Freshworks (NASDAQ:FRSH) Surprises With Q4 Sales, Guides For 18.6% Growth Next Year

Business software provider Freshworks (NASDAQ: FRSH) announced better-than-expected results in Q4 FY2023, with revenue up 20.2% year on year to $160.1 million. The company expects next quarter's revenue to be around $163.5 million, in line with analysts' estimates. It made a non-GAAP profit of $0.08 per share, improving from its profit of $0.01 per share in the same quarter last year.

Is now the time to buy Freshworks? Find out by accessing our full research report, it's free.

Freshworks (FRSH) Q4 FY2023 Highlights:

Revenue: $160.1 million vs analyst estimates of $158.5 million (1% beat)

EPS (non-GAAP): $0.08 vs analyst estimates of $0.05 ($0.03 beat)

Revenue Guidance for Q1 2024 is $163.5 million at the midpoint, roughly in line with what analysts were expecting

Management's revenue guidance for the upcoming financial year 2024 is $707.5 million at the midpoint, in line with analyst expectations and implying 18.6% growth (vs 19.8% in FY2023)

Free Cash Flow of $28.59 million, up 29.5% from the previous quarter

Net Revenue Retention Rate: 108%, in line with the previous quarter

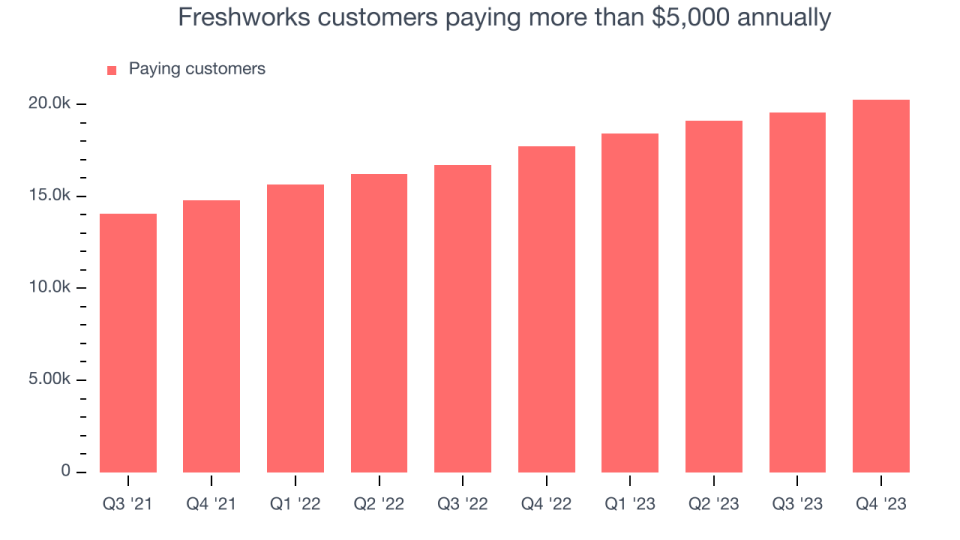

Customers: 20,261 customers paying more than $5,000 annually

Gross Margin (GAAP): 83.1%, up from 81.1% in the same quarter last year

Market Capitalization: $6.40 billion

“At Freshworks, we delivered a strong finish to the year, outperforming our financial estimates across the board in Q4,” said Girish Mathrubootham, CEO and Founder of Freshworks.

Founded in Chennai, India in 2010 with the idea of creating a “fresh” helpdesk product, Freshworks (NASDAQ: FRSH) offers a broad range of software targeted at small and medium-sized businesses.

Sales Software

Companies need to be able to interact with and sell to their customers as efficiently as possible. This reality coupled with the ongoing migration of enterprises to the cloud drives demand for cloud-based customer relationship management (CRM) software that integrates data analytics with sales and marketing functions.

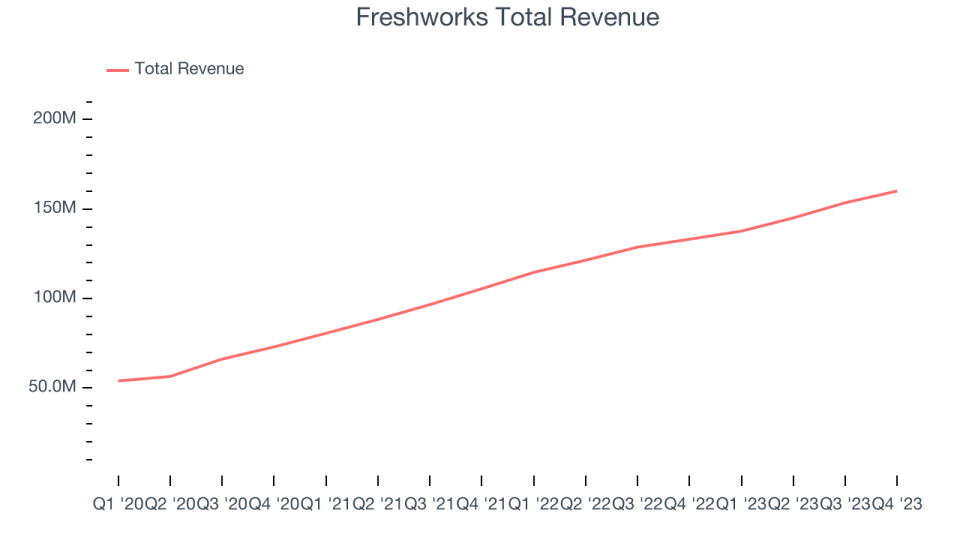

Sales Growth

As you can see below, Freshworks's revenue growth has been strong over the last two years, growing from $105.5 million in Q4 FY2021 to $160.1 million this quarter.

This quarter, Freshworks's quarterly revenue was once again up a very solid 20.2% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $6.56 million in Q4 compared to $8.47 million in Q3 2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Freshworks is expecting revenue to grow 18.7% year on year to $163.5 million, in line with the 20.1% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $707.5 million at the midpoint, growing 18.6% year on year compared to the 19.8% increase in FY2023.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Large Customers Growth

This quarter, Freshworks reported 20,261 enterprise customers paying more than $5,000 annually, an increase of 710 from the previous quarter. That's quite a bit more contract wins than last quarter and quite a bit above what we've typically observed in past quarters, demonstrating that the business has good sales momentum. We've no doubt shareholders will take this as an indication that the company's go-to-market strategy is working very well.

Key Takeaways from Freshworks's Q4 Results

We were impressed by Freshworks's significant improvement in new large contract wins and free cash flow this quarter. We were also glad next year's revenue guidance is strong. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The market was likely expecting more, however, and the stock is down 2.9% after reporting, trading at $21.18 per share.

So should you invest in Freshworks right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.