Free ETFs Don’t Work

Recently, PowerShares tried to penetrate a crowded fund space by temporarily waiving all management fees for its KBW series of financial sector ETFs, launched in November.

The result? Although an expense ratio of zero was eye-catching at first, the effect wore off quickly.

These funds are:

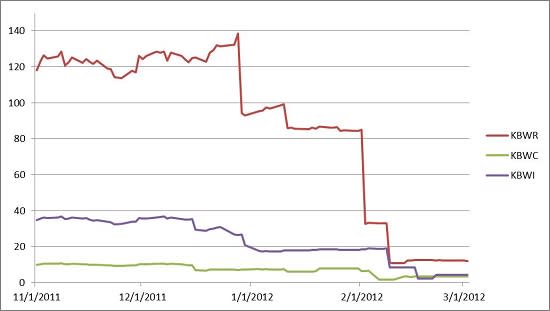

On Feb. 1, PowerShares ended the freebie and raised fees on each of the four ETFs to 35 bps, at which point, assets in three of the four funds collapsed. That happened even though the new fees were on par with those of competitors.

Fund assets for KBWR, KBWI and KBWC have dropped by 89.7 percent, 88 percent and 66.1 percent, respectively; and most of these drops occurred a few days after the expense ratios were raised.

What Happened?

The PowerShares KBW funds launched with above-average amounts of seed capital because of market makers—who gathered inventories, at no cost, in anticipation of the funds doing well. The sudden collapse in assets happened when market makers exited the fund after PowerShares began charging management fees.

PowerShares may have assumed that by the time providers of seed capital left, the ETFs would have gathered significant assets from other market players. After all, KBW indexes were popular as underlying indexes for the SPDR financial sector funds, which switched index providers a week before PowerShares’ KBW ETFs launched.

But, the no-fee ploy clearly didn’t work, nor did it make a difference that when expense ratios did kick in that the PowerShares funds cost exactly the same as the competing SPDR funds.

A History Lesson

If history holds any lessons, then one of them is that zero expense ratios haven’t worked in the past either.In 2009, Old Mutual Global Index Trackers launched the GlobalShares FTSE Emerging Markets Index Fund (GSR) —which is now delisted—with a two-month fee exemption, and an expense ratio of 39 bps thereafter.

Ten months later, GSR had accumulated less than $10 million above seed capital. Meanwhile, the Schwab Emerging Markets Equity ETF (NYSEArca:SCHE - News), which launched a month after GSR, managed to accumulate $233 million above its seed capital.

SCHE’s expense ratio at launch was 25 bps—the cheapest in class at the time—which goes to show that low expense ratios can attract investors to a product. But the nuance here seems to be that investors are not as likely to be hoodwinked by gimmicks surrounding management fee waivers.

Getting The Short End Of The Stick

Only market makers seem to benefit from temporary 100 percent fee waivers, since it allows them to hold a large inventory of shares at no cost.

Investors who don’t know any better may be caught off guard once the expense ratio jumps and a given fund’s assets nose-dives. Those who do know better will instead choose a fund with lower holding cost from the get-go, as SCHE’s successful launch clearly demonstrates.

Although it may seem like a good idea at first, zero expense ratios take away from a fund’s strengths and put too much focus on holdings costs alone. That’s a shame, because the prices for KBWR, KBWB, KBWC and KBWI have appreciated by an average of 17.45 percent since launch.

Still, the way fund providers make money is through management fees. No matter how good a fund is, if it doesn’t have enough dollars invested—it will close.

PowerShares is now left with two funds that have few assets—KBWC and KBWI are each below $5 million. Fortunately, the PowerShares KBW funds are young and still have the chance to gain momentum. I just hope they didn’t shoot themselves in the foot already.

Permalink | ' Copyright 2012 IndexUniverse LLC. All rights reserved

More From IndexUniverse.com