Freshpet Inc (FRPT) Delivers Strong Q4 and Full Year 2023 Results with Net Sales and Adjusted ...

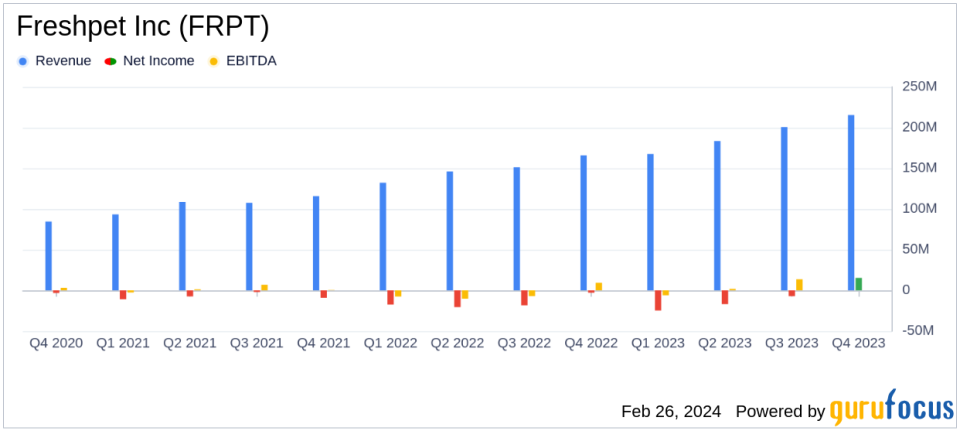

Net Sales: Increased by 29.9% in Q4 and 28.8% for the full year 2023.

Gross Profit: Improved to 34.6% of net sales in Q4, reflecting better plant expense leverage and reduced quality costs.

Net Income: Achieved $15.3 million in Q4, a notable improvement from a net loss of $2.9 million in the same period last year.

Adjusted EBITDA: Grew to $31.3 million in Q4, representing 14.5% of net sales.

Cash Flow: Operating cash flow increased significantly to $75.9 million for the full year 2023.

On February 26, 2024, Freshpet Inc (NASDAQ:FRPT) released its 8-K filing, detailing the company's financial performance for the fourth quarter and full year ended December 31, 2023. The company, known for its premium fresh pet food products, has reported a sixth consecutive year of over 25% net sales growth, with a strong finish in the fourth quarter.

Freshpet's business model focuses on producing and selling high-quality fresh pet food, primarily targeting dogs, which accounted for 92% of its 2022 sales. With its products available across the United States, Canada, the United Kingdom, and other European countries, Freshpet continues to expand its reach through various retail channels.

Financial Performance and Challenges

Freshpet's CEO, Billy Cyr, highlighted the company's inflection point, with significant investments leading to improved profitability and operating cash flow. The company's net sales for Q4 2023 increased by 29.9% to $215.4 million, driven by a 25% volume gain. The full year net sales also saw a substantial rise of 28.8% to $766.9 million.

The gross profit margin for Q4 improved to 34.6%, up from 27.6% in the previous year, due to better leverage on plant expenses and reduced quality costs. However, the company faced challenges with increased depreciation expenses related to capacity expansion and costs associated with equipment disposal.

SG&A expenses as a percentage of net sales decreased to 27.7% in Q4, down from 28.8% in the prior year period, reflecting reduced logistics costs and increased leverage on depreciation and share-based compensation as the business scales. Despite these improvements, the company incurred higher media spend and variable compensation accrual.

The net income for Q4 was $15.3 million, a significant turnaround from the net loss of $2.9 million in the same quarter of the previous year. The full year 2023 saw a net loss of $33.6 million, which was an improvement from the $59.5 million net loss in the prior year.

Adjusted EBITDA for Q4 was $31.3 million, or 14.5% as a percentage of net sales, compared to $18.8 million, or 11.3% in the prior year period. The full year Adjusted EBITDA was $66.6 million, or 8.7% of net sales, a significant increase from the previous year's $20.1 million, or 3.4%.

"Our strong 2023 results demonstrate that Freshpet has reached an inflection point: The significant investments we have made to create scale and extend our first mover advantage have begun to generate improved profitability and significant operating cash flow. That is the promise of the Fresh Future plan we announced last year, and it is working," commented Billy Cyr, Freshpet's Chief Executive Officer.

Balance Sheet and Outlook

As of December 31, 2023, Freshpet had a strong balance sheet with cash and cash equivalents of $296.9 million and a net debt position of $393.1 million. The company generated $75.9 million in cash from operations for the full year 2023, a substantial increase from the previous year, driven by improved profitability and more efficient working capital management.

Looking ahead to 2024, Freshpet has provided guidance that suggests continued growth and profitability improvements. The company plans to leverage its balance sheet to support ongoing capital needs in line with its long-term capacity plan.

The company's commitment to fresh, real food for pets, along with its strategic investments and operational efficiencies, positions it well for sustained growth and profitability, making it an attractive prospect for value investors and potential GuruFocus.com members.

For more detailed financial information and the full earnings report, please refer to the 8-K filing.

Explore the complete 8-K earnings release (here) from Freshpet Inc for further details.

This article first appeared on GuruFocus.