Freeport's (FCX) Earnings and Revenues Surpass Estimates in Q4

Freeport-McMoRan Inc. FCX recorded net income (attributable to common stock) of $388 million or 27 cents per share in fourth-quarter 2023, down around 44.3% from $697 million or 48 cents in the year-ago quarter.

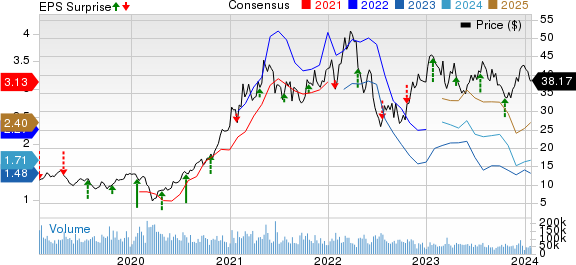

Barring one-time items, adjusted earnings per share came in at 27 cents, topping the Zacks Consensus Estimate of 21 cents.

Revenues rose nearly 2.6% year over year to $5,905 million. The figure also surpassed the Zacks Consensus Estimate of $5,820.7 million. The company witnessed higher copper sales in the reported quarter.

Freeport-McMoRan Inc. Price, Consensus and EPS Surprise

Freeport-McMoRan Inc. price-consensus-eps-surprise-chart | Freeport-McMoRan Inc. Quote

Operational Highlights

Copper production rose nearly 2.3% year over year to 1,095 million pounds in the reported quarter. The figure fell short of our estimate of 1,108 million pounds.

Consolidated sales increased around 7.1% year over year to 1,116 million pounds of copper. The figure was higher than our estimate of 1,085 million pounds. The upside can be attributed to higher mining rates.

The company sold 549,000 ounces of gold, up around 16.3% year over year. The figure was lower than our estimate of 580,000 ounces. FCX also sold 22 million pounds of molybdenum, up around 15.8% year over year during the quarter. The figure was higher than our estimate of 20 million pounds.

Consolidated average unit net cash costs per pound of copper were $1.52, flat year over year. The figure was lower than our estimate of $1.58.

The average realized price for copper was $3.81 per pound, up around 1% year over year. The figure was higher than our estimate of $3.6 per pound. The average realized price per ounce for gold rose around 13.7% year over year to $2,034. The figure was above our estimate of $1,900.

Financial Position

Cash and cash equivalents (including restricted) at the end of the quarter were $5,966 million, down around 27.8% year over year. The company’s long-term debt was $8,656 million, down around 9.7% year over year.

Cash flows provided by operations were $5,279 million for the year ended Dec 31, 2023.

Guidance

Freeport expects consolidated sales for the year 2024 to be approximately 4.1 billion pounds of copper, 2 million ounces of gold and 85 million pounds of molybdenum. This includes an estimated 1 billion pounds of copper, 575,000 ounces of gold, and 20 million pounds of molybdenum in the first quarter of 2024.

The unit net cash costs for copper are expected to average $1.60 per pound for 2024, encompassing $1.55 per pound in the first quarter of the same year. These predictions are based on the achievement of current sales volume and cost estimates, assuming average prices of $2,000 per ounce of gold and $19.00 per pound of molybdenum for the entire year.

The company is also forecasting operating cash flows of approximately $5.8 billion for 2024. Meanwhile, capital expenditures for the full year are projected to be around $4.6 billion.

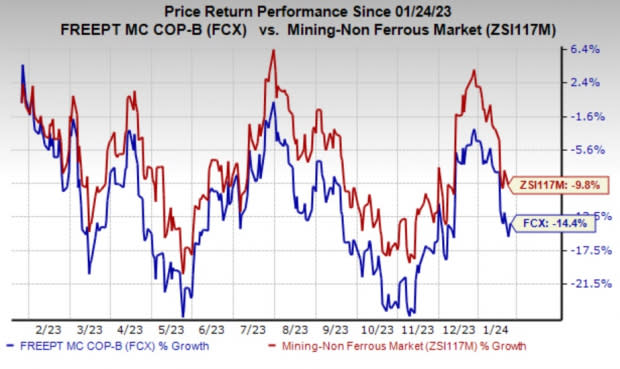

Price Performance

Freeport’s shares are down 14.4% in the past year compared with a 9.8% fall of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Freeport currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Cameco Corporation CCJ, Carpenter Technology Corporation CRS and The Andersons ANDE, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Cameco has a projected earnings growth rate of 188% for the current year. The Zacks Consensus Estimate for CCJ’s current-year earnings has been revised upward by 12.5% in the past 60 days. The stock is up around 75.5% in a year.

The consensus estimate for CRS’s current fiscal year earnings is pegged at $3.97, indicating a year-over-year surge of 248.3%. CRS beat the Zacks Consensus Estimate in all of the last four quarters, with the average earnings surprise being 14.3%. The company’s shares have rallied 57% in the past year.

ANDE beat the Zacks Consensus Estimate in three of the last four quarters and missed one, with the average earnings surprise being 32.8%. The company’s shares have increased 45.4% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Freeport-McMoRan Inc. (FCX) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Cameco Corporation (CCJ) : Free Stock Analysis Report