Franco-Nevada (FNV) Q3 Earnings Beat Estimates, Sales Up Y/Y

Franco-Nevada Corporation FNV reported adjusted earnings of 91 cents per share in third-quarter 2023, beating the Zacks Consensus Estimate of 88 cents per share. The bottom line increased 10% year over year.

The company generated revenues of $310 million in the reported quarter, up 1.7% year over year. The upside was driven by an increase in GEOs from its Precious Metal assets and higher gold prices. This was partially offset by lower commodity prices for its diversified assets.

In the September-end quarter, 77.8% of revenues were sourced from Precious Metal assets (64.5% gold, 10.2% silver and 3.1% platinum group metals).

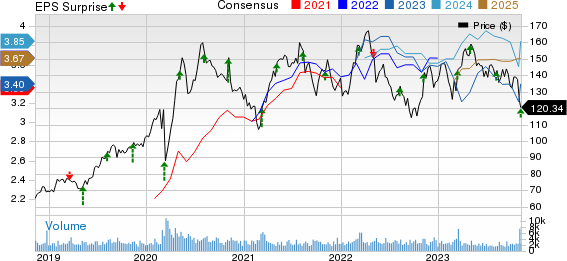

Franco-Nevada Corporation Price, Consensus and EPS Surprise

Franco-Nevada Corporation price-consensus-eps-surprise-chart | Franco-Nevada Corporation Quote

The company sold 125,337 Gold Equivalent Ounces (GEOs) from precious metal assets in the reported quarter, up from the prior-year quarter’s 120,542 GEOs. The upside was driven by solid contributions from its Cobre Panama, Guadalupe-Palmarejo and MWS mines.

In the reported quarter, adjusted EBITDA was down 1% year over year to $255 million. Adjusted EBITDA margin was 82.4% in the quarter under review.

Financial Position

The company had $1,297 million cash in hand at the end of the third quarter of 2023, up from the $1,197 million reported as of the end of 2022. It recorded an operating cash flow of $708 million in the first nine months of 2023, down from $720 million in the prior-year period.

Franco-Nevada is debt-free and uses its free cash flow to expand its portfolio and pay out dividends. FNV now has an available capital of $2.3 billion.

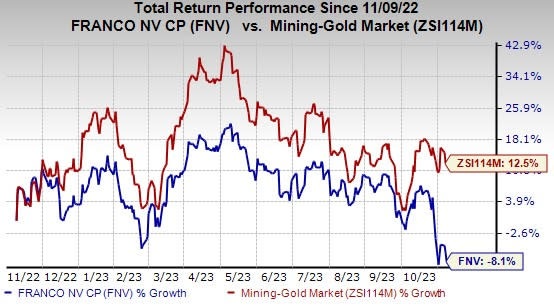

Price Performance

Franco-Nevada’s shares have lost 8.1% in the past year against the industry’s growth of 12.5%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

FNV currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Carpenter Technology Corporation CRS, Universal Stainless & Alloy Products, Inc. USAP and The Andersons Inc. ANDE. CRS and USAP sport a Zacks Rank #1 (Strong Buy) at present, and ANDE carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Carpenter Technology has an average trailing four-quarter earnings surprise of 14.3%. The Zacks Consensus Estimate for CRS’ fiscal 2024 earnings is pegged at $3.57 per share. The consensus estimate for 2024 earnings has moved 3% north in the past 60 days. Its shares gained 62% in the last year.

Universal Stainless & Alloy Products has an average trailing four-quarter earnings surprise of 44.4%. The Zacks Consensus Estimate for USAP’s 2023 earnings is pegged at 27 cents per share. Earnings estimates have been unchanged in the past 60 days. USAP’s shares gained 89% in the last year.

Andersons has an average trailing four-quarter earnings surprise of 64.4%. The Zacks Consensus Estimate for ANDE’s 2023 earnings is pegged at 52 cents per share. The consensus estimate for 2023 earnings has been unchanged in the past 60 days. Its shares gained 25% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Universal Stainless & Alloy Products, Inc. (USAP) : Free Stock Analysis Report

Franco-Nevada Corporation (FNV) : Free Stock Analysis Report