Franklin's (BEN) November AUM Rises 6% on Favorable Markets

Franklin Resources, Inc. BEN reported a preliminary asset under management (AUM) balance of $1.41 trillion for November 2023. This reflected a 6% increase from $1.33 trillion as of Oct 31. The rise in the AUM balance was primarily due to the impacts of positive markets and flat long-term net outflows.

Total month-end fixed-income assets were $494.9 billion, up 5.5% from the prior month’s level. Equity assets of $447.9 billion increased 9% from October 2023. BEN recorded $148.9 billion in multi-asset class, up 5.8% sequentially. Alternative assets aggregated $257.5 billion, up 1.5% from the last month.

Also, cash-management funds totaled $63.2 billion, which increased 5.2% from the last month’s level.

Franklin seems well-poised for growth on the back of a robust foothold in the global market and revenue-diversification efforts. Also, it is growing through strategic acquisitions. These are supporting the company in improving and expanding its alternative investments and multi-asset solution platforms.

However, BEN’s AUM is exposed to market fluctuations, foreign exchange translations, regulatory changes and a sudden slowdown in overall business activities, which are likely to act as near-term headwinds. Going forward, changes in AUM might hurt investment management fees and adversely impact Franklin’s financials.

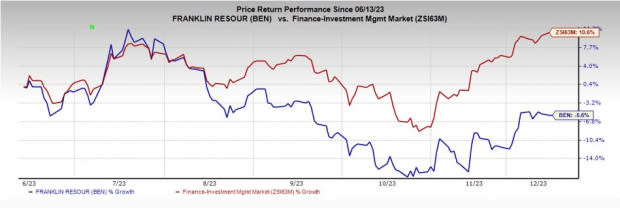

The stock has lost 5.6% over the past six months against the industry's 10.6% growth.

Image Source: Zacks Investment Research

BEN currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A Competitive Landscape

Virtus Investment Partners, Inc. VRTS recorded a sequential rise of 6.2% in its preliminary AUM balance for November 2023 on the back of favorable market returns. The company reported a month-end AUM of $165.5 billion, which reflected a rise from the Oct 31, 2023 level of $155.8 million.

VRTS offered services to $2.6 billion of other fee-earning assets. This was excluded from the above-mentioned AUM balance.

WisdomTree, Inc. WT reported a total AUM of $98.15 billion as of Nov 30, 2023, which reflected a 4.5% increase from the prior-month level. The rise was primarily due to the impacts of a favorable market move that totaled $4.29 billion.

WT, during November, recorded inflows from the U.S. equity, international developed market equity, emerging market equity, cryptocurrency, alternatives and leveraged and inverse strategies of $85 million, $38 million, $148 million, $10 million, $13 million, and $45 million, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Franklin Resources, Inc. (BEN) : Free Stock Analysis Report

Virtus Investment Partners, Inc. (VRTS) : Free Stock Analysis Report

WisdomTree, Inc. (WT) : Free Stock Analysis Report