Franklin Resources' (BEN) AUM Rises on Strategic Acquisition

Franklin Resources, Inc. BEN reported its preliminary month-end assets under management (AUM) of $1.60 trillion as of Jan 31, 2024. This reflected an increase of 9.6% from the prior month’s level.

The increase was driven by the acquisition of Putnam Investments (closed on Jan 1). This was partly offset by modest long-term net outflows.

BEN recorded a fixed income AUM of $565.9 billion at the end of January 2024, increasing 10.6% from the December-end level. Further, Equity Income assets were $550.9 billion, which jumped 17.8% from the previous month.

Alternative income assets increased slightly to $256.4 billion from the prior month’s level. Also, Multi-Asset Income AUM was $160.6 billion, which increased 3.9% from December 2023.

Cash management balance was $68.1 billion, up 4% from the prior month’s level.

Franklin Resources’ strategic acquisitions, global reach and investment strategies are expected to support its financials. Also, a strong AUM balance will continue to support top-line growth. We project the three-year AUM to witness a CAGR of 9.1% by fiscal 2026. However, rising expenses are a near-term concern.

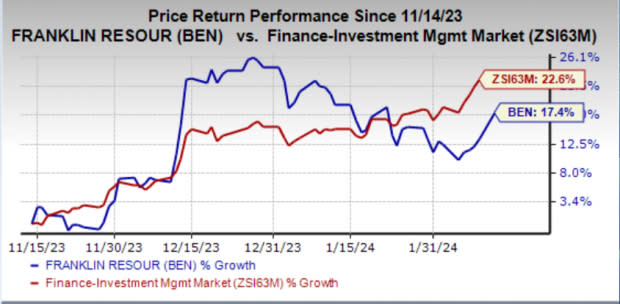

Over the past three months, shares of Franklin Resources have gained 17.4% compared with the industry’s growth of 22.6%.

Image Source: Zacks Investment Research

At present, Franklin Resources carries a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here

Performance of Other Asset Managers

AllianceBernstein Holdings AB announced a preliminary AUM of $726 billion as of Jan 31, 2024. This reflects a slight rise from the previous month’s $725 billion.

The rise in AUM was contributed by market gains, partially offset by net outflows. Retail channels witnessed net inflows, offset by net outflows from Institutions and Private Wealth channels.

Invesco IVZ announced a preliminary month-end AUM of $1,583.9 billion as of Jan 31, 2024, which decreased 0.1% from the previous month-end.

IVZ delivered net long-term inflows of $1.7 billion this month. Also, non-management fee-earning net inflows and money market net outflows were $5.8 billion and $1.3 billion, respectively. AUM balance was negatively impacted by unfavorable market returns. Foreign exchange decreased AUM by $4.4 billion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Franklin Resources, Inc. (BEN) : Free Stock Analysis Report

Invesco Ltd. (IVZ) : Free Stock Analysis Report

AllianceBernstein Holding L.P. (AB) : Free Stock Analysis Report