Fresh Del Monte Produce Inc. Reports Fiscal Year 2023 Results: Gross Margin Improvement Amidst ...

Gross Profit Margin: Increased to 8.1% for FY 2023 from 7.7% in the previous year.

Strategic Alternatives: Company exploring options for Mann Packing operation.

Debt Reduction: Long-term debt reduced by $140 million or 26% to $400 million at the end of FY 2023.

Dividend Increase: Quarterly dividend raised by 25% for the second consecutive year.

Net Sales: Decreased to $4,320.7 million in FY 2023 from $4,442.3 million in the prior year.

Net Loss: Reported a net loss of $(11.4) million for FY 2023 compared to a net income of $98.6 million in the previous year.

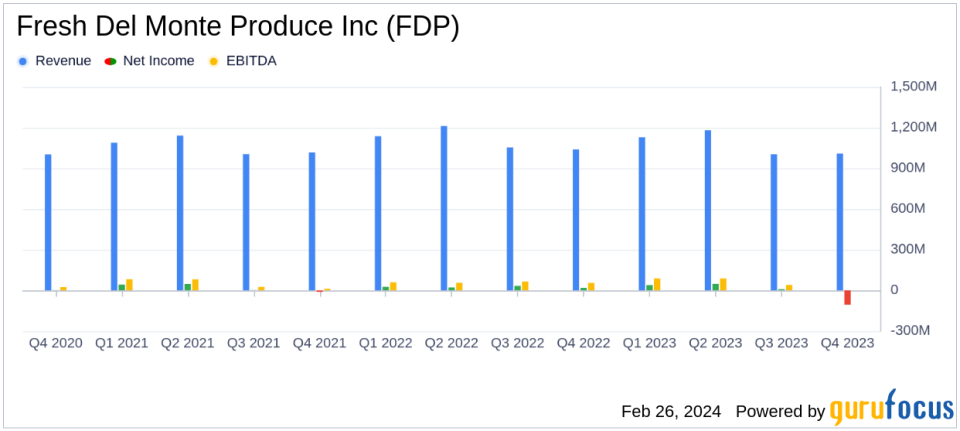

On February 26, 2024, Fresh Del Monte Produce Inc (NYSE:FDP) released its 8-K filing, announcing its financial results for the fourth quarter and the full fiscal year ended December 29, 2023. The company, a global purveyor of high-quality fresh and fresh-cut fruit and vegetables, operates primarily through its Fresh and value-added products segment, which saw a gross margin increase to 8.1% for the fiscal year 2023 from 7.7% in the prior year.

Fresh Del Monte's financial performance reflects a mixed picture, with a notable increase in gross profit margin despite a decrease in net sales. The company's strategic management of assets, including the sale of underutilized assets for $120 million, contributed to the highest full-year gross profit and margin since 2016. However, challenges such as lower sales volumes across all segments and the impact of exchange rate fluctuations have posed hurdles for the company.

The importance of these financial achievements cannot be overstated for a company in the Consumer Packaged Goods industry. The ability to manage costs effectively and improve margins is crucial in an industry characterized by thin profit margins and intense competition. Fresh Del Monte's focus on strategic asset management, cost control, and innovation has allowed it to navigate these challenges successfully.

Key financial metrics from the income statement include a decrease in net sales to $4,320.7 million for the full fiscal year 2023, down from $4,442.3 million in the prior year. The balance sheet shows a reduction in long-term debt to $400 million, a significant decrease from the previous year's $539.8 million. The cash flow statement highlights net cash provided by operating activities at $177.9 million, indicating a healthy cash generation capability.

The company's Chairman and Chief Executive Officer, Mohammad Abu-Ghazaleh, commented on the results:

"We are pleased with many aspects of our full year 2023 results including our strong gross margins and cash flow which enabled us to have strong full year adjusted earnings per share growth, reduce our long-term debt by $140 million to end the year with an adjusted leverage ratio of 1.7x and continue to return value to shareholders by increasing our dividend 25% for the second year in a row."

Despite the reported net loss for the fiscal year, the company's strategic initiatives, such as exploring alternatives for its Mann Packing operation and focusing on profitability improvements, demonstrate a proactive approach to overcoming the challenges faced.

Fresh Del Monte's performance analysis reveals a company that is adept at navigating the complexities of the global produce market. While the reported net loss and reduced net sales indicate areas for improvement, the company's increased gross profit margin and successful debt reduction reflect a strong underlying operational efficiency. The increase in the quarterly dividend also signals confidence in the company's financial stability and commitment to shareholder value.

Value investors and potential GuruFocus.com members interested in the Consumer Packaged Goods sector may find Fresh Del Monte Produce Inc's strategic approach to asset management and cost control, coupled with its focus on innovation and partnerships, a compelling reason to consider the company's stock for their portfolios.

For a more detailed breakdown of Fresh Del Monte Produce Inc's financial results and strategic initiatives, readers are encouraged to view the full 8-K filing.

Explore the complete 8-K earnings release (here) from Fresh Del Monte Produce Inc for further details.

This article first appeared on GuruFocus.