Freshworks Inc (FRSH) Posts 20% Revenue Growth in Q4; Full Year 2023 Results Show Improved ...

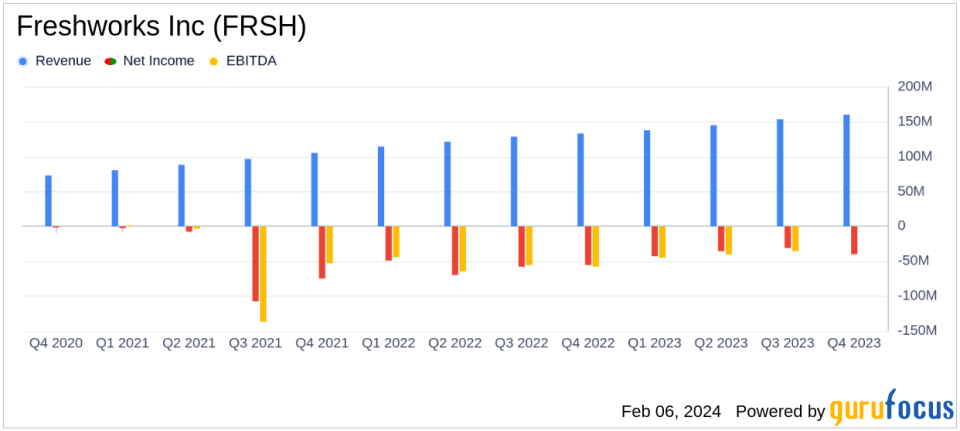

Revenue Growth: Q4 revenue increased by 20% year-over-year, reaching $160.1 million.

Operating Cash Flow: Net cash provided by operating activities was $30.9 million in Q4, a significant increase from $7.2 million in the same quarter last year.

Free Cash Flow: Free cash flow for Q4 stood at $28.6 million, compared to $4.0 million in Q4 2022.

Non-GAAP Income from Operations: Non-GAAP income from operations was $11.5 million in Q4, a substantial improvement from a non-GAAP loss of $2.8 million in the prior year's quarter.

Net Dollar Retention Rate: Remained stable at 108% year-over-year.

Customer Growth: Number of customers contributing more than $5,000 in ARR increased by 14% year-over-year.

Financial Outlook: For Q1 2024, revenue is expected to grow by 18-19% year-over-year, with non-GAAP income from operations projected between $12.5 - $14.5 million.

On February 6, 2024, Freshworks Inc (NASDAQ:FRSH) released its 8-K filing, announcing the fourth quarter and full year financial results for the period ending December 31, 2023. The company, known for its software as a service platform that aids businesses in customer engagement and support, reported a 20% year-over-year growth in Q4 revenue, amounting to $160.1 million. This growth is consistent in constant currency terms as well, indicating a robust underlying business performance.

Freshworks Inc (NASDAQ:FRSH) has made significant strides in improving its business efficiency, as evidenced by the $30.9 million in net cash provided by operating activities and $28.6 million of free cash flow in the quarter. The company's CEO, Girish Mathrubootham, highlighted the integration of generative AI across their product portfolio and strategic go-to-market refinements as key drivers of their strong financial performance.

Financial Performance and Challenges

The company's financial achievements are particularly noteworthy in the context of the software industry, where cash flow and operational efficiency are critical metrics for sustainability and growth. Freshworks Inc (NASDAQ:FRSH) has demonstrated its ability to not only grow revenue but also to translate that growth into operational income and cash flow, which are vital for ongoing investment in product development and market expansion.

Despite the positive results, challenges remain in the form of maintaining growth momentum and managing operational costs. The company's GAAP loss from operations, although reduced from the previous year, still stood at $(40.0) million for Q4 and $(170.2) million for the full year. This underscores the importance of continued focus on efficiency and cost control.

Key Financial Details

Examining the income statement, Freshworks Inc (NASDAQ:FRSH) reported a non-GAAP net income per share of $0.08 for Q4, a significant improvement from $0.01 in the same quarter of the previous year. This reflects the company's successful efforts in improving profitability. The balance sheet remains strong with $1.19 billion in cash, cash equivalents, and marketable securities, providing a solid foundation for future growth.

The cash flow statement further reinforces the company's financial health, with free cash flow for the full year 2023 reported at $77.8 million, a dramatic turnaround from a negative free cash flow of $(14.8) million in 2022. This metric is particularly important as it indicates the company's ability to generate cash from its core business operations.

"2023 was a defining year for us. We unleashed the power of the latest generative AI across our product portfolio to deliver tangible value for our customers," said Girish Mathrubootham, CEO and Founder of Freshworks.

The company's performance is a testament to its strategic initiatives and focus on leveraging AI technology to enhance its offerings. The financial outlook for the first quarter and full year 2024 suggests continued confidence in the company's growth trajectory, with revenue expected to increase by 18-19% year-over-year.

For value investors and potential GuruFocus.com members, Freshworks Inc (NASDAQ:FRSH) presents a compelling case of a tech company that is not only growing its top line but also demonstrating fiscal discipline and operational efficiency. The company's ability to generate free cash flow and improve non-GAAP income from operations is indicative of a maturing business model that is beginning to realize economies of scale and operational leverage.

For more detailed analysis and up-to-date information on Freshworks Inc (NASDAQ:FRSH) and other exciting investment opportunities, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Freshworks Inc for further details.

This article first appeared on GuruFocus.