Franklin Electric Co Inc (FELE) Reports Mixed Results for Q4 and Record Full Year 2023 Performance

Q4 Net Sales: $473.0 million, a 3% decrease from the previous year.

Full Year Net Sales: Record $2.1 billion, a 1% increase over the prior year.

Operating Income: Q4 at $50.8 million; Full Year record $262.4 million.

Earnings Per Share (EPS): Q4 at $0.82; Full Year record $4.11, up 4%.

Cash Flows: Record operating cash flows of $315.7 million for the year.

2024 Guidance: Sales expected to be $2.10 billion to $2.17 billion; EPS forecasted at $4.22 to $4.40.

On February 13, 2024, Franklin Electric Co Inc (NASDAQ:FELE) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full year of 2023. The company, a global leader in water and fuel pumping systems, faced a slight downturn in Q4 sales but achieved record-breaking annual results.

Company Overview

Franklin Electric Co Inc designs, manufactures, and distributes water and fuel pumping systems, including submersible motors, pumps, electronic controls, and water treatment systems. The company operates through three segments: Water Systems, Fueling Systems, and Distribution. The Water Systems segment focuses on groundwater, water transfer, and wastewater applications. The Fueling Systems segment caters to fueling system applications, while the Distribution segment supports installing contractors with sales and presale support.

Financial Performance and Challenges

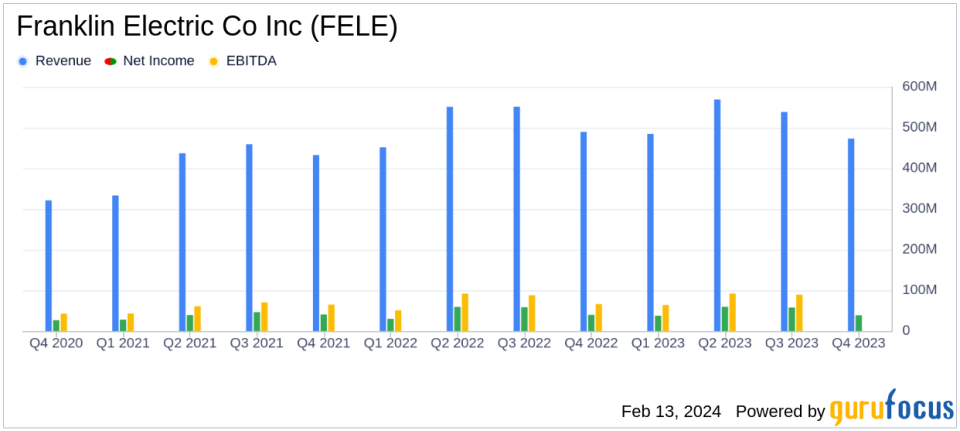

For Q4 2023, Franklin Electric reported consolidated net sales of $473.0 million, marking a 3% decrease compared to the prior year. The Water Systems and Distribution segments each saw a 1% dip in net sales, while the Fueling Systems segment experienced a more significant 23% decrease. This decline in the Fueling Systems segment was attributed to customer inventory destocking, higher interest rates, labor constraints, and permitting delays, which pushed some new station build plans into 2024.

Despite these challenges, the company's full-year performance was robust, with record net sales of $2.1 billion, a 1% increase over the previous year. Operating income for 2023 reached a record $262.4 million, with an operating margin of 12.7%, and GAAP fully diluted EPS also hit a record at $4.11, a 4% increase from the previous year. These financial achievements underscore the company's resilience and effective management in a complex market environment.

Income Statement and Balance Sheet Highlights

Franklin Electric's operating income for Q4 2023 was $50.8 million, with an operating margin of 10.7%. The full-year operating income was a record at $262.4 million, with a 12.7% operating margin. Net income attributable to Franklin Electric Co., Inc. for Q4 was $38.5 million, with a diluted EPS of $0.82. For the full year, net income was $193.3 million, with a diluted EPS of $4.11.

The balance sheet reflects a strong financial position, with cash and equivalents of $84.9 million as of December 31, 2023, an increase from $45.8 million the previous year. Total assets stood at $1.73 billion, while total liabilities and equity were also at $1.73 billion, indicating a balanced financial structure.

"The Franklin Electric team delivered another solid quarter to end a record year overall for the Company with new full year records for net sales, operating income, earnings per share, and operating cash flows," commented Gregg Sengstack, Franklin Electrics Chairperson and Chief Executive Officer.

Analysis and Forward-Looking Statements

Franklin Electric's performance in 2023 demonstrates the company's ability to navigate market fluctuations and maintain profitability. The record cash flows from operating activities, which increased by $214.0 million over the prior year, reflect improved working capital management and supply chain resilience. Looking ahead, the company expects full-year 2024 sales to range between $2.10 billion and $2.17 billion, with EPS projected to be between $4.22 and $4.40.

The company's diversified portfolio and global presence, coupled with a commitment to meeting customer needs for water and energy solutions, provide a solid foundation for future growth and shareholder value enhancement. Franklin Electric's financial health and strategic positioning suggest a positive outlook as it enters 2024, with anticipated demand momentum.

Investors and stakeholders can access the earnings conference call and further details through the provided webcast links, ensuring transparency and ongoing communication regarding the company's performance and strategic direction.

Explore the complete 8-K earnings release (here) from Franklin Electric Co Inc for further details.

This article first appeared on GuruFocus.