Are Friends reruns really worth $100 million?

Netflix (NFLX) is reportedly paying AT&T’s WarnerMedia (T) $100 million for the right to stream “Friends” reruns next year.

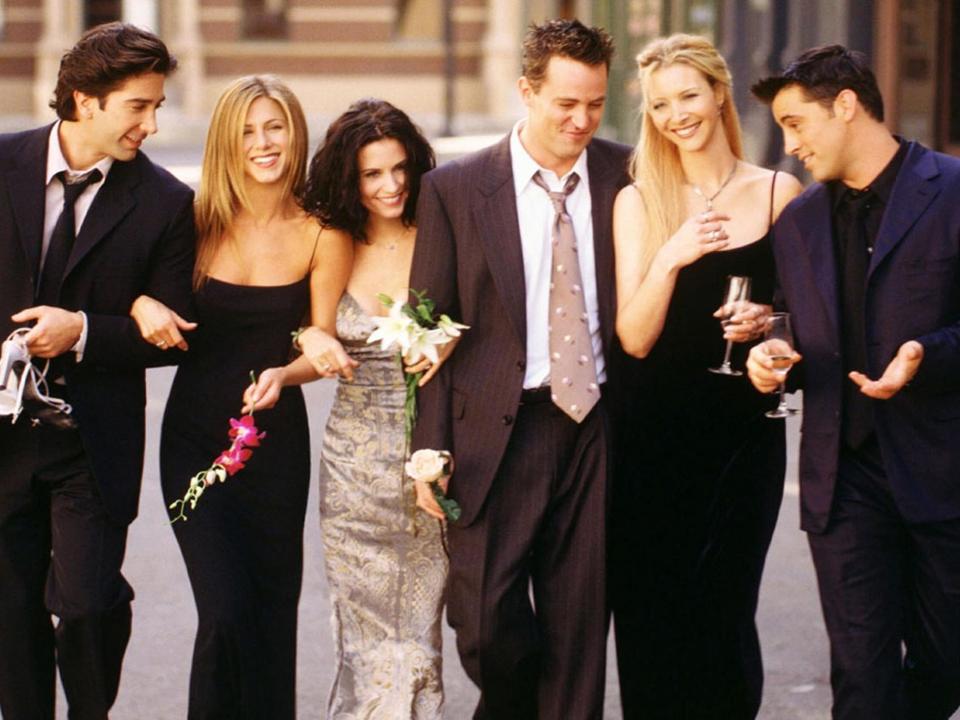

Friends debuted in 1994 and ran until 2004. However fans of Ross, Rachel, Monica, Joey and the gang can watch it anytime on Netflix.

The show has been a strong performer for Netflix, and fans of the show are passionate. Many took to social media to vent their frustration at the possibility that the show might be taken off the streaming platform.

While $100 million might seem like a lot for reruns of a 90s sitcom, Wall Street analysts believe that Netflix was smart to pursue the deal.

David Miller of Imperial Capital says that the price tag is a bargain for Netflix.

“The budget that goes to any one particular series has to correlate to audience share. If they’re spending $100 million over $13 billion in content commitments, it’s less than 1% of the content budget. So I would guess that’s a bargain. I would guess that the audience they get from Friends’ reruns is more than 1% of aggregate viewing, and yet it’s less than 1% of the content budget. So that’s a bargain, so yes it’s a smart call,” he said.

Ivan Feinseth of Tigress Financial says that the deal is a safer bet for Netflix when accounting for the risk profile of original content.

“My personal belief is I would rather see them spend on development of new content, however the risk profile would be that new content may or not be popular, where certain proven content such as ‘Friends’ [is.] There [is] a current generation of Netflix viewers that were not even around when ‘Friends’ was originally on TV. So the answer is that it’s not as crazy as it sounds,” he said.

However, Feinseth does see a downside for Netflix once the deal expires.

“Remember they’re buying the rights to rerun, they’re not buying the rights to own it … So it’s the least risky move, in theory, but also a lower potential return because they don’t own it,” he said.

Even though WarnerMedia’s new streaming service in 2019 will be a rival of Netflix, BTIG’s Richard Greenfield believes that passing up on Netflix’s offer would have been a mistake for AT&T’s WarnerMedia.

“[If] you take that content off of Netflix and put it onto a service that no one subscribes to you risk damaging the value of the content. So it’s very hard to take content away from Netflix because of one, the reach, and, two, the money. Reach and money are a very potent combination for Netflix,” he said.

Going into 2019, AT&T and Netflix will be frenemies as they both compete and work together.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

More from Sibile:

Sean Hannity, Tucker Carlson lead Fox News to November ratings victory

Christie’s exec on how to be ‘the most powerful woman in the room’

Netflix uses more and more of the world’s internet

Kellyanne Conway: The nation’s opioid epidemic is the ‘crisis next door’