Frontdoor Inc (FTDR) Reports Strong Revenue and Net Income Growth for Full-Year 2023

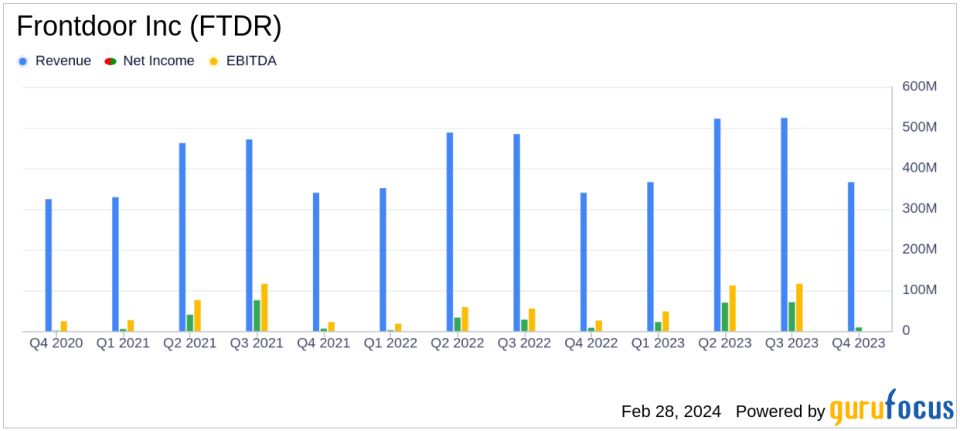

Revenue Growth: Full-year revenue increased by 7% to $1.78 billion.

Gross Profit Margin: Gross profit margin rebounded significantly, up 700 basis points to 50%.

Net Income Surge: Net income soared by 141% to a record $171 million.

Adjusted EBITDA: Adjusted EBITDA climbed by 62% to $346 million.

Share Repurchase: Frontdoor utilized $120 million to repurchase 3.6 million shares.

Free Cash Flow: Free Cash Flow was reported at $170 million for the 12 months ended December 31, 2023.

On February 28, 2024, Frontdoor Inc (NASDAQ:FTDR) released its 8-K filing, announcing a robust financial performance for the full year of 2023. The company, a leading provider of home service plans in the United States, operates under renowned brands such as American Home Shield, HSA, OneGuard, and Landmark, offering comprehensive protection against unexpected home system and appliance breakdowns.

Frontdoor Inc (NASDAQ:FTDR) reported a full-year revenue increase of 7% to $1.78 billion, with a notable gross profit margin rebound of 700 basis points to 50%. The company achieved a record net income of $171 million, a significant 141% increase from the previous year. Adjusted EBITDA also saw a substantial rise, reaching $346 million, up 62% from 2022. These financial achievements underscore the company's resilience and operational efficiency in the personal services industry.

Financial Performance and Challenges

Frontdoor Inc (NASDAQ:FTDR)'s performance in 2023 was marked by strong revenue growth, driven by a 14% increase in renewals and a 40% increase in other revenue streams. However, the company faced challenges in the real estate and direct-to-consumer first-year channels, which saw declines of 23% and 12%, respectively. Despite these headwinds, the company's focus on price increases and cost management led to a substantial improvement in profitability.

The company's financial achievements are particularly important as they reflect the success of strategic initiatives to improve execution and combat a challenging macroeconomic environment. The rebound in gross profit margin to the highest levels in nearly a decade demonstrates the effectiveness of these measures.

Income Statement and Balance Sheet Highlights

Frontdoor Inc (NASDAQ:FTDR)'s income statement reflects a robust financial position, with net income increasing significantly. The balance sheet remains healthy, with $325 million in cash as of December 31, 2023, including $168 million of unrestricted cash. The company's disciplined capital allocation strategy is evident in its share repurchase program, where it utilized $120 million to buy back 3.6 million shares.

"Frontdoor delivered record financial performance in 2023," said Chairman and Chief Executive Officer Bill Cobb. "This is an exceptional turnaround from when I started 21 months ago, and I would like to thank our associates and contractors for their hard work in achieving these results."

"We took decisive actions to improve execution and combat a challenging macroeconomic environment, which resulted in gross margins rebounding to the highest levels in nearly 10 years," said Chief Financial Officer Jessica Ross.

Analysis of Company's Performance

The company's performance in 2023 is a testament to its ability to navigate a complex economic landscape while maintaining focus on growth and customer satisfaction. Frontdoor Inc (NASDAQ:FTDR)'s strategic initiatives, including the relaunch of the American Home Shield brand and expansion of on-demand service offerings, are set to drive future growth. The company's strong foundation and stabilized margins position it well for continued success in the years to come.

Frontdoor Inc (NASDAQ:FTDR) is optimistic about its future, targeting higher revenue and adjusted EBITDA in 2024. With a solid track record of financial discipline and strategic investments, the company is poised to capitalize on growth opportunities and deliver value to its stakeholders.

For detailed financial figures and management's discussion, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Frontdoor Inc for further details.

This article first appeared on GuruFocus.