Fresh thinking about the electric grid holds possibilities

It is easy to simply state a problem and offer no solutions. For example, where are we going to get the electricity to power the transition to electric heavy-duty trucks? One potential answer is to look at the electric grid differently.

Common wisdom holds that the outdated and constrained electric grid cannot support the scaling of electric trucks. Looking at the grid’s current use supports that.

Electrifying just the long-haul portion of the U.S. trucking fleet would require 10% of the nation’s electric power generation, according to a December 2022 study from the American Transportation Research Institute.

That assumes the status quo. When utilities calculate limits on a new interconnection, engineers consider the potential load from all customers on a circuit. They assume these loads will happen at the same time.

They rarely do. Some customers use more electricity during the day. Some use more at night.

Opening up the grid with software controls

Southern California Edison (SCE) is planning a two-year pilot program that could make more power available by thinking about the grid differently. A customer like electric infrastructure developer Forum Mobility could use specialized software called a load control management system (LCMS).

An LCMS would allow a charging depot to get an interconnection that would modulate the power it draws from the grid depending on grid conditions. It would get greater access to electricity in times of plenty and less when other customers are maxing out.

This process would allow interconnections of charging depots more quickly. The assumption is it would lower ratepayer costs by increasing throughput through the existing grid infrastructure.

Forum on Thursday announced a 9-megawatt charging depot at California’s Port of Long Beach. The facility adjacent to the Long Beach Container Terminal. will require as much power as a large sports facility. Forum expects energy flowing to the site will be capable of charging more than 200 trucks a day by the third quarter of 2024.

Simultaneous charging for 44 trucks

The Long Beach charging depot will offer 19 dual-port 360-kilowatt chargers and six 360-kW single-dispenser chargers. They will be able to charge 44 trucks at the same time with the ability to charge an electric Class 8 truck in about 90 minutes depending on battery size.

“That’s just several hundred trucks a day. We need [to charge] thousands and thousands of trucks a day,” Matt LeDucq, CEO of Forum Mobility, told me this week before Thursday’s announcement of the Long Beach facility.

“Incremental generation that happens on-site is going to be pretty valuable and pretty necessary. I think that the good news is there’s still sites like the one that we have here and we have more depots coming that look exactly like this one from a power perspective.”

New role for public utility commissions

Pilots like the one that SCE is planning require lobbying, education and advocacy with public utilities commissions.

“Utilities can’t be proactive without the public utilities commissions letting them be proactive,” LeDucq said. “Utilities commissions have to acknowledge that they’re going to have a new role in how things play out over the next couple of decades.”

Looking at creative ways to get more out of the existing grid could forestall expensive upgrades that typically raise rates for residential customers.

“The grid has never been used as a major fuel source for transportation. And so the way that tariffs are constructed today might not be the way that tariffs need to be put together in the future. And that’s complicated,” LeDucq said. “How do you make a tariff for commercial charging that doesn’t unduly hurt the residential customer?”

An intelligent approach to grid operations by utilities and rate-setting public utility commissions could make a difference.

“Just because a line has 1 megawatt of capacity on it doesn’t mean that it always has 1 megawatt of capacity on it. It only has one megawatt of capacity when the grid is most constrained. If we can get our grid more intelligent, that very line that has 1 megawatt capacity probably has 5 or 6 or 7 megawatts for the vast majority of the year.”

Growing demand for power

Startups like WattEV, TeraWatt, Voltera and Zeem Solutions and established carriers like Scneider and NFI Industries are in queue for multiple megawatts of charging power. Then there’s Greenlane, a $650 million joint venture of Daimler Truck, NextEra Energy Resources and Black Rock Alternatives, targeting Southern California for charging sites.

NFI expected to have a state-subsidized charging site in Ontario, California, for its electric drayage trucks up and running by this time a year ago. The latest estimate is February 2024.

Forum announced a 4.4-acre site in Livermore in Northern California in June. Planning began 18 months ago for the newly announced Long Beach site.

“Lead times of electrical equipment tend to drive the schedules of these projects,” LeDucq said. “So for Livermore, that project chugs along. We’ve got our switchgear and transformers being manufactured now.”

Forum’s target customer remains small trucking fleets and owner-operators who could be shut out of electrification if the grid runs out of available electricity before they move to electric trucks. Forum and others should have been working on infrastructure expansion years ago, LeDucq said.

“There’s a pretty good argument that we are a little bit out of step with a few things,” he said. “Infrastructure takes a long time and we need to get out ahead of the market.”

Slowing California’s Advanced Clean Trucks roll

The American Trucking Associations this week cheered the decision by Connecticut to withdraw from a plan to ban gasoline-powered vehicles by 2035.

“The tide is turning as state officials across the country wake up to the reality that California’s electric-truck mandates are bad policy that carry serious political consequences,” ATA President and CEO Chris Spear said in a news release.

“As Connecticut, North Carolina, and Maine have realized, blindly following California’s sure-to-fail approach is not the only option,” Spear said. “Ensuring the necessary infrastructure is in place and allowing for a range of technological solutions to prevail, rather than one-size-fits-all mandates, is how we succeed together on the road to zero emissions.”

This is the mantra of the Clean Freight Coalition (CFC). The ATA was a founding member when the lobbying group began operations in March.

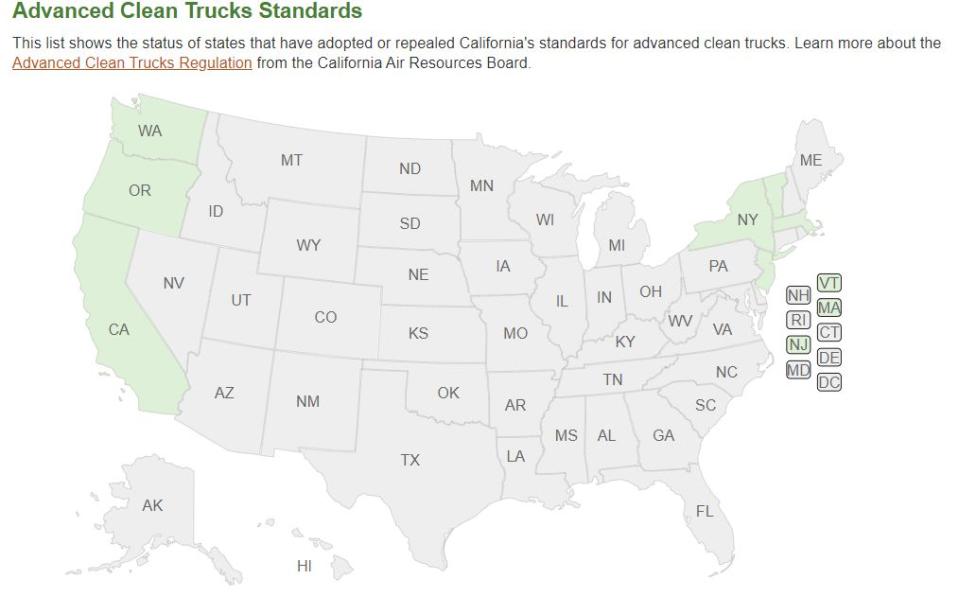

Seven states — Oregon, Washington, Colorado, New York, Massachusetts, New Jersey and Vermont — have adopted the California rules. Several others are considering signing on.

With the first of the Advanced Clean Trucks and Advanced Clean Fleets rules taking effect in January, the battle against the rules is intensifying.

The California Trucking Association has sued to delay implementation of the ACF. The Engine Manufacturers Association cut a deal with the California Air Resources Board to delay implementation of new rules on oxygen nitrates (NOx) emissions in exchange for staying on the sidelines of legal challenges to those rules.

The EMA quietly quit the CFC just before negotiating with CARB.

(Save the date: Clean Freight Coalition Executive Director Jim Mullen will be my guest on Truck Tech next Wednesday at 3 p.m. on the FreightWaves YouTube channel.)

Briefly noted …

Daimler Truck North America will use Freightliner eCascadia electric trucks for its inbound logistics, a move Volvo Trucks North America implemented in December 2022.

Hyundai Motor will demonstrate its Xcient fuel cell truck in the United Arab Emirates of Sharjah and Dubai.

BYD produced its 6 millionth battery-electric vehicle at its Zhengzhou factory in China. The company makes Class 8 electric truck models in California.

The Volvo FH Electric heavy-duty truck became the first electric truck selected as International Truck of the Year.

Autonomous middle-mile logistics pioneer Gatik was named on Fast Company’s Next Big Things in Tech list in the Robotics and Automation category.

Peterbilt assembled the 750,000th truck at its Denton, Texas, plant. The manufacturing facility opened in 1980.

Truck Tech Episode 43: Waabi looks to AI to leapfrog autonomous competitors

Raquel Urtasun, founder and CEO of Waabi Innovation, talked about all things AI in autonomous trucking.

That’s it for this week. Thanks for reading (and watching). We value your feedback. Please write aadler@freightwaves.com with comments and story suggestions. Click here to get Truck Tech via email on Fridays. And catch the latest in major events and hear from the top players on Truck Tech at 3 p.m. Wednesdays on the FreightWaves YouTube channel.

The post Fresh thinking about the electric grid holds possibilities appeared first on FreightWaves.