Francis Chou's Q2 2023 13F Filing Update

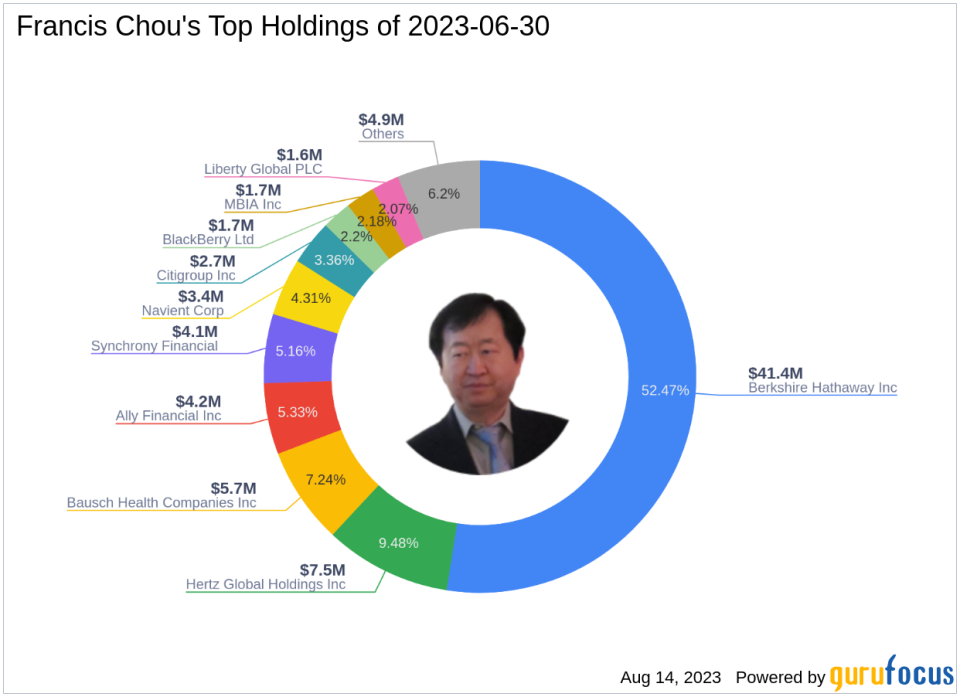

Renowned value investor Francis Chou recently submitted his 13F report for the second quarter of 2023, which concluded on June 30, 2023. Chou, known for his disciplined and value-oriented investment approach, manages a portfolio comprising 18 stocks with a total value of $79 million.

The top three holdings in Chou's portfolio were BRK.A (52.47%), HTZWW (9.48%), and BHC (7.24%).

Top Three Trades of the Quarter

Chou's top three trades for the quarter included Alibaba Group Holding Ltd (NYSE:BABA), Resolute Forest Products Inc (NYSE:RFP), and Navient Corp (NAS:NAVI).

Alibaba Group Holding Ltd (NYSE:BABA)

Chou initiated a new position in Alibaba, purchasing 3,400 shares. This investment represents a 0.36% weight in the equity portfolio. The shares were traded at an average price of $87.76 during the quarter. As of August 14, 2023, Alibaba's stock price was $93.763, with a market cap of $238.84 billion. The stock has returned -1.14% over the past year. GuruFocus rates Alibaba's financial strength and profitability 7 out of 10 and 9 out of 10, respectively. The company's valuation ratios include a P/E ratio of 20.30, a P/B ratio of 1.69, a PEG ratio of 18.45, a EV-to-Ebitda ratio of 9.36, and a P/S ratio of 1.90.

Resolute Forest Products Inc (NYSE:RFP)

Chou completely sold out his 261,460-share investment in Resolute Forest Products. The shares were traded at an average price of $21.59 during the quarter. As of August 14, 2023, Resolute's stock price was $21.92, with a market cap of $1.68 billion. The stock has returned 53.72% over the past year. GuruFocus rates Resolute's financial strength and profitability 8 out of 10 and 5 out of 10, respectively. The company's valuation ratios include a P/E ratio of 2.26, a P/B ratio of 0.45, a PEG ratio of 0.12, a EV-to-Ebitda ratio of 2.26, and a P/S ratio of 0.25.

Navient Corp (NAS:NAVI)

Chou also initiated a new position in Navient Corp, purchasing 183,338 shares. This investment represents a 4.09% weight in the equity portfolio. The shares were traded at an average price of $17.45 during the quarter. As of August 14, 2023, Navient's stock price was $17.62, with a market cap of $2.15 billion. The stock has returned 8.92% over the past year. GuruFocus rates Navient's financial strength and profitability 2 out of 10 and 6 out of 10, respectively. The company's valuation ratios include a P/E ratio of 6.07, a P/B ratio of 0.73, a PEG ratio of 0.65, and a P/S ratio of 1.73.

In conclusion, Francis Chou (Trades, Portfolio)'s Q2 2023 13F filing reveals his strategic moves in the equity market. His investment decisions, based on his value-oriented philosophy, provide valuable insights for investors seeking to understand market trends and opportunities.

This article first appeared on GuruFocus.