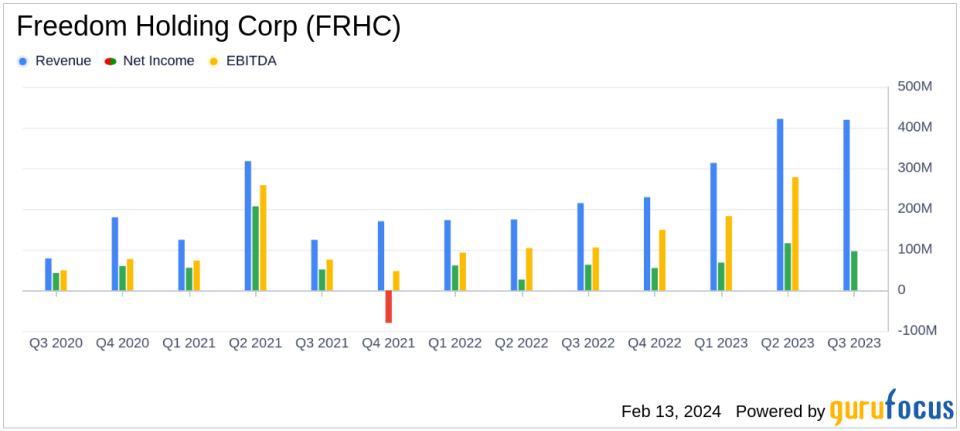

Freedom Holding Corp (FRHC) Reports Stellar Growth with 96% Revenue Increase in Q3

Revenue: Soared to $419 million in Q3, marking a 96% increase year-over-year.

Net Income: Climbed to $96 million, a 54% increase from the previous year's quarter.

Earnings Per Share (EPS): Diluted EPS rose to $1.63, up from $1.05 in the same quarter last year.

Operating Expenses: Increased to $307 million, in line with strategic expansion plans.

Insurance Underwriting Premiums: Witnessed a 177% surge to approximately $79 million.

Customer Growth: Brokerage customer count grew to approximately 458,000, a significant rise from the previous fiscal year-end.

Asset Growth: Total assets reached $7.5 billion, a substantial increase from $5.1 billion at the last fiscal year-end.

On February 12, 2024, Freedom Holding Corp (NASDAQ:FRHC) released its 8-K filing, unveiling its financial results for the third quarter and nine months ended December 31, 2023. The company, a prominent player in the securities industry across various regions including Central Asia, Europe, the United States, and the Middle East/Caucasus, has reported a record-breaking quarter with significant year-over-year growth in key financial metrics.

Financial Performance Overview

FRHC's third-quarter revenue nearly doubled to $419 million, up from $214 million in the prior year's quarter, driven by robust growth across all business lines. Net income also saw a healthy increase to $96 million, translating to a 54% rise compared to the third quarter of fiscal 2023. The company's diluted earnings per share (EPS) improved to $1.63, up from $1.05 in the same period last year.

For the nine months ending December 31, 2023, FRHC's revenue totaled approximately $1.2 billion, a remarkable 107% increase from the previous year. Operating expenses followed the upward trend, reaching $840 million, which reflects the company's strategic expansion efforts. Despite the increased expenditures, net income for the nine months stood at approximately $279 million, providing a significant boost to both basic and diluted EPS.

Balance Sheet and Customer Growth

FRHC's total assets experienced a substantial increase, reaching $7.5 billion as of December 31, 2023, compared to $5.1 billion at the end of the previous fiscal year. Net working capital also saw an uptick, rising to $1.0 billion from $771 million. The company's brokerage customer count expanded to approximately 458,000, a notable increase from around 370,000 at the end of the last fiscal year.

"Our Central Asia and Eastern European business lead the way for growth," said Timur Turlov, CEO of FRHC. He emphasized the company's successful diversification of revenue streams and the expansion of business lines across all regions. Turlov also noted the strategic growth in operating expenses, which aligns with the company's expansion plans and the increased interest expenses due to the growth of short-term financing and client deposits.

Key Financial Highlights and Challenges

The company's impressive performance was not without its challenges. The report indicated a net loss from securities trading of approximately $5.1 million for the third quarter, primarily due to the decline in the value of Kazakhstan Development Fund bonds. However, this was offset by a significant increase in insurance underwriting income and fee and commission income, which rose by 49% to approximately $120 million.

FRHC's strategic expansion has led to the opening of new branch offices in Italy, The Netherlands, Austria, and Bulgaria, further solidifying its presence in Europe. The company's insurance divisions, Freedom Life and Freedom Insurance, also contributed significantly to the revenue growth.

Freedom Holding Corp's performance this quarter is a testament to its strategic vision and operational excellence. The company's ability to navigate market challenges and continue its growth trajectory is indicative of its strong position within the capital markets industry. As FRHC continues to build out its digital fintech ecosystem and expand its cross-selling capabilities, particularly in Central Asian markets, investors and stakeholders alike have much to look forward to in the future of this dynamic financial services holding company.

For a detailed understanding of Freedom Holding Corp's financial performance and future prospects, readers are encouraged to visit Freedom Holding Corp's website and review the full earnings report.

Explore the complete 8-K earnings release (here) from Freedom Holding Corp for further details.

This article first appeared on GuruFocus.