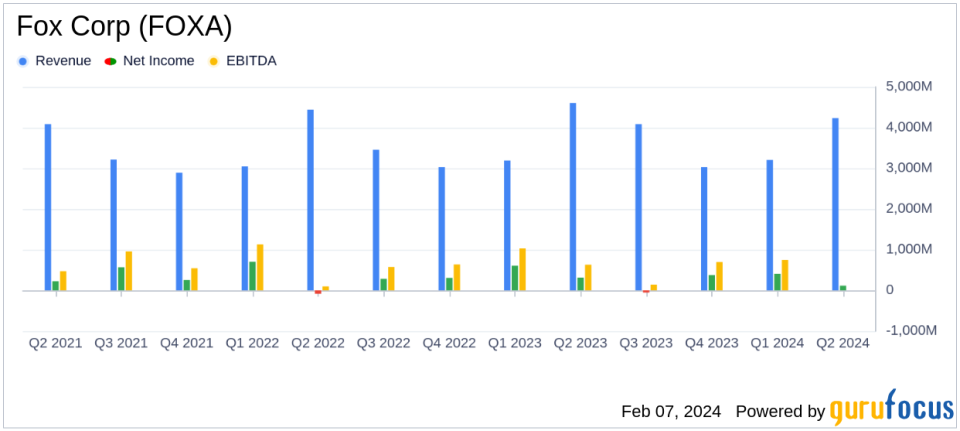

Fox Corp (FOXA) Posts Mixed Q2 Fiscal 2024 Results with Revenue Decline and EBITDA Drop

Revenue: Declined to $4.23 billion from $4.61 billion in the prior year quarter.

Net Income: Decreased to $115 million, with EPS of $0.23, down from $321 million and EPS of $0.58 year-over-year.

Adjusted EBITDA: Fell to $350 million from $531 million in the same quarter last year.

Affiliate Fee Revenue: Grew by 4%, with a 10% increase in the Television segment.

Advertising Revenue: Dropped by 20%, affected by the absence of the FIFA Men's World Cup and lower political advertising.

Dividend: Announced a dividend of $0.26 per Class A and Class B share.

Share Repurchase: Approximately $5.1 billion of Class A and Class B common stock repurchased to date.

On February 7, 2024, Fox Corp (NASDAQ:FOXA) released its 8-K filing, detailing the financial outcomes for the second quarter of fiscal year 2024. The company, known for its robust portfolio including Fox News, FOX broadcast network, and a suite of sports and entertainment assets, faced a challenging quarter with a noticeable decline in revenue and earnings compared to the same period last year.

Fox Corp (NASDAQ:FOXA) reported a total quarterly revenue of $4.23 billion, a decrease from the $4.61 billion reported in the prior year quarter. The dip in revenue was primarily due to a 20% decrease in advertising revenues, which was attributed to the absence of the FIFA Men's World Cup, lower political advertising revenues, and other market challenges. Despite this, affiliate fee revenues saw a 4% increase, driven by growth in the Television segment.

The company's net income for the quarter stood at $115 million, down from $321 million reported in the prior year quarter, with earnings per share (EPS) falling from $0.58 to $0.23. Adjusted net income attributable to Fox Corporation stockholders was $165 million ($0.34 per share), compared to $259 million ($0.48 per share) in the prior year quarter. Adjusted EBITDA also saw a reduction, coming in at $350 million compared to $531 million reported in the prior year quarter.

Operational Highlights and Financial Performance

The Television segment's affiliate fee revenues increased by 10%, led by higher rates at the company's owned and operated stations and third-party FOX affiliates. However, the segment reported a quarterly EBITDA loss of $138 million, compared to an EBITDA contribution of $256 million in the prior year quarter, primarily due to the aforementioned revenue impacts.

Cable Network Programming reported a slight increase in segment revenues, rising to $1.66 billion, with affiliate fee revenues increasing marginally. The segment's EBITDA improved significantly, reaching $564 million, a 60% increase from the prior year quarter, mainly due to lower sports programming rights amortization and production costs.

Despite the financial headwinds, Fox Corp (NASDAQ:FOXA) declared a dividend of $0.26 per Class A and Class B share and continued its share repurchase program, with approximately $5.1 billion of its Class A and Class B common stock repurchased to date.

Executive Chair and Chief Executive Officer Lachlan Murdoch commented on the results, stating, "At the halfway point in our fiscal year, our results demonstrate the strength and durability of our core brands and their ability to deliver solid audiences across our portfolio. FOX Sports continues to benefit from the power of live sports programming and FOX News has maintained its leadership in cable news, while Tubi has been resilient in an increasingly competitive market. Combining this steadfast portfolio of assets with a best-in-class balance sheet underpins our ability to deliver value for our shareholders."

The company's balance sheet remains robust, with a strong cash position and a disciplined approach to capital allocation. The repayment of $1.25 billion of 4.030% senior notes in January 2024 further solidifies Fox Corp's financial stability.

While the quarter presented its challenges, particularly in the advertising domain, Fox Corp (NASDAQ:FOXA) continues to leverage its diverse media assets and strategic investments to navigate the evolving industry landscape. The company's focus on live sports and news, coupled with its digital expansion through platforms like Tubi, positions it to potentially rebound in future quarters.

Explore the complete 8-K earnings release (here) from Fox Corp for further details.

This article first appeared on GuruFocus.