Freeline (FRLN) Shares Rise on Merger Agreement With Syncona

Freeline Therapeutics Holdings plc FRLN, a clinical-stage biotechnology company, announced that it has entered into a definitive agreement with United Kingdom-based portfolio company Syncona Ltd. Per the deal, Freeline is set to be acquired by Syncona in an all-cash transaction.

The above transaction is expected to be closed in the first quarter of 2024, subject to approval by Freeline’s minority shareholders. Shares of Freeline were up 10.2% on Nov 22 following the announcement of the news.

Per the acquisition agreement, Syncona will acquire all shares of Freeline for $6.50 per American Depositary Share (ADS) that it currently does not own. The price offered by Syncona represents a 51% premium over the closing price of Freeline’s shares as of Oct 18 and values the latter’s entire issued share capital at approximately $28.3 million.

Also, as part of the merger agreement, Freeline will receive up to $15 million in secured convertible debt financing from Syncona. With this financing, Freeline is looking to fund its operations and continue the advancement of FLT201, its gene therapy candidate till the acquisition transaction is completed.

Freeline is currently evaluating FLT201 in the phase I/II GALILEO-1 study for the treatment of patients with Gaucher disease type 1. The company is planning to use the proceeds from the above mentioned debt financing for a potential registrational study on FLT201 and move ahead with its GBA1-linked Parkinson’s disease research program.

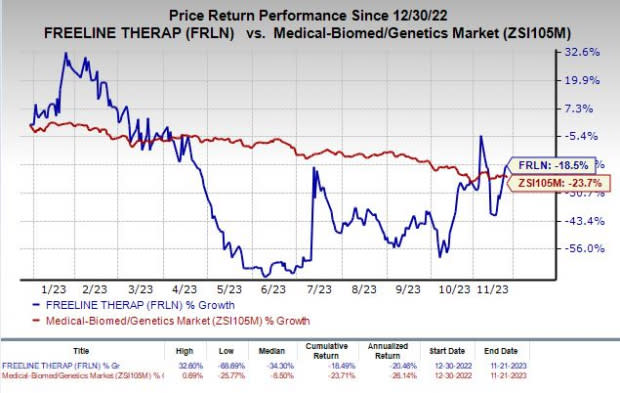

Shares of Freeline have lost 18.5% in the year-to-date period compared with the industry’s decline of 23.7%.

Image Source: Zacks Investment Research

Upon the completion of the above acquisition, Freeline will become a privately held, wholly-owned company of Syncona, and its ADS will not be trading any further on the Nasdaq stock exchange.

We note that Freeline’s independent directors unanimously recommended that the above acquisition transaction is in the best interest of the company and is likely to create significant value for its shareholders.

Zacks Rank & Other Stocks to Consider

Freeline currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the healthcare sector are CytomX Therapeutics, Inc. CTMX, Ligand Pharmaceuticals Incorporated LGND and Puma Biotechnology, Inc. PBYI, sporting a Zacks Rank #1 (Strong Buy) each.You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for CytomX Therapeutics’ 2023 loss per share have narrowed from 37 cents to 10 cents. Meanwhile, loss per share estimates for 2024 have narrowed from 51 cents to 22 cents. Year to date, shares of CTMX have lost 18.4%.

Earnings of CytomX Therapeutics beat estimates in three of the last four quarters while missing the same on the remaining occasion. CTMX delivered a four-quarter average earnings surprise of 45.44%.

In the past 60 days, Ligand Pharmaceuticals’ earnings per share estimates for 2023 have improved from $4.98 to $5.33. During the same period, earnings per share estimates for 2024 have moved up from $4.26 to $4.64. Year to date, shares of LGND have decreased 12.5%.

Earnings of Ligand Pharmaceuticals beat estimates in each of the trailing four quarters. On average, LGND came up with a four-quarter earnings surprise of 67.19%.

In the past 60 days, estimates for Puma Biotechnology’s 2023 earnings per share have improved from 67 cents to 72 cents. During the same period, earnings per share estimates for 2024 have moved up from 55 cents to 62 cents. Year to date, shares of PBYI have lost 9%.

Earnings of Puma Biotechnology beat estimates in three of the last four quarters while missing the same on the remaining occasion. PBYI delivered a four-quarter average earnings surprise of 76.55%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

CytomX Therapeutics, Inc. (CTMX) : Free Stock Analysis Report

Freeline Therapeutics Holdings PLC Sponsored ADR (FRLN) : Free Stock Analysis Report