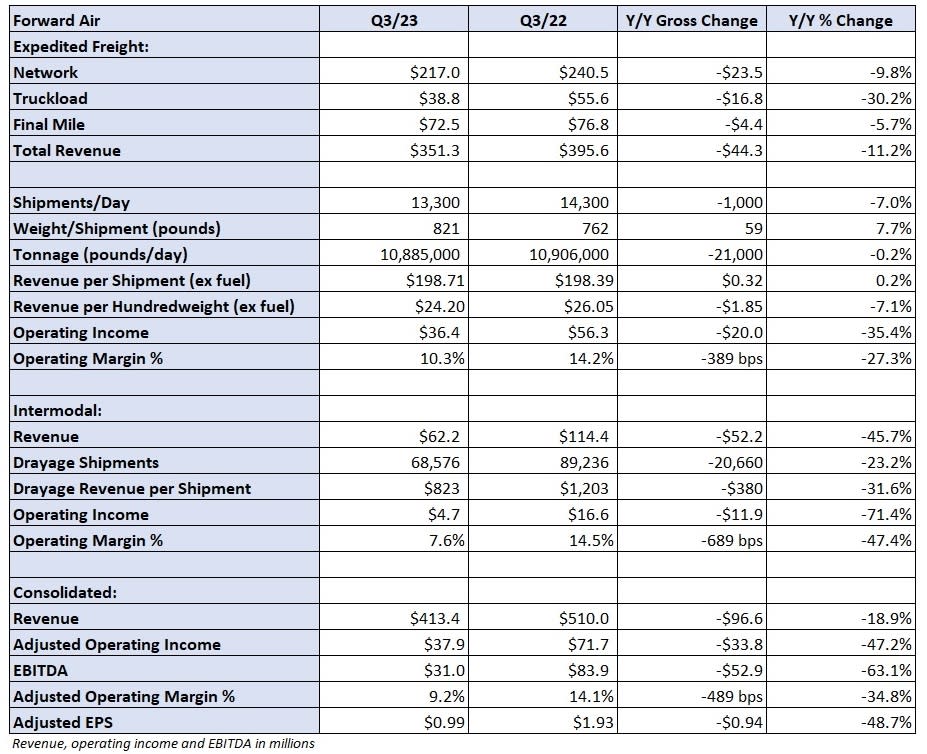

Forward Air reported third-quarter adjusted earnings per share of 99 cents Monday after the market closed. The result was 12 cents light of consensus and 94 cents lower year over year (y/y).

Forward (NASDAQ: FWRD) pinned the miss on soft demand for its noncore intermodal and truckload brokerage services. A news release said the company is accelerating a “strategic portfolio review,” which could include selling some or a portion of those units.

The adjusted result excluded $22 million in due diligence and transaction costs, or 63 cents per share, presumably tied to a planned merger that has become heavily scrutinized by shareholders. Last week, Forward floated the idea of ending the transaction, which shareholders have asked it to do, alleging Omni Logistics has failed to comply with pre-closing requirements regarding access to information.

Omni’s CEO disputed those claims in a Thursday letter to customers.

“We are pursuing this transaction to accelerate our customer-focused strategy of removing layers of complexity and costs from logistics, without sacrificing service,” Omni CEO J.J. Schickel said.

Omni contends it has “fully complied with all obligations of the merger agreement” and that it intends “to enforce that binding agreement to ensure the successful completion of the transaction.”

Forward’s fourth-quarter guidance was also worse than expected.

The company forecast revenue to decline 7% to 17% y/y, implying $423 million at the midpoint of the range. That was below the consensus estimate of $468 million at the time of the print. Adjusted EPS was forecast to a range of 98 cents to $1.02, which was below a $1.13 consensus estimate.

During the third quarter, Forward saw positive sequential trends in its expedited segment, which includes less-than-truckload operations. Revenue was up 4% to $351 million as tonnage increased 3% and revenue per hundredweight, or yield, increased 1% excluding fuel surcharges.

“Precision execution of our revenue growth strategies led to positive volume trends and improved freight quality metrics,” said Forward Chairman, President and CEO Tom Schmitt.

The metrics were less favorable compared to the year-ago quarter, when freight demand was stronger.

The expedited segment’s revenue was off 11% y/y as tonnage was flat and yield excluding fuel was down 7%. However, October tonnage per day is 6% higher y/y.

The unit posted an 89.7% operating ratio, which was 390 bps worse y/y. The LTL portion of the unit reported an 85.5% OR in September “after a sluggish start to the third quarter.”

Schmitt said the proposed merger, which potentially pitted it as a competitor to its some of its current customers, hasn’t hurt business.

“We are growing with both our domestic freight forwarder and direct shipper customers,” Schmitt said.

Forward reported a 14% increase in average daily volumes with freight forwarders since the transaction was announced on Aug. 10. Shippers that now work with Forward directly, as opposed to using a freight forwarder, increased by more than one-third y/y in the quarter to more than 240.

Some of Forward’s existing forwarding customers had concerns that its integration of Omni, which is also a freight forwarder and a competitor to those customers, would place them at a competitive disadvantage.

Shares of FWRD were off 2.8% in after-hours trading on Monday.

Forward will host a call on Tuesday at 9 a.m. EDT to discuss third-quarter results.

More FreightWaves articles by Todd Maiden

The post Forward Air misses Q3 mark, Q4 outlook also light appeared first on FreightWaves.