Is Freshpet (FRPT) Too Good to Be True? A Comprehensive Analysis of a Potential Value Trap

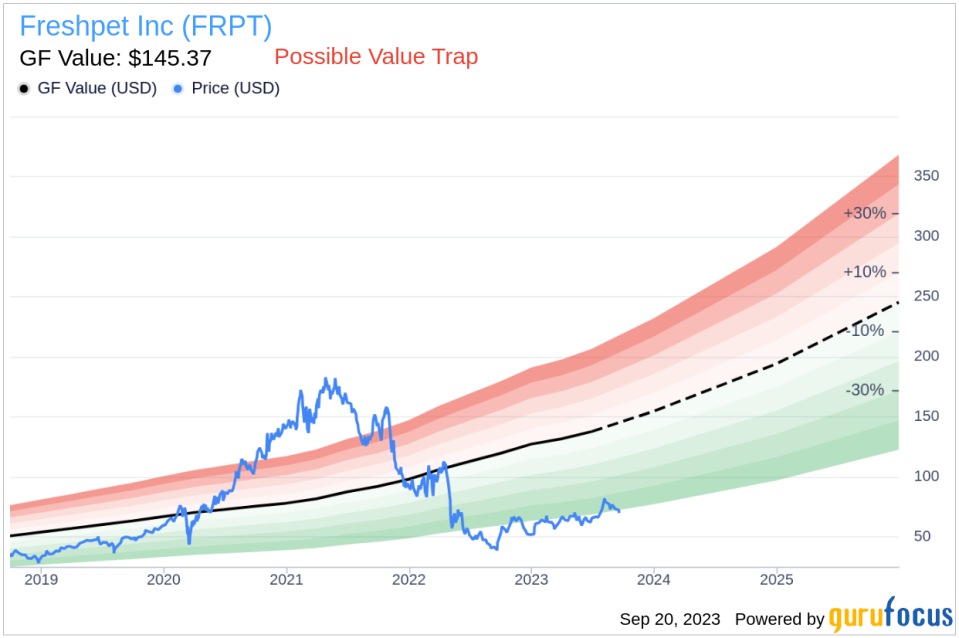

Value-focused investors are always on the hunt for stocks that are priced below their intrinsic value. One such stock that merits attention is Freshpet Inc (NASDAQ:FRPT). The stock, which is currently priced at $70.03, recorded a loss of 3.36% in a day and a 3-month increase of 13.42%. The stock's fair valuation, as indicated by its GF Value, is $145.37.

Understanding GF Value

The GF Value represents the current intrinsic value of a stock derived from our exclusive method. The GF Value Line on our summary page provides an overview of the fair value at which the stock should be trading. It is calculated based on three factors:

1. Historical multiples (PE Ratio, PS Ratio, PB Ratio, and Price-to-Free-Cash-Flow) that the stock has traded at.

2. GuruFocus adjustment factor based on the company's past returns and growth.

3. Future estimates of the business performance.

We believe the GF Value Line is the fair value that the stock should be trading at. The stock price will most likely fluctuate around the GF Value Line. If the stock price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. On the other hand, if it is significantly below the GF Value Line, its future return will likely be higher.

Uncovering Potential Risks

However, investors need to consider a more in-depth analysis before making an investment decision. Despite its seemingly attractive valuation, certain risk factors associated with Freshpet should not be ignored. These risks are primarily reflected through its low Piotroski F-score, Altman Z-score, and Beneish M-score. These indicators suggest that Freshpet, despite its apparent undervaluation, might be a potential value trap. This complexity underlines the importance of thorough due diligence in investment decision-making.

Introducing Freshpet Inc (NASDAQ:FRPT)

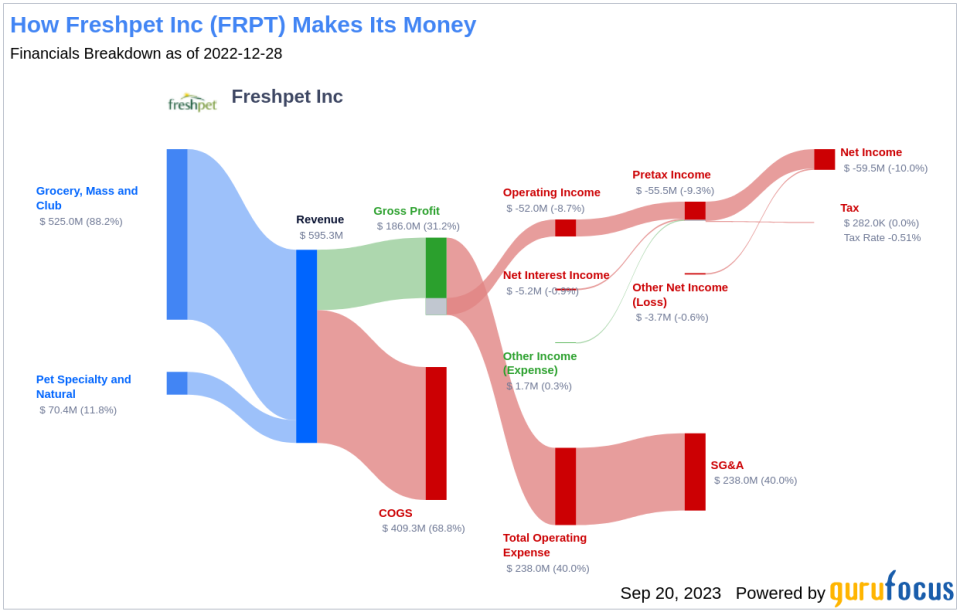

Freshpet Inc manufactures and markets natural fresh meals and treats for dogs and cats. The Company's products are distributed throughout the United States, Canada, and other international markets, into major retail classes including Grocery (including online), Mass and Club, Pet Specialty, and Natural retail. The company's products include Nature's Fresh, Deli Fresh, Vital, and Freshpet among others.

Conclusion

Given the complexities and potential risks associated with Freshpet (NASDAQ:FRPT), it is crucial for investors to conduct a comprehensive analysis before making an investment decision. While the stock's current price is below its GF Value, indicating potential undervaluation, the low Piotroski F-score, Altman Z-score, and Beneish M-score suggest that Freshpet could be a potential value trap. Therefore, despite the attractive valuation, investors should approach Freshpet with caution and conduct thorough due diligence.

This article first appeared on GuruFocus.