Franklin (BEN) Q1 Earnings & Revenues Top Estimates, AUM Rises

Franklin Resources Inc.’s BEN first-quarter fiscal 2024 (ended Dec 31, 2023) adjusted earnings of 65 cents per share surpassed the Zacks Consensus Estimate of 57 cents. The bottom line jumped 28% year over year.

BEN’s results benefited from a rise in revenues and an improvement in assets under management (AUM) balance. Also, the company’s balance sheet position remained robust in the quarter. However, higher expenses were headwinds.

Adjusted operating income was $417 million compared with the prior-year quarter’s $395.1 million. Also, net income attributable to Franklin was $251.3 million, up 52% year over year.

Revenues & Expenses Rise

Total operating revenues inched up 1% year over year to $1.99 billion. The reported figure outpaced the Zacks Consensus Estimate of $1.91 billion.

Investment management fees grew 1% year over year to $1.65 billion. We projected the same to be $1.57 billion. Sales and distribution fees increased nearly 2% to $296.4 million. Our estimate for the metric was $292 million.

Shareholder-servicing fees declined 3% on a year-over-year basis to $32.5 million. Our estimate was $37.1 million. Other revenues remained flat at $10 million. We suggested other revenues to be $9.8 million.

Total operating expenses were up 1% year over year to $1.78 billion. Our estimate for the same was $1.69 billion.

Franklin reported an operating margin of 10.4% compared with 9.9% in the year-ago quarter.

AUM Increases

As of Dec 31, 2023, total AUM was $1.46 trillion, up 5% year over year. This is in line with our estimates. Franklin’s long-term net outflows were $5 billion in the reported quarter compared with $10.9 billion in the year-ago quarter. We estimated the same to be $4.4 billion.

Average AUM was $1.39 trillion, up 3% from the prior-year quarter. We projected average AUM to be $1.42 trillion.

Capital Position Strong

As of Dec 31, 2023, cash and cash equivalents, along with investments, were $5.6 billion, while total stockholders' equity was $12.6 billion.

In the reported quarter, Franklin repurchased 2.4 million shares of its common stock for a total cost of $58.8 million.

Our Viewpoint

The company’s efforts to diversify its business into asset classes, that are seeing growing client demand, will likely propel AUM growth. Its acquisitions expanded alternative investments and multi-asset solution platforms.

However, a challenging operating backdrop and several geopolitical concerns may significantly affect its AUM. Due to its focus on technological upgrades, costs may rise and weigh on bottom-line growth.

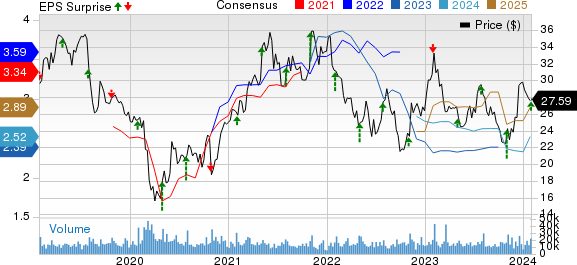

Franklin Resources, Inc. Price, Consensus and EPS Surprise

Franklin Resources, Inc. price-consensus-eps-surprise-chart | Franklin Resources, Inc. Quote

Currently, Franklin sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Performance of Other Asset Managers

BlackRock, Inc.’s BLK fourth-quarter 2023 adjusted earnings of $9.66 per share handily surpassed the Zacks Consensus Estimate of $8.84. The figure reflects an increase of 8.2% year over year.

BLK’s quarterly results benefited from a rise in revenues and higher non-operating income. Further, AUM balance witnessed an improvement owing to net inflows. However, higher expenses acted as a dampener.

Invesco’s IVZ fourth-quarter 2023 adjusted earnings of 47 cents per share handily surpassed the Zacks Consensus Estimate of 38 cents. The bottom line grew 20.5% year over year.

Results benefited from an increase in AUM balance on decent inflows. However, a rise in operating expenses and lower revenues were the undermining factors.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Franklin Resources, Inc. (BEN) : Free Stock Analysis Report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

Invesco Ltd. (IVZ) : Free Stock Analysis Report