Fox Factory Holding Corp (FOXF) Navigates Industry Headwinds to Deliver Mixed Annual Results

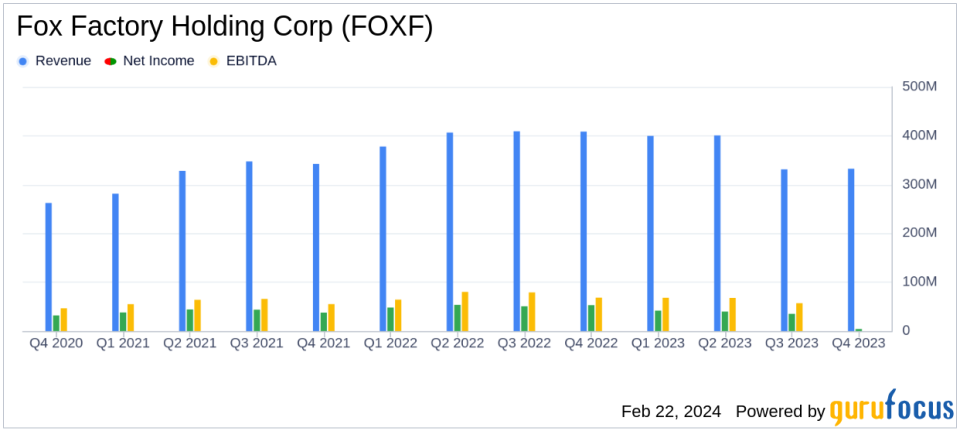

Net Sales: Annual net sales decreased by 8.6% to $1.46 billion in fiscal 2023.

Net Income: Net income dropped to $120.8 million in fiscal 2023, down from $205.3 million in the previous year.

Earnings Per Share: Diluted EPS for fiscal 2023 was $2.85, compared to $4.84 in fiscal 2022.

Adjusted EBITDA Margin: Adjusted EBITDA margin decreased to 17.8% in fiscal 2023 from 20.1% in the prior year.

Strategic Acquisitions: FOXF completed the acquisitions of Custom Wheel House and Marucci, contributing to revenue and diversification.

Share Repurchase: Returned $25 million to shareholders through the share repurchase plan.

Debt Management: Paid down $15 million on outstanding debt and secured a Term A Loan for $400 million to fund the Marucci acquisition.

Fox Factory Holding Corp (NASDAQ:FOXF) released its 8-K filing on February 22, 2024, detailing its financial results for the fourth quarter and fiscal year ended December 29, 2023. The company, known for its performance-defining products for bikes, vehicles, and off-road applications under the FOX, FOX RACING SHOX, and RACE FACE brands, faced a challenging macroeconomic environment, including a UAW strike and higher interest rates that impacted dealer behaviors.

Financial Performance and Challenges

FOXF's annual net sales saw a decline, primarily due to a significant decrease in Specialty Sports Group (SSG) net sales, which was partially offset by growth in the Powered Vehicles Group (PVG) and Aftermarket Applications Group (AAG). The decrease in SSG net sales was attributed to channel inventory recalibration and softer end consumer demand, despite the revenue contribution from the recent Marucci acquisition. The PVG's performance was affected by the UAW strike and macroeconomic factors, although it still managed to grow by 21% due to strong OEM demand and production efficiencies.

The company's gross margin contracted to 27.7% in the fourth quarter, down from 32.0% in the same period last year, reflecting a shift in product mix and the impact of the UAW strike. Adjusted EBITDA margin also decreased, highlighting the challenges FOXF faced during the quarter.

Strategic Moves and Financial Health

Despite the headwinds, FOXF continued its strategy of vertical integration and diversification through the acquisitions of Custom Wheel House and Marucci. These strategic moves are crucial for a company in the Vehicles & Parts industry, where innovation and market expansion are key drivers of long-term growth. The company's focus on product development and a robust pipeline of new high-performance products is expected to support its strategy and growth plans.

On the balance sheet, FOXF ended the fiscal year with $83.6 million in cash and cash equivalents, a decrease from the previous year, mainly due to debt payments and share repurchases. Inventory levels increased, reflecting the inclusion of inventory from the recent acquisitions. Total debt rose significantly to $743.5 million, driven by additional borrowings to support working capital needs and acquisitions.

Outlook and Investor Relations

For fiscal 2024, FOXF anticipates net sales in the range of $1.53 billion to $1.68 billion and adjusted earnings per diluted share between $2.30 and $2.60. The company's CEO, Mike Dennison, expressed confidence in FOXF's product leadership and long-term growth plans, despite the current economic uncertainties and the impact of higher interest rates.

Investors interested in further details about FOXF's financial performance can join the investor conference call or access the webcast in the Investor Relations section of the company's website.

Value investors and potential GuruFocus.com members seeking more comprehensive insights into Fox Factory Holding Corp's financials, strategic initiatives, and future prospects can find additional information in the full 8-K filing.

For inquiries, contact Vivek Bhakuni, Sr. Director of Investor Relations and Business Development, at vbhakuni@ridefox.com.

Explore the complete 8-K earnings release (here) from Fox Factory Holding Corp for further details.

This article first appeared on GuruFocus.