Fresh Del Monte: A Cheap but Cyclical Stock

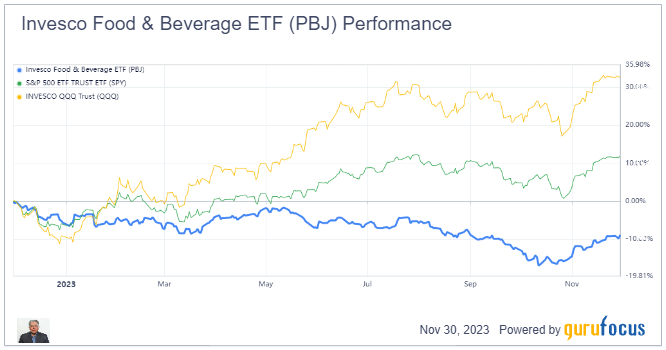

The food industry is going through a bit of slump lately with the stock market still caught up in the excitement of artificial intelligence and the "Magnificent Seven" stocks.

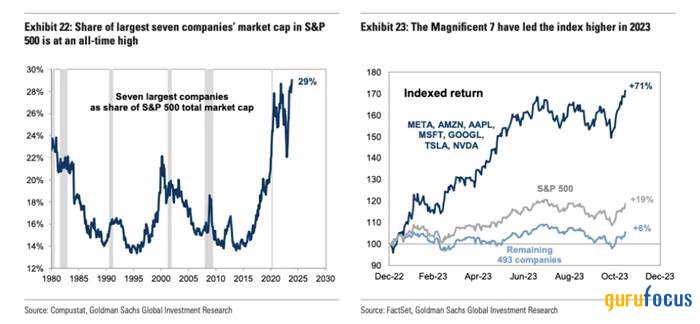

In fact, if we were to remove the effect of the Magnificent Seven the stock market is more or less flat this year. (These stocks are Alphabet (NASDAQ:GOOG), Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Meta (NASDAQ:META), Microsoft (NASDAQ:MSFT), Nvidia (NASDAQ:NVDA) and Tesla (NASDAQ:TSLA)).

Source: Research from Goldman Sachs shows the S&P 500 has never been this top-heavy, which is leading to gains in seven stocks driving the major average higher. (Goldman Sachs Global Investment Research)

As such, I turn my attention to the opposite of the Magnificent Seven; the most boring and unexciting part of the market, which looks undervalued, is food stocks. One of the most boring of these food stocks is Fresh Del Monte Produce Inc. (NYSE:FDP), a purveyor of fresh fruit and vegetables.

The company

Fresh Del Monte is an integrated producer, marketer and distributor of fruit and vegetables to grocery stores and food wholesalers. It operates in three segments. The first, the fresh and value-added products segment, includes pineapples, fresh-cut fruit, fresh-cut vegetables, melons, vegetables, non-tropical fruit, other fruit and vegetables, avocados, canned and prepared foods. Second is the banana segment and the third is the other products and services segment, which includes a third-party freight and logistic services business and the Jordanian poultry and meats business.

The company has a global footprint, operating in North America, Europe, Asia and the Middle East. Around 61% of the business comes from North America, where it operates 27 distribution centers. In Europe, Fresh Del Monte owns and operates a fresh-cut fruit facility in England, a production facility in Greece and a distribution center in Germany. In Asia, it distributes products from leased centers in Japan and Hong Kong, operates fresh-cut fruit facilities and owns a distribution center in South Korea. In Central America, the company owns extensive farming land in Costa Rica, greenhouses in Guatemala and a banana operation in Panama. South America sees the company owning land in Brazil, Uruguay and Chile, with leased land for non-tropical fruit production. In Africa, Fresh Del Monte owns facilities in Kenya. In the Middle East, it has various operations in Jordan, including a poultry business and hydroponic greenhouse. In the UAE, it leases a distribution and manufacturing center and in Saudi Arabia, it owns 60% of joint venture distribution centers. Additionally, the company has facilities in Kuwait.

Overall, there are a lot of hard assets, like production facilities, warehouses and farm land, on the balance sheet. The company has significant insider ownership with 14.45% of the stock owned by the CEO Mohammad Abu-Ghazaleh and another 6.76% by Amir Abu-Ghazaleh. The Abu-Ghazaleh family acquired Fresh Del Monte Produce in 1996 and took the company public on the New York Stock Exchange the following year.

This is a low-margin, high-volume business. It has slim net profit margins of around 2%, so its very dependent on operational efficiency. The company has been profitable for eight of the last 10 years.

Looking at the GuruFocus qualitative metrics, I see the company has a very low predictability rank, but ranks high on valuation. Growth and profitability are middling and the financial strength is good.

Modestly Undervalued | ||

76 | of 100 | |

1 | of 5 | |

4 | of 10 | |

7 | of 10 | |

10 | of 10 | |

6 | of 10 | |

7 | of 10 | |

6 | of 10 |

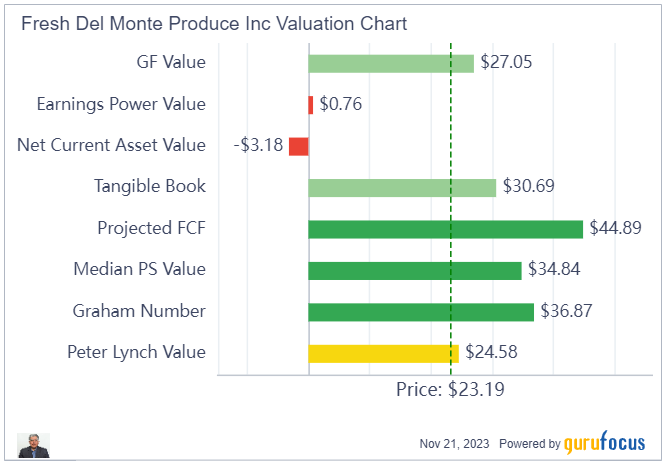

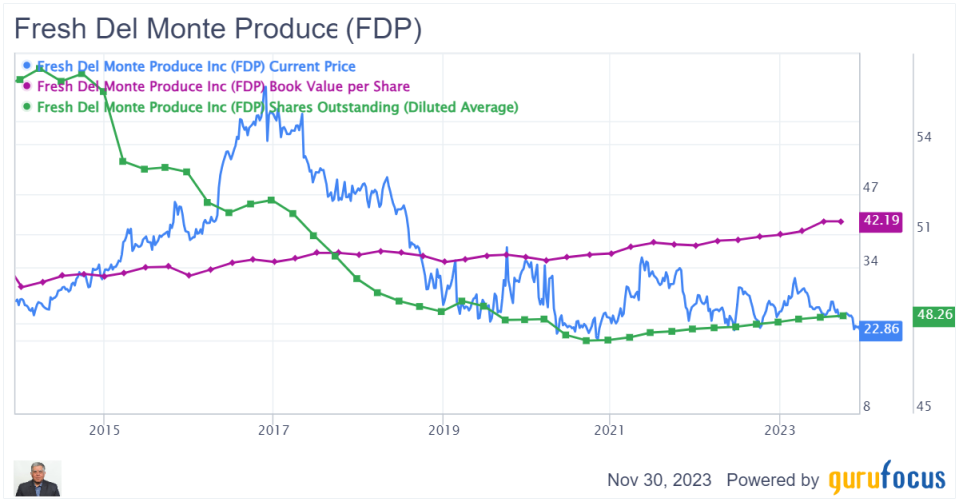

The valuation chart below looks very good with lots of green. It shows the stock is trading below tangible book value, which sets a very conservative value for the company. Tangible book value is calculated as follows: Assets - Liabilities - Intangible Assets.

Tangible book value per share is important because it shows the value of a company's net assets minus its intangible assets on a per-share basis. Intangible assets are important, but they are not physical assets that can be readily sold if the company gets into trouble.

Graham number

Given the amount of tangible assets on the balance sheet, I think a Graham number approach to valuation makes sense. It is a conservative valuation approach that measures a stock's fundamental value by taking into account the company's earnings per share and tangible book value per share. (Graham Number = Square Root of (22.5) x (TTM EPS) x (Book Value per Share)). The 22.5 is included in the formula as a rule of thumb to account for Benjamin Graham's assumption that the price-earnings ratio should not be over 15 and the price-book ratio should not be over 1.5 for an undervalued stock (Thus, 15 PE x 1.5 PB= 22.5). According to Graham, this is the upper bound of the price range that a defensive investor should pay for the stock. According to this theory, any stock price below the Graham number is considered undervalued, and thus worth looking into for investment.

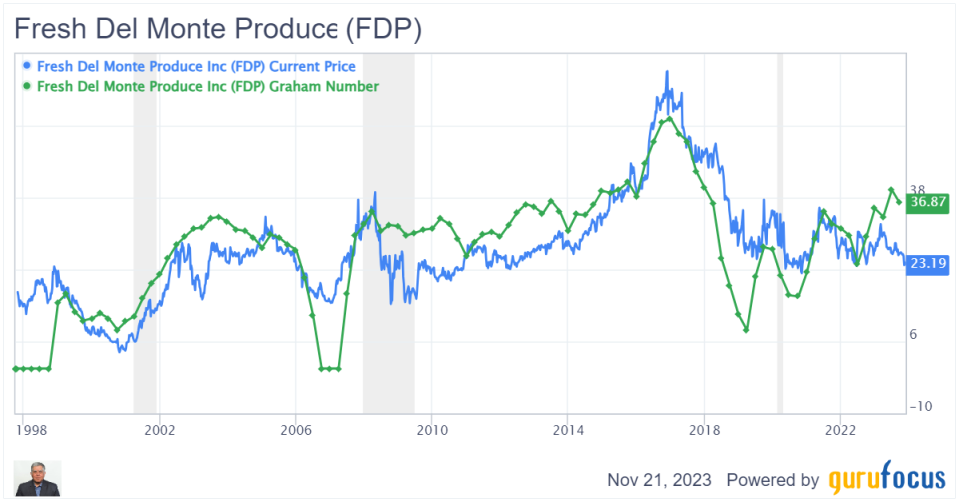

Looking at the long term (25-year) chart below tracking the FDP stock price (blue line) and the Graham number, I note the Graham number and the stock price are quite well correlated and whenever the stock price has dipped below the Graham number line (green line), it has subsequently bounced back to get above it. The chart also shows the stock appears to be substantially undervalued at present with the blue line well below the green line. Currently, the gap between the two lines is quite wide and there is a 58% margin of safety below the current Graham number. Therefore, based on this analysis, I expect the valuation gap to close in the one to three years and the stock could gain over 50% from here. Meanwhile, investors get to collect a decent dividend.

FDP Data by GuruFocus

However, note the stock price is cyclical and thus, it is important to be aware of this tendency and sell the stock when it starts to appear fully valued. I think when the stock price approaches the green Graham number line, the stock should be sold to take a profit even though momentum may continue to drive the stock upward. I think it is better to be not too greedy with this one given its cyclical nature. Like they say, picking tops and bottoms is for the lucky and the liars.

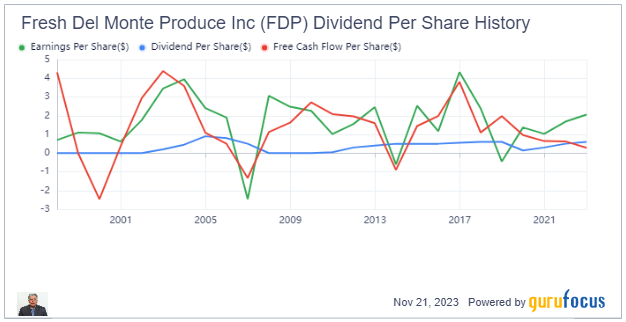

Dividends

The company pays a dividend currently at 3.23%. However, one should note with caution the earnings and free cash flow are erratic and the company has cut its dividend in the past, during the financial crisis in 2008 and at the start of the Covid pandemic. This explains the low predictability score. However, the company's beta is 0.6, so the stock is less volatile overall as compared to the rest of the market.

Buybacks

In addition to the dividends, the company does have a history of buybacks. Shares outstanding have been reduced by 2% per year over the last 10 years. So it is possible that management and board will restart the buyback process given the share price is well below the tangible book value.

FDP Data by GuruFocus

Conclusion

Given the large amount of hard assets on the balance sheet, a Graham-type valuation approach makes sense for Fresh Del Monte. This is a boring cyclical value company that sells fresh food. Everyone has to eat, right?

The company's balance sheet is solid with low debt, lots of tangible assets and it has a reasonably good record of shareholder returns. It is profitable and pays a decent dividend. The company is still owner operated, ensuring good long-term alignment between shareholders and management. Its economic moat rises from its disribution network and operations. However, it is a low-growth, cyclical company with rather erratic earnings, but investors are only paying a price-earnings ratio of less than 10. While Fresh Del Monte is cheap now, every few years it becomes fully valued. So the trick to making money is sell it at the right time.

This article first appeared on GuruFocus.