Friedman Industries Inc (FRD) Reports Mixed Q3 Results Amid Market Volatility

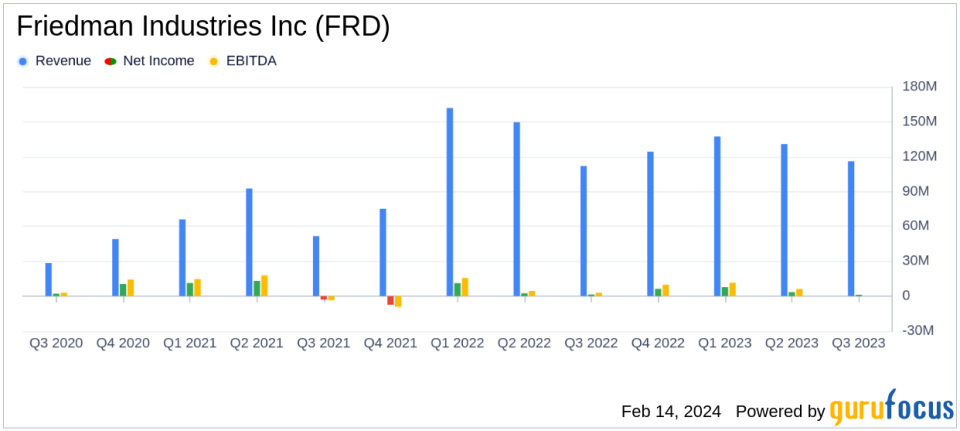

Net Earnings: $1.2 million ($0.16 diluted earnings per share) for Q3 FY2023, down from $1.4 million ($0.19 diluted earnings per share) in Q3 FY2022.

Sales: Increased to approximately $116.0 million in Q3 FY2023 from $111.9 million in Q3 FY2022.

Gross Margin: Improved to 9.0% in Q3 FY2023 from 4.5% in the previous quarter.

Flat-Roll Segment: Sales rose to approximately $106.4 million with operating profits of $8.7 million in Q3 FY2023.

Tubular Segment: Sales declined to approximately $9.5 million with an operating loss of $0.1 million in Q3 FY2023.

Hedging Activities: Loss of approximately $4.1 million recognized in Q3 FY2023 due to rising steel prices.

Balance Sheet: Total assets increased to $228,955 thousand as of December 31, 2023, from $199,312 thousand as of March 31, 2023.

Friedman Industries Inc (FRD) released its 8-K filing on February 14, 2024, announcing the financial results for the third quarter ended December 31, 2023. The company, known for its steel manufacturing and processing, operates in two segments: Coil Products and Tubular Products, with the former being the primary revenue generator. The Coil Products segment includes Temper Pass, Cut-To-Length, Whole Coils, and Toll Processing, while the Tubular Products segment offers Electric Resistance Welded Pipe and Pipe Finishing Services.

Performance and Challenges

During the quarter, Friedman Industries experienced an increase in hot-rolled coil (HRC) pricing, which positively impacted physical margins, especially in the latter half of the quarter. The gross margin percentage rose to 9.0% compared to 4.5% in the preceding second quarter. However, the company faced challenges due to its downside hedging protection, which partially offset the benefits of higher HRC prices. The market value of the company's inventory saw a substantial increase, with expectations to realize this value appreciation in the fourth quarter.

Despite the positive trend in sales volume, which is expected to continue, Friedman Industries reported a decrease in net earnings to approximately $1.2 million, or $0.16 diluted earnings per share, compared to $1.4 million, or $0.19 diluted earnings per share, in the same quarter of the previous year. The company attributes this to the hedging losses incurred due to the inflection point in steel prices during the quarter.

Financial Achievements and Industry Significance

The company's financial achievements, particularly the increase in sales to approximately $116.0 million, are significant in the steel industry, where pricing volatility can greatly affect margins. The improved gross margin reflects Friedman Industries' ability to navigate market fluctuations effectively. The increase in total assets from $199,312 thousand to $228,955 thousand demonstrates the company's growth and potential for reinvestment.

Financial Metrics and Importance

The financial results highlight several key metrics that are important to the company's performance:

"Our gross margin percentage increased to 9.0% for the third quarter compared to 4.5% for the preceding second quarter. The rise in HRC price brought a corresponding increase in HRC futures pricing, which caused the improved physical margin to be partially offset by our downside hedging protection." - Michael J. Taylor, President and Chief Executive Officer.

This commentary emphasizes the importance of gross margin as a measure of profitability and the impact of hedging strategies on financial outcomes.

Analysis of Company's Performance

Friedman Industries' performance in the third quarter reflects a mixed outcome. While the company managed to increase its sales and improve its gross margin, it also faced a reduction in net earnings and incurred significant losses from hedging activities. The flat-roll segment showed strength with increased sales volume and operating profits, whereas the tubular segment struggled with a decrease in sales and an operating loss.

The company's outlook remains positive, with expectations of a strong fourth quarter driven by solid margins and a slight increase in sales volume. The recent expansion of operations, including the commencement of operations at the Sinton, TX facility, indicates strategic growth and an ability to capitalize on market opportunities.

For a more detailed analysis of Friedman Industries Inc's financial performance and future prospects, interested readers and investors are encouraged to review the full 8-K filing and consider the implications of the company's hedging strategies and market position.

Explore the complete 8-K earnings release (here) from Friedman Industries Inc for further details.

This article first appeared on GuruFocus.