Four Corners Property Trust Inc Reports Solid Growth in Rental Revenue for Q4 2023

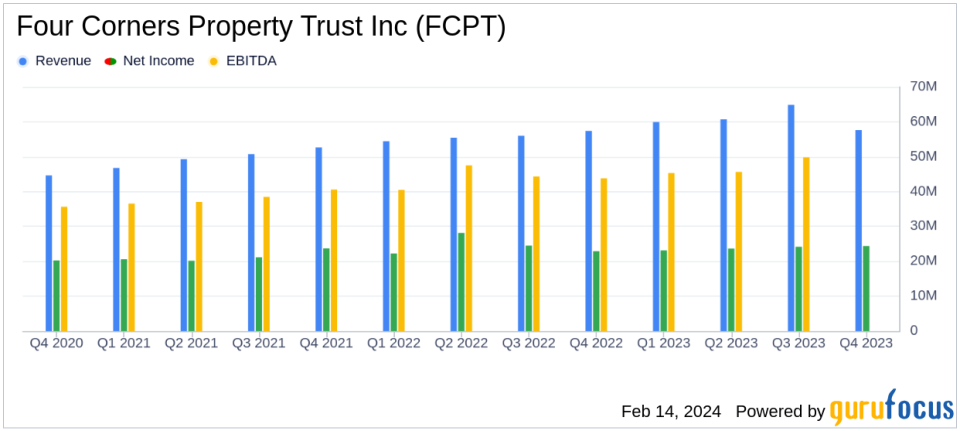

Rental Revenue: Increased by 15% to $57.6 million in Q4 2023 compared to the prior year.

Net Income: Attributable to common shareholders was $24.4 million for Q4, maintaining $0.27 per diluted share year-over-year.

Acquisitions: FCPT grew its portfolio with $333 million in high-quality acquisitions, enhancing rent by 14%.

Funds from Operations (FFO): NAREIT-defined FFO per diluted share rose to $0.41 in Q4, a $0.01 increase from Q4 2022.

Adjusted Funds from Operations (AFFO): AFFO per diluted share for Q4 reached $0.43, up $0.02 from the same quarter in 2022.

Liquidity: FCPT reported approximately $259 million in available liquidity, including cash and undrawn credit.

Dividends: Declared a dividend of $0.345 per common share for Q4 2023.

On February 14, 2024, Four Corners Property Trust Inc (NYSE:FCPT) released its 8-K filing, detailing its financial results for the fourth quarter and full year ended December 31, 2023. FCPT, a real estate investment trust specializing in restaurant and retail properties, reported a robust increase in rental revenue and continued strong rent collection, signaling a positive trajectory for the company's financial health.

Company Overview

FCPT operates through two segments: real estate operations, which generate the majority of its revenue through leasing properties to tenants in the restaurant and retail industries, and restaurant operations, conducted through a taxable REIT subsidiary. The company's strategic focus on acquiring and leasing properties has resulted in a diversified portfolio that spans 47 states and is 99.8% occupied.

Financial Performance and Challenges

The company's rental revenue for the fourth quarter increased by 15% over the prior year, reaching $57.6 million. This growth is attributed to $333 million in high-quality acquisitions, which bolstered rent by 14%. Despite the positive revenue trends, net income attributable to common shareholders saw a slight decrease from $97.8 million in the previous year to $95.3 million in 2023. This reduction in net income, while modest, could signal challenges in maintaining profitability amidst expansion efforts.

FCPT's disciplined approach to capital allocation has resulted in a low leverage start to the year, with a net debt to adjusted EBITDAre ratio of 5.5x. However, the company must navigate the complexities of integrating new acquisitions and managing its expanded portfolio to maintain financial stability and growth.

Financial Achievements and Importance

The company's financial achievements, particularly the increase in rental revenue and AFFO, are significant indicators of FCPT's ability to generate stable cash flows from its long-term net leases. These metrics are crucial for REITs, as they reflect the company's operational efficiency and its potential to provide consistent returns to shareholders through dividends. FCPT's declared dividend of $0.345 per common share for the fourth quarter underscores its commitment to delivering shareholder value.

Key Financial Metrics

FCPT's balance sheet as of December 31, 2023, shows total assets of $2.45 billion, with real estate investments net of depreciation standing at $2.21 billion. The company's liquidity position is strong, with $259 million available, including cash and undrawn credit facilities. The capital raising efforts through the ATM program have contributed to this liquidity, providing the company with the flexibility to pursue further growth opportunities.

"2023 was a solid acquisition year. We grew rent 14% with $333 million of high-quality acquisitions," said Bill Lenehan, CEO of FCPT. "Additionally, our portfolio continues to perform well with high rent collections and occupancy, and we start the year with low leverage. We remain disciplined allocators of capital and are finding interesting investment opportunities as we focus on building an accretive pipeline."

FCPT's performance in the fourth quarter demonstrates a resilient business model capable of delivering growth through strategic acquisitions and effective capital management. The company's focus on maintaining high occupancy rates and strong rent collections positions it well for continued success in the competitive REIT market.

Conclusion

Four Corners Property Trust Inc's Q4 2023 earnings report reflects a company that is effectively expanding its portfolio while maintaining financial discipline. With a solid increase in rental revenue and a strong liquidity position, FCPT is poised to continue its growth trajectory and deliver value to its shareholders. Investors and potential members of GuruFocus.com interested in a REIT with a proven track record of disciplined growth and stable cash flows may find FCPT an attractive opportunity.

Explore the complete 8-K earnings release (here) from Four Corners Property Trust Inc for further details.

This article first appeared on GuruFocus.