Four Corners (FCPT) Expands Portfolio, Buys $17.9M Properties

Four Corners Property Trust FCPT is on an acquisition spree. It has recently announced the purchase of four newly built properties for $17.9 million. These acquisitions will help diversify the company’s portfolio and provide a steady income stream, benefiting both the business and its stockholders.

These four newly built properties, situated in a strong retail corridor in Michigan and Indiana, are occupied under long-term net leases. The acquired portfolio comprises eight renowned brands and nine lease agreements. It includes Starbucks, Aspen Dental, Bronson Health, Great Clips, Mattress Firm, Oak Street Health, Taco Bell and WellNow Urgent Care. The properties were acquired at a 6.6% cap rate on rent as of the closing date, excluding transaction costs.

Moreover, the company has recently announced the purchase of a Fast Pace Urgent Care property for $2.3 million and two Wawa properties for $2.5 million. These strategic moves not only broaden its footprint in various sectors but also ensure portfolio diversification.

Additionally, Four Corners closed the significant acquisition of 13 Darden restaurant properties, comprising 12 Cheddar's Scratch Kitchen properties and an Olive Garden property. Purchased for $79.5 million, this acquisition boosted Four Corners’ total investment to $269.1 million from the beginning of the year through Jul 6 for 71 properties.

Four Corners’ already robust and diversified portfolio is further enhanced by these acquisitions. In addition to strengthening its presence in the retail sector, the company is also making strides in the healthcare domain, as shown by the Fast Pace Urgent Care property purchase. Other noteworthy acquisitions include a WellNow property and a T-Mobile property for $4 million, an Optima Dermatology clinic for $9.3 million and two Tire Discounters properties for $5.3 million.

As a result, Four Corners is well-positioned to generate consistent rental income and deliver value to shareholders. Moreover, these acquisitions align with the REIT’s strategy of acquiring high-quality, net-leased properties and expanding its presence in attractive markets.

On the contrary, a high-interest-rate environment poses potential challenges, despite the impressive growth witnessed by the company. High interest rates could raise the cost of borrowing for future acquisitions, potentially slowing down its expansion efforts. However, its strategy of investing in properties with strong credit operators and long-term leases is likely to provide some buffer against these headwinds.

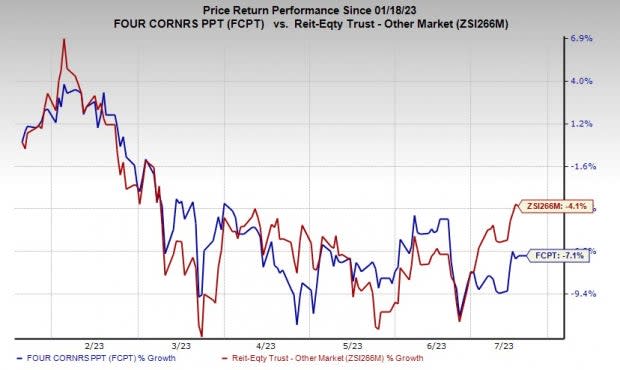

Shares of this Zacks Rank #3 (Hold) company have declined 7.1% in the past six months, wider than the industry's fall of 4.1%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the REIT sector are Ventas VTR and EastGroup Properties EGP, each presently carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Ventas’ 2023 funds from operations (FFO) per share has risen marginally over the past two months to $2.99.

The Zacks Consensus Estimate for EastGroup Properties’ current-year FFO per share has moved marginally north over the past two months to $7.56.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ventas, Inc. (VTR) : Free Stock Analysis Report

EastGroup Properties, Inc. (EGP) : Free Stock Analysis Report

Four Corners Property Trust, Inc. (FCPT) : Free Stock Analysis Report