Freeport (FCX) to Report Q4 Earnings: What's in the Cards?

Freeport-McMoRan Inc. FCX is set to release fourth-quarter 2023 results before the opening bell on Jan 24.

The mining giant’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, while missed once. It has a trailing four-quarter earnings surprise of roughly 21.9%, on average. Freeport is expected to have gained from its efforts to increase mining rates, the strength in copper prices and lower costs in the fourth quarter.

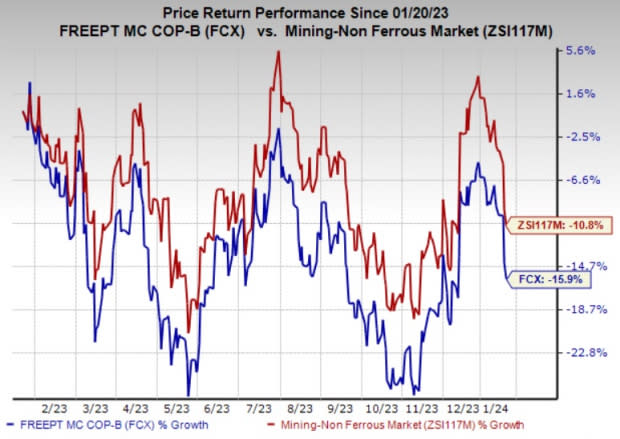

The stock has lost 15.9% in the past year compared with the industry’s 10.8% decline.

Image Source: Zacks Investment Research

Let’s see how things are shaping up for this announcement.

What do the Estimates Indicate?

For the fourth quarter of 2023, Freeport expects sales volumes to be 1.1 billion pounds of copper, 580,000 ounces of gold and 20 million pounds of molybdenum.

The Zacks Consensus Estimate for Freeport’s fourth-quarter consolidated revenues is currently pegged at $5,844.3 million, which suggests a year-over-year increase of 1.5%.

A Few Factors to Watch

Freeport is likely to have benefited from improved costs in the fourth quarter. It is seeing improving trends for several of its commodity-based input costs and remains focused on managing costs and improve productivity. Our estimate for fourth-quarter consolidated net cash costs per pound of copper currently stands at $1.58, which indicates a sequential decrease of 8.7%.

Moreover, continued strong performance at PT Freeport Indonesia and efforts to increase operating rates at Cerro Verde and El Abra mines are likely to have aided the company’s copper volumes in the quarter to be reported. FCX is expected to have witnessed improved volumes in its Grasberg operations in the December quarter on higher mining rates and ore grades. The company is also likely to have benefited from higher milling rates in South America. Our estimate for consolidated copper sales for the fourth quarter is 1,085 million pounds.

Freeport’s fourth-quarter results are also expected to have been supported by the strength in copper prices. Copper prices had started 2023 on a strong note, fueled by investor expectations of a surge in demand after the reopening of the China economy from COVID-led restrictions. However, softer demand from China and global economic concerns weighed on copper prices during the second quarter.

Copper started the third quarter on a positive note amid expectations that demand in China will improve, backed by stimulus measures from the government, but closed the quarter lower on worries over China’s real estate sector. However, prices of the red metal moved higher in the fourth quarter and hit a three-month high in early December on supply disruptions (partly due to the Panama copper mine closure), better-than-expected data from China, a weaker dollar and prospects of interest rate cuts. Copper maintained the momentum through December and ended the year on a high note amid concerns over supply constraints.

Freeport-McMoRan Inc. Price and EPS Surprise

Freeport-McMoRan Inc. price-eps-surprise | Freeport-McMoRan Inc. Quote

Zacks Model

Our proven model does not conclusively predict an earnings beat for Freeport this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. But that’s not the case here.

Earnings ESP: Earnings ESP for Freeport is -8.72%. The Zacks Consensus Estimate for earnings for the fourth quarter is currently pegged at 23 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Freeport currently carries a Zacks Rank #3.

Stocks That Warrant a Look

Here are some companies in the basic materials space you may want to consider as our model shows they have the right combination of elements to post an earnings beat this quarter:

Carpenter Technology Corporation CRS, scheduled to release earnings on Jan 25, has an Earnings ESP of +0.89% and carries a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for CRS’s earnings for the fiscal second quarter is currently pegged at 85 cents.

Barrick Gold Corporation GOLD, slated to release earnings on Feb 14, has an Earnings ESP of +3.99% and carries a Zacks Rank #3 at present.

The consensus mark for GOLD’s fourth-quarter earnings is currently pegged at 23 cents.

Kinross Gold Corporation KGC, scheduled to release fourth-quarter earnings on Feb 14, has an Earnings ESP of +25.00%.

The Zacks Consensus Estimate for Kinross' earnings for the fourth quarter is currently pegged at 9 cents. KGC currently carries a Zacks Rank #3.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Freeport-McMoRan Inc. (FCX) : Free Stock Analysis Report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report